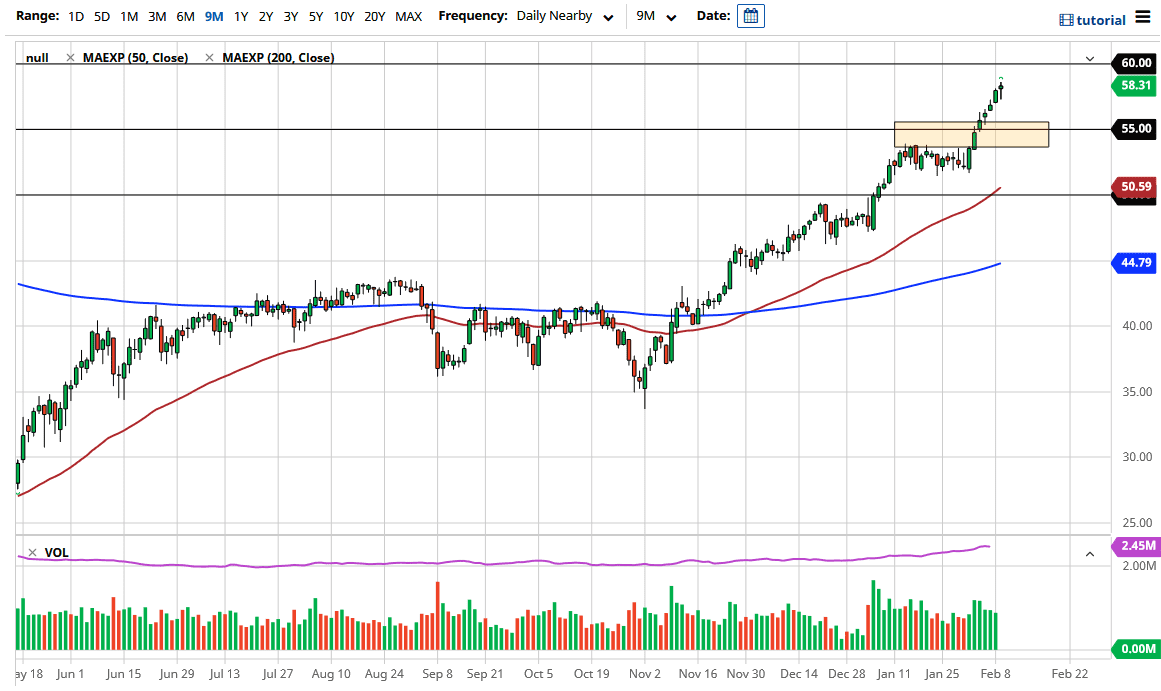

The West Texas Intermediate Crude Oil market pulled back significantly during the trading session on Tuesday, but found plenty of support underneath to form a hammer-shaped candlestick. If we can break above the top of the candlestick, it is likely that we could go looking towards the $60 level. On the other hand, if we were to break down below the bottom of the candlestick, that could turn it into a “hanging man”, which is a negative sign. If we do get that negative sign, then I suspect that we will probably go looking towards the $55 level in order to find buyers again.

I think this is a market that is very difficult to sell, but we most certainly are starting to get a little bit ahead of ourselves. If we do break above the highs of the session for Tuesday, then it is likely that the $60 level will be significant resistance as it has psychological importance, but it also has been important in the past from a structural standpoint. I have no interest in selling this market whatsoever, and I look at pullbacks as potential buying opportunities, as we are obviously in a very bullish market.

The whole idea behind oil rallying is based upon hope due to the stimulus and the “reflation trade” out there. I think we are getting way ahead of ourselves, but it is only a matter of time before we need to come back to reality. This is not to say that I expect some type of major meltdown, rather the $60 level is probably a bit rich for the reality of the economic situation out there. This reminds me of all of the other risk asset markets out there: it is getting far too ahead of itself. Pay attention to the US dollar, because if it suddenly spikes in value, it is possible that it could work against the value of the oil market as well. This market is certainly one that you want to buy and not sell, but you do not necessarily want to buy it all the way up here.