Bullish case

Buy the GBP/USD after the bullish breakout.

Have a take-profit at 1.3900 (upper side of ascending channel).

Add a stop-loss at 1.3583 (lower side of the channel).

Timeline: 1 - 3 weeks.

Bearish case

Set a sell-stop at 1.3583 and a take-profit at 1.3400.

Add a take-profit at 1.3700.

The GBP/USD price broke out in the American session helped by the overall weak US dollar after the Tesla Bitcoin announcement. The pair jumped to a multi-year high of 1.3780, 20% above last year’s low of 1.1415.

Weaker Dollar Pushes Sterling Higher

The GBP/USD soared as the US dollar declined against most developed and emerging market currencies. The US Dollar Index has dropped for the past three consecutive days and is trading at $90.75.

This performance is mostly because of three key reasons. First, on Friday, the US delivered weak employment numbers that showed that the economy added just 40,000 jobs. The numbers implied that the American economy is recovering slower than expected.

Second, the US congress is deliberating another $1.9 trillion stimulus package on top of the $900 billion it passed in January. This package, coupled with the actions of the Federal Reserve, has led to a dollar devaluation.

Finally, the dollar has dropped because of the latest announcement by Tesla. The world’s most valuable automaker said that it had invested $1.5 billion in Bitcoin. As a result, some analysts are now questioning whether the dollar’s hegemony will remain in a time of decentralised currencies.

Meanwhile, the GBP/USD is rising because of the Bank of England (BoE) actions. In its interest rate decision last week, the bank said that it was not considering negative rates at the moment. The bank reiterated that it was studying such rates and their implications.

Later this week, the pair will react to the UK GDP data that will come out on Friday and the US inflation numbers scheduled for tomorrow.

GBP/USD Technical Outlook

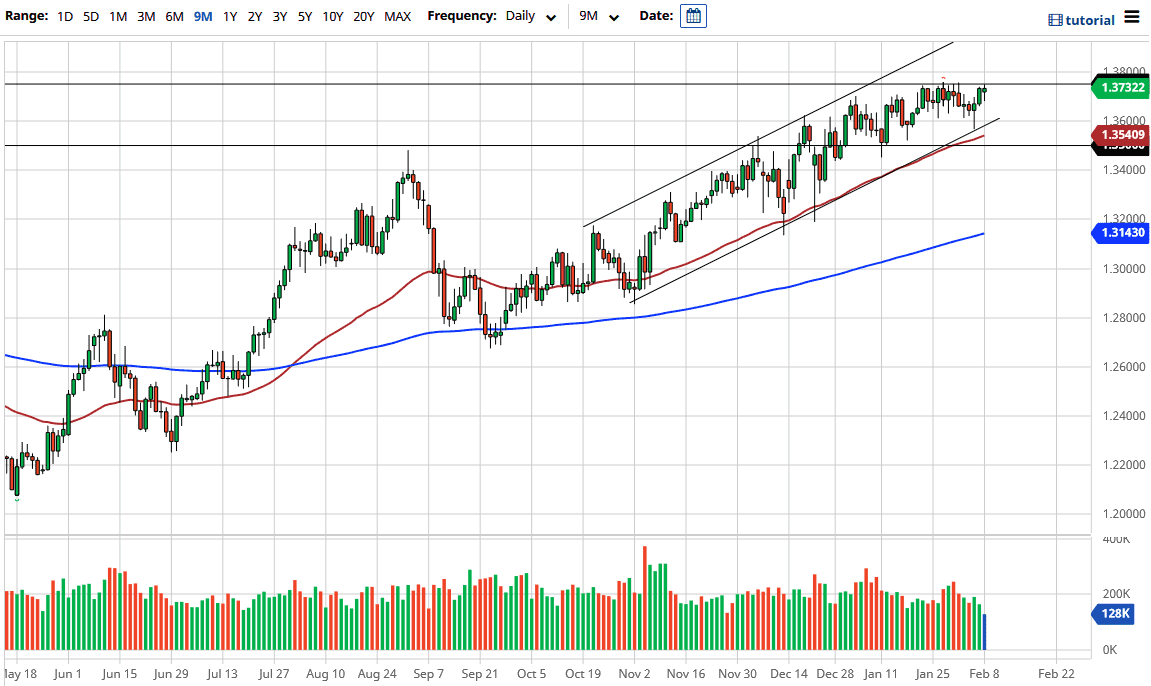

The four-hour chart shows that the GBP/USD price has been struggling to move above the resistance level at 1.3757 in the past few weeks. Also, the pair has been forming an ascending triangle pattern for a while. It has also moved above the 25-day exponential moving average.

The pair managed to move above the resistance at 1.3757 overnight, in a major victory for bulls. Also, the Relative Strength Index (RSI) has continued rising, but is a few points below the overbought level.

Therefore, the pair will likely continue rising as bulls target the resistance at 1.3900. This price is at the upper side of the ascending channel on the daily chart.