USDT/USD is a stable coin which serves as a foundation theoretically within the cryptocurrency marketplace. The value of Tether is constantly near 1.0000, based on the principle that the digital currency is backed by USD as each Tether token is generated via a correlated accounting with Bitcoin. However, this correlation has been questioned before, and it is not only traders who are sometimes skeptical about the value of USDT/USD.

The New York State Attorney General’s office is investigating the accounting of Tether. While technical traders can certainly speculate on USDT/USD and look at its incremental ability to trade slightly above and below the 1.0000 juncture, they should keep the notion in mind that a ruling which is expected to be announced in the near future will likely have an effect on value.

This means that the so-called stable coin, which USDT/USD is deemed, may face the potential for some rather speculative volatility in the near future. There are no guarantees; if no news is generated via the New York State Attorney General’s office, traders should expect a rather tranquil mode within the USDT/USD, which is standard and makes Tether a rather boring speculative asset.

Tether’s incremental movements are small and leverage needs to be calculated carefully to produce a trade which can exhibit meaningful profits and losses. The risk of transaction costs losses while trading USDT/USD is known; if the change of value within the token is not enough to offset the fees for speculating on the asset.

However, USDT/USD technical traders who actually do participate within the speculative asset should have an eye and ear on developing news which could certainly affect the price of Tether in a manner to which it is unaccustomed. Again, there are no certainties, but if a speculator has the ability to sell USDT/USD based on the perception that there will be negative news, having a working order that has sufficient risk management ready may be a speculative wager worth pursuing.

On the other hand, if a trader believes that the New York State Attorney General will take no action, then buying USDT/USD on lower support levels is the logical choice. Tether, which acts as a stable coin within the cryptocurrency marketplace, may find itself within a short-term speculative storm suddenly and traders may have an opportunity to take advantage of its quiet trading range if they are prepared.

Tether Short-Term Outlook:

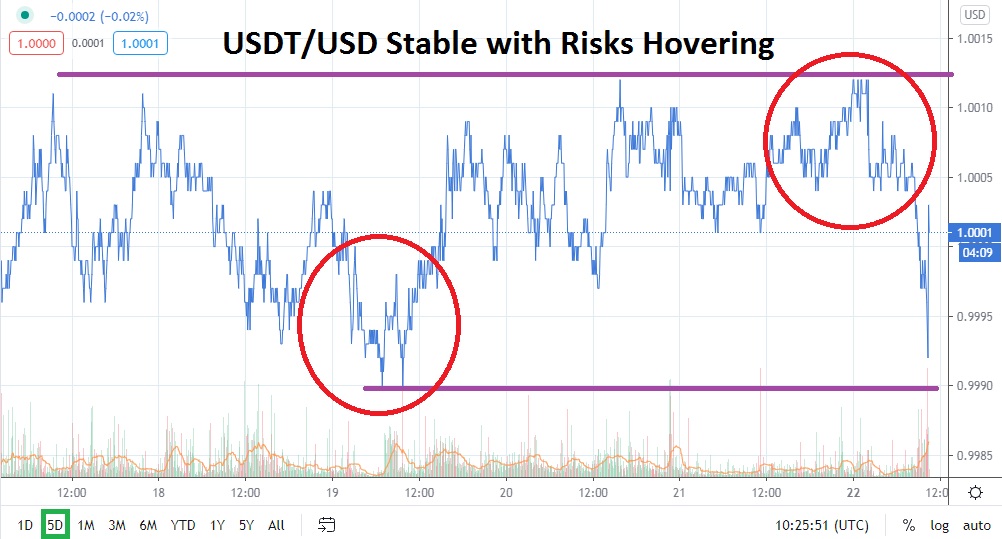

Current Resistance: 1.0005

Current Support: 0.9996

High Target: 1.0012

Low Target: 0.9990