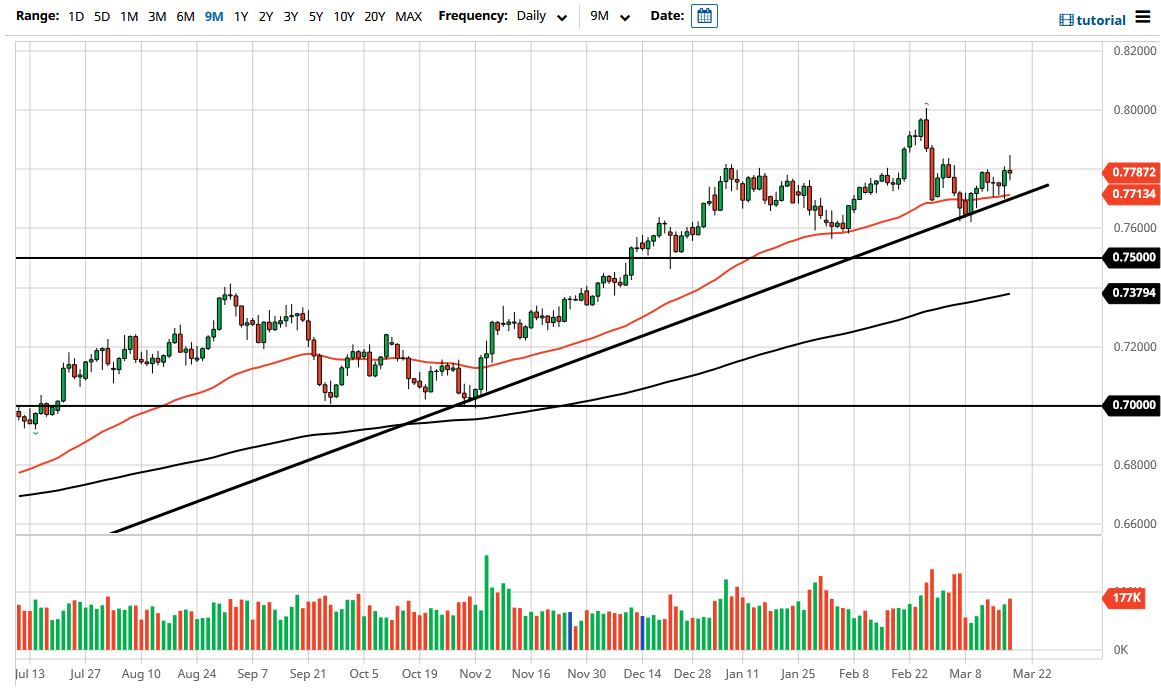

The Australian dollar shot higher initially during the trading session on Thursday but gave back the gains as bond yields in America continue to spike. This is a major problem for Forex markets, because suddenly it makes the US dollar a lot more attractive due to the fact that you can simply buy bonds in clip coupons to make a return. In fact, the higher the rates go, the more realistic it is that we will see a resurgence in the greenback, due to the fact that you get a real yield once you look past inflation by clipping these coupons.

Whether or not that actually happens might be a completely different conversation, but it clearly looks as if we are trying to figure out where to go from here. This is a market that will have a lot of noise attached to it, because it is a commodity currency; but at the same time, we have those concerns coming out of the bond market and that does weigh upon certain commodities such as gold. Furthermore, you need to pay close attention to what the copper market is doing. Currently, it is at extraordinarily high levels, but it may have gotten a little bit ahead of itself. With this, I like the idea of buying dips, but Friday could make things even worse due to the fact that it is quad witching in the United States. This means that there will be four different options classes closing out quarterly contracts, and that could cause a massive amount of volatility.

Until US traders can get it together in the bond market, it is difficult to imagine that we will have anything close to it, and as a result, we will see a sudden push into the US dollar occasionally, followed by a massive selloff. This will have an influence on the Aussie dollar, just as it would any other market. No matter what you are trading these days, you have to have one eye on yields in the 10-year bond while putting money to work. The bond market has taken the Federal Reserve to task, looking to raise interest rates because of fears of inflation. This will be interesting to watch over the next couple weeks, but unfortunately, it is going to cause nothing but headaches for traders. Buying on the dips probably works but I would not expect much in the way of momentum.