For the second consecutive week, the GBP/USD stabilized above the 1.4000 psychological resistance, which strongly confirms the bullish performance. The move towards stronger ascending levels culminated in testing the 1.4240 resistance level, its highest in three years, before stabilizing around 1.4190 as of this writing. The pound gained strong momentum this week after the British government announced a four-step roadmap to open up the economy, which means that all restrictions will be lifted by June 21, provided that the outbreak stabilizes as scientists expect.

The gap between the actual market price displayed on financial website dashboards, and the amount you are actually dealing with when buying or converting foreign currency is known as a "spread", and is a source of frustration for many who watch the market hoping to act on the pound's rally. The psychological meltdown in the retail market comes amid a continuous rise for weeks in the value of the pound, driven by a combination of dissolving Brexit fears in the aftermath of the December trade deal. The rise in the pound is credited to the elimination of negative interest rate expectations from the Bank of England and the vaccination progress in the United Kingdom. The UK vaccination was seen to be paying off on Monday when the prime minister announced a roadmap to exit lockdowns.

This approach will be slow, but caution appears to be welcome by the medical community as well as the public with opinion polls showing broad approval for the four-stage strategy.

Credibility is important to investors and companies alike, which in turn is seen by analysts as supportive of the sterling exchange rate dynamics. A note from JP Morgan's Forex office in London says, “Johnson's exit plan has been very cautious to say the least - admittedly the right trick because the buzzword for not backing down can certainly be achieved quickly and effectively (as in the data at least) from the vaccine program."

While there have been concerns that an over-cautious approach could pose a potential headwind to the economy and the British pound, the market judgment is that the UK is on its way out of the current lockdown cycles, which is not necessarily guaranteed in other countries where vaccination rates are lagging. "No other country in the West has a clear and detailed strategy to get out of the nightmare of COVID-19 like the United Kingdom," says Antonello Gerrera, the UK correspondent for the Italian newspaper La Repubblica. "There will be pitfalls of course." However, unless variables and companies spoil the plans and despite the presumed “slowness”, the UK is preparing to return to “normalcy” much earlier than other countries.

Economists at Goldman Sachs say that with the current vaccine rollout, low infection rates and the prospect of an expansionary March budget, the UK is well-positioned to deliver a near-term recovery. In this regard, Christian Muller, an economist at Goldman Sachs, says: “The outperformance in the UK has been a topic since the beginning of the year as UK assets have benefited from a decline in uncertainty following the Brexit decision in addition to very good progress in vaccinations against COVID-19, especially against the rest of Europe.”

After the announcement of the British government plan, EasyJet said that flight bookings from the United Kingdom jumped by 337% and holiday reservations increased by 630% compared to the previous week, with August holidays being the most popular, followed by July and September.

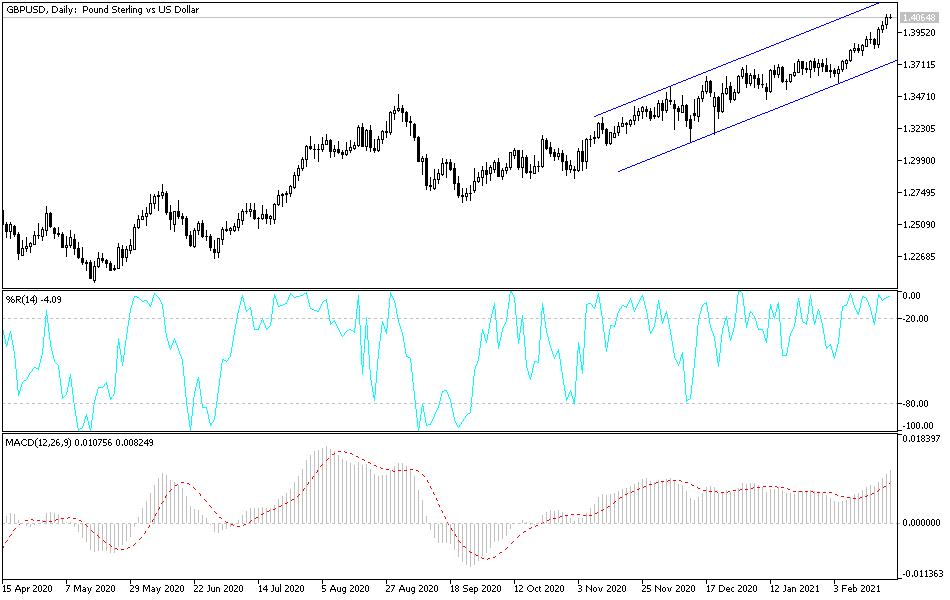

Technical analysis of the pair:

The bullish trend of the GBP/USD has increased in strength and its recent gains have led technical indicators to strong overbought levels. Overall, the latest British government announcement will continue to support the pound's gains for a longer period. The closest targets for bulls might be 1.4255, 1.4320 and 1.4400. There will be no initial downside move without the pair moving below the 1.4000 support level. Still, I would prefer to buy the pair on every dip.

US Federal Reserve Chairman Jerome Powell will give his second testimony Tuesday.