The turmoil regarding US economic stimulus plans continues to weaken risk sentiment towards the dollar. Accordingly, the USD/JPY is moving under downward pressure that pushed it to the support level of 104.40 before settling around the level of 104.56 as of this writing. This movement comes before the announcement of the US weekly jobless claims.

Republicans are attacking the Democrats' $1.9 trillion relief package from COVID-19 as too costly, with funds going to local and state governments as well as many American families who are not as in need. Five committees in the House of Representatives worked yesterday on comprehensive legislation that will send $1,400 in payments to some Americans. It would also give hundreds of billions of dollars for state and local governments to boost vaccination efforts and increase unemployment benefits. Democratic leaders hope to pass the bill in the House of Representatives later this month, with Senate approval and a bill on Biden's office by mid-March.

As the committees worked, Republicans released amendments highlighting what they see as weaknesses in the legislation. Their themes were clear: Democrats are overspending, hurting workers and employers, opening doors to fraud and rewarding political allies - allegations that Democrats dismiss as absurd. The proposals indicated that Biden's plan faces strong Republican opposition in the House and Senate as Democrats have few votes to spare.

The Congressional Budget Office expects the US economy to add an average of 521,000 jobs per month this year, a sign of strong hiring made possible in part thanks to government aid. But these gains will likely depend on containing the virus. In 2021, employers started adding 49,000 jobs only in January as disease-related deaths limited economic activity.

Fed Chairman Jerome Powell stressed the Fed's commitment to bringing US unemployment to its lowest level in several decades, as the situation was before the pandemic, while noting little concern about the risks of potential high inflation or the instability of financial markets. Powell stressed during a webcast of the New York Economic Club that the job market in the United States was still weak despite improving from the recession caused by the epidemic.

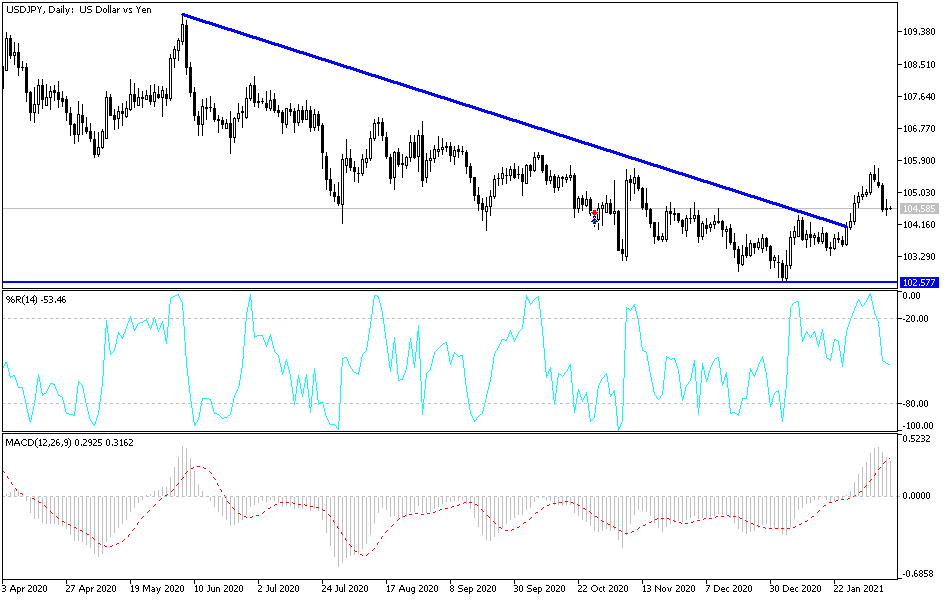

Technical analysis of the pair:

In the event that the USD/JPY falls below the support level of 104.00, the performance will be bearish and the pair will likely test stronger support levels. The closest of those are now 104.20, 103.75 and 102.90. On the upside, and as I mentioned before, the 106.00 resistance is pivotal a stronger bullish performance. I still prefer to buy the pair from every downside level.