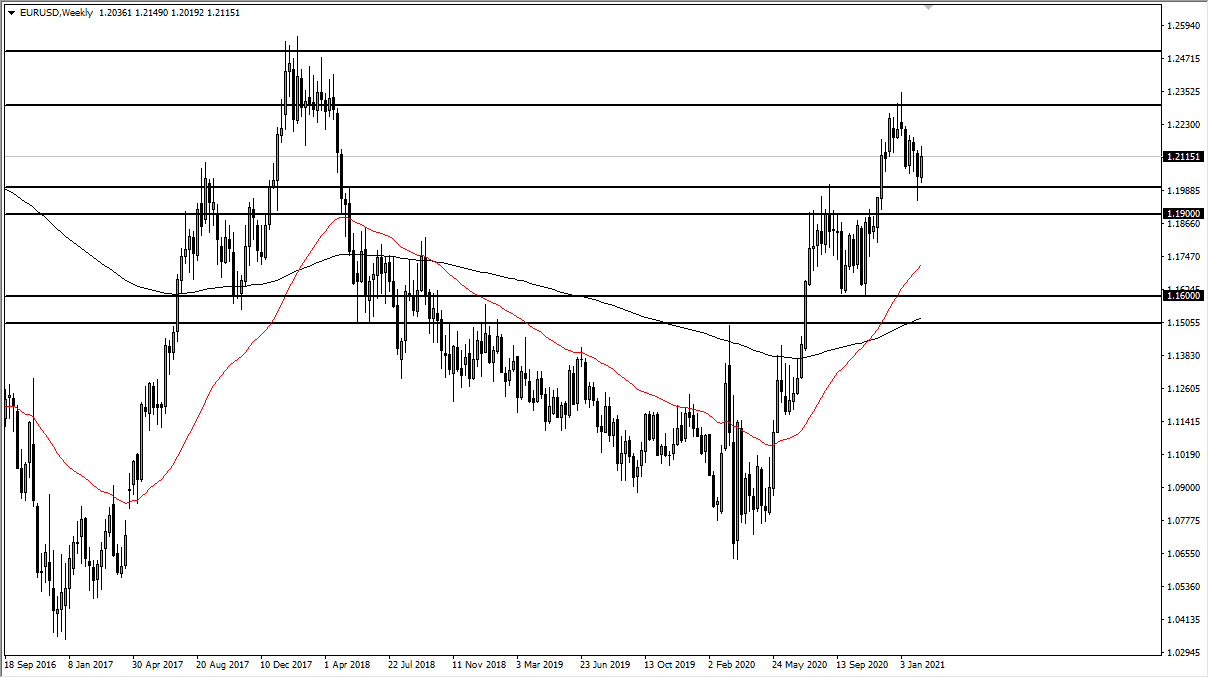

EUR/USD

The euro rallied during the course of the week to break back above the 1.21 handle. By bouncing from one point to zero level, it reaffirmed the fact that we are still in an uptrend, and as we pull back towards that level again, there will be buyers interested in the market. This being the case, I think that if you buy dips you should do fairly well, as it goes with the longer-term trend. However, it is very difficult to imagine that the market is simply going to break through the 1.23 level easily. I think “choppiness” will be the best word to describe the market.

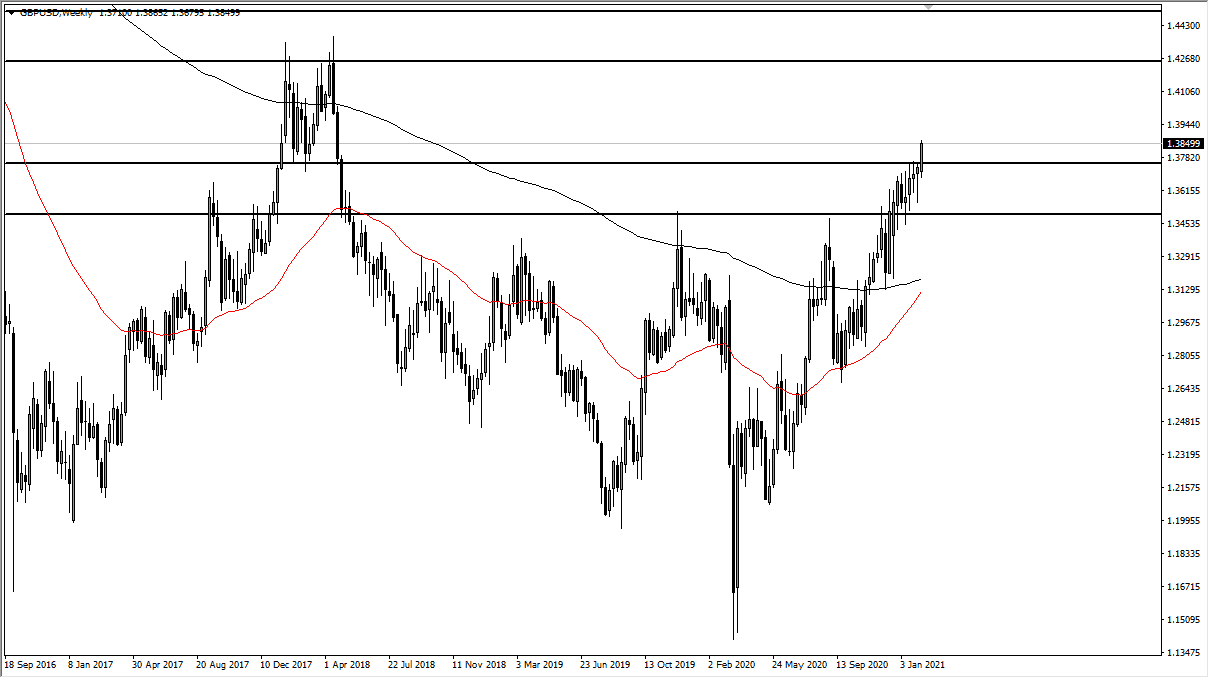

GBP/USD

The British pound has broken out during the course of the week, finally slicing through the 1.3750 level. This is an area that has been quite difficult for traders to get through, and now that we have, I suspect that when this market pulls back you have to look at it as offering value that you can take advantage of. To the downside, even if we break down below the 1.3750 level, it is very likely that the market will find support all the way down to the 1.35 handle. Longer-term, I believe that this market will go looking towards 1.4250 level, but it is going to take quite some time to get there.

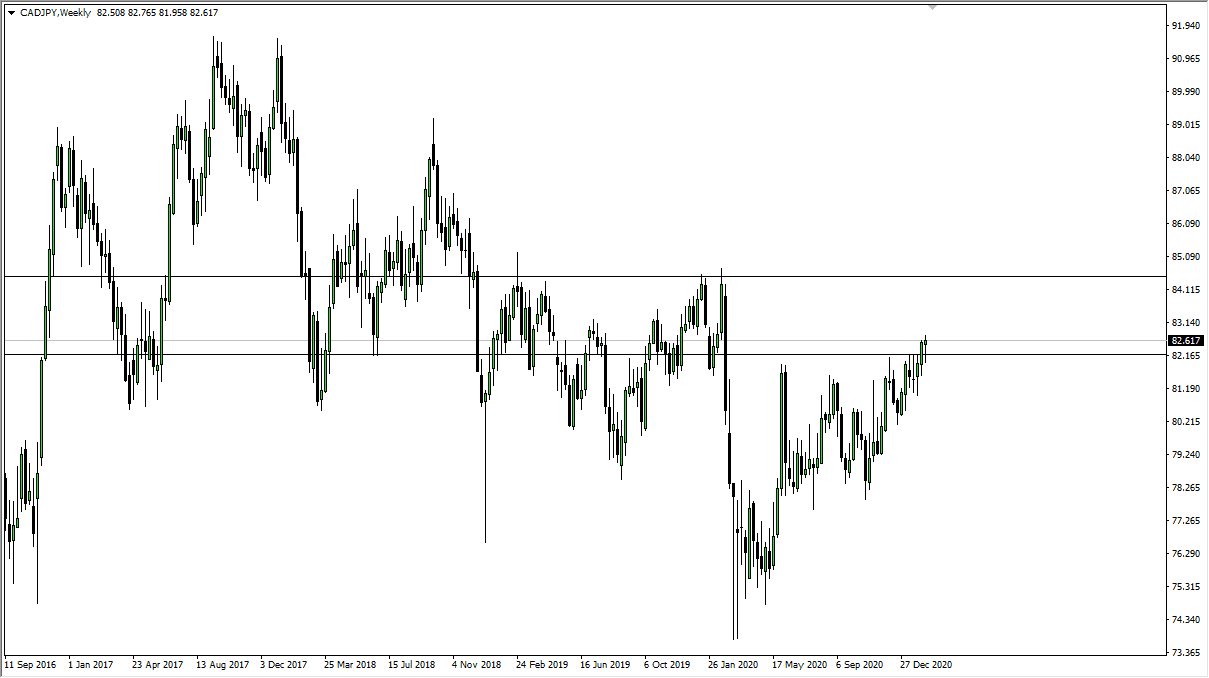

CAD/JPY

The Canadian dollar initially fell during the course of the week against the Japanese yen, but has found enough support near the ¥82 level to turn things around. By forming a bullish candle during the previous week and now what looks like a hammer, it appears that the buyers are willing to step in and pick up this market every time it dips. This is based upon the “reflation trade” as commodities continue to find a bit of a bid. I think buying the dips continues to work here as well but would be concerned if we broke back down below the ¥81.50 level.

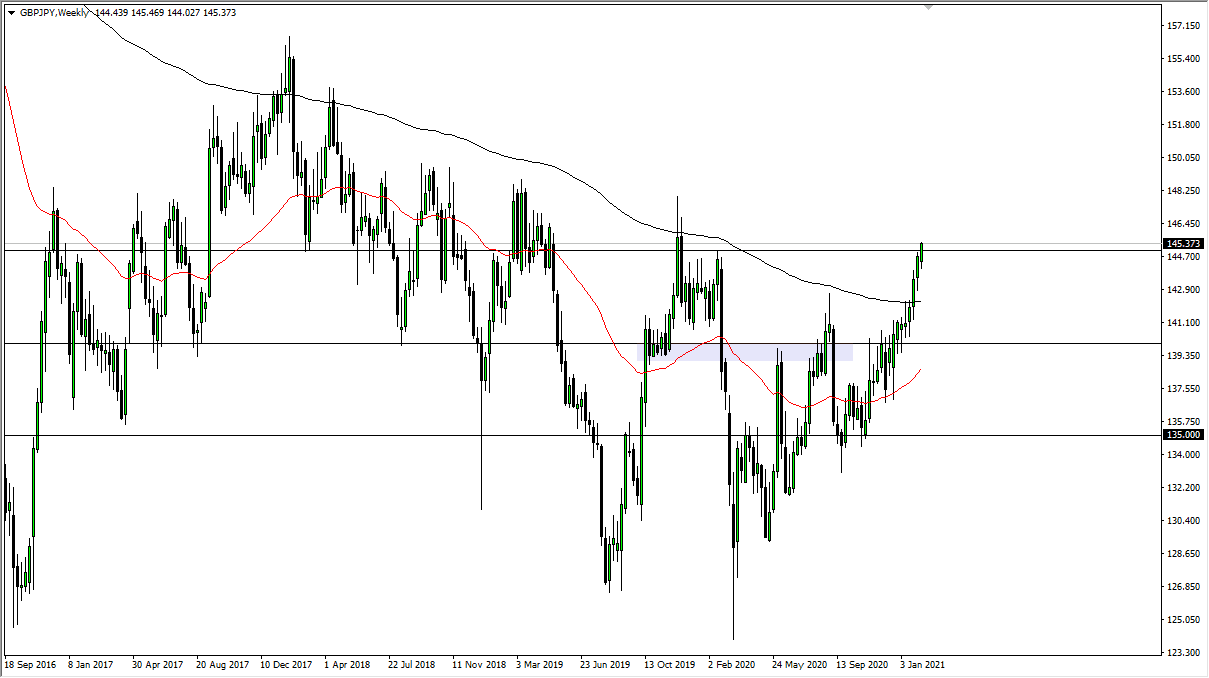

GBP/JPY

The British pound initially pulled back against the Japanese yen, but just like the Canadian dollar, it ended up breaking out to the upside. Now that we have cleared the ¥145 level, I believe that short-term pullbacks in this pair will continue to be bought into, as we have made a clean break of what is obviously a psychologically and structurally important level. The next major area of resistance that I see above is at the 147.50 level.