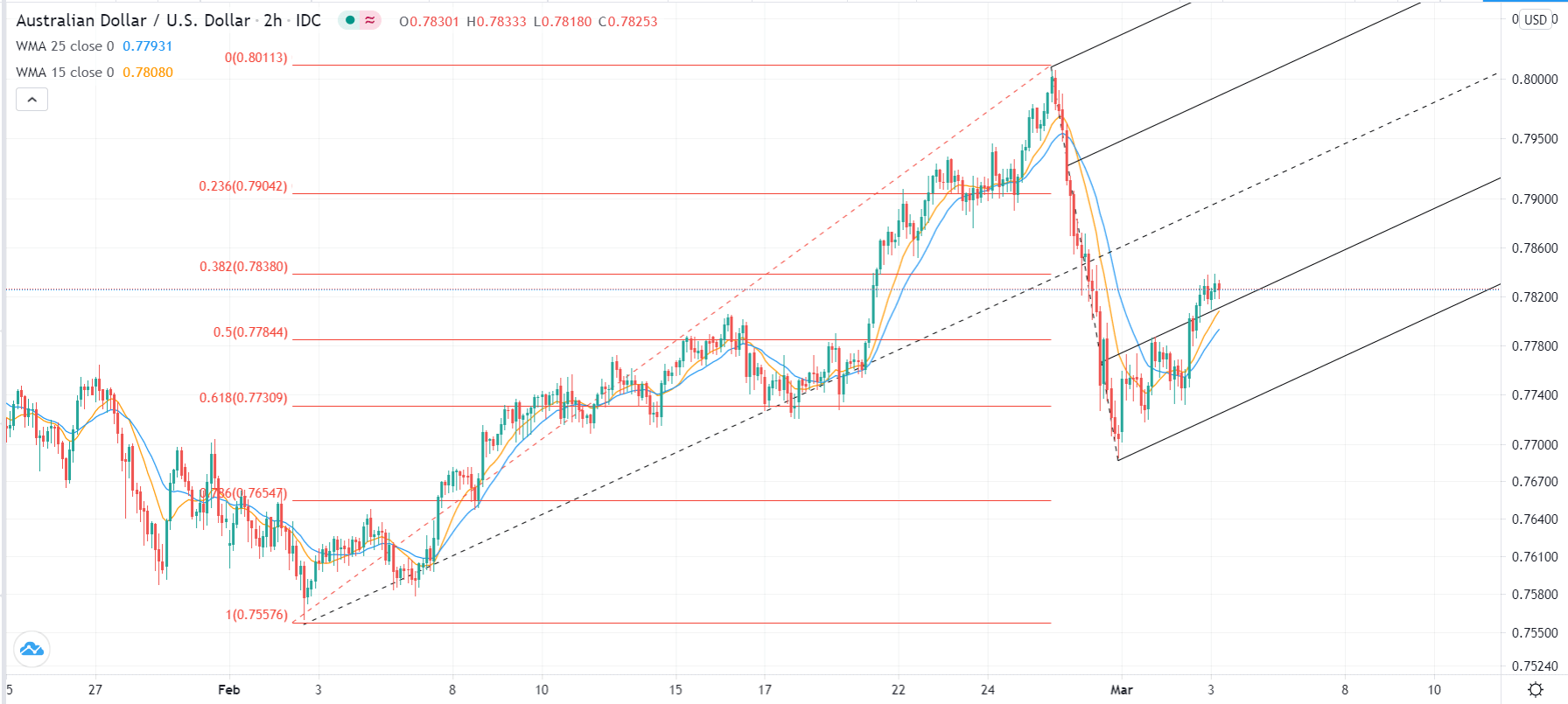

The Australian dollar initially pulled back a bit during the trading session on Tuesday to reach down towards the previous uptrend line. The fact that we have seen a bit of a bounce from there does suggest that we have more upward momentum than anything else and, as a result, it looks like we are ready to continue to try to get to the 0.80 level above. That is an area that is worth paying attention to, as the longer-term charts have seen the 0.80 level as crucial.

The 50-day EMA sits just below the uptrend line, and that could add even more support to the market in general. This is a market in which I think you should continue to buy short-term dips, but it is worth noting that the monthly candlestick from February was a shooting star. Because of this, it could set up a huge move in one direction or the other. If we were to break above the top of the shooting star, that would be a very bullish sign, and then clearing that massive resistance barrier that starts at 0.80 would be a huge sign of buying pressure. The top of the resistance is closer to the 0.81 handle, which then opens up the possibility of a move all the way to the 0.88 handle, maybe the 0.90 level.

At this point, I think that if we were to turn around and break down below the 0.75 handle, we would kick off some type of massive pullback. Keep in mind that the Australian dollar is highly levered to the commodity market, which is highly levered to the idea of the “reopening trade.” As long as traders continue to look at the vaccination attempts and the herd immunity coming to various large economies as an opportunity for more commodities needed, this should send the market much higher, as Australia is a major supplier of hard commodities such as copper and iron.

Furthermore, the US dollar is struggling a bit due to the idea that the stimulus package is coming soon in the United States, which could work against the value of the greenback. The most negative thing for the market right now is the idea that yields in America have been rising from time to time.