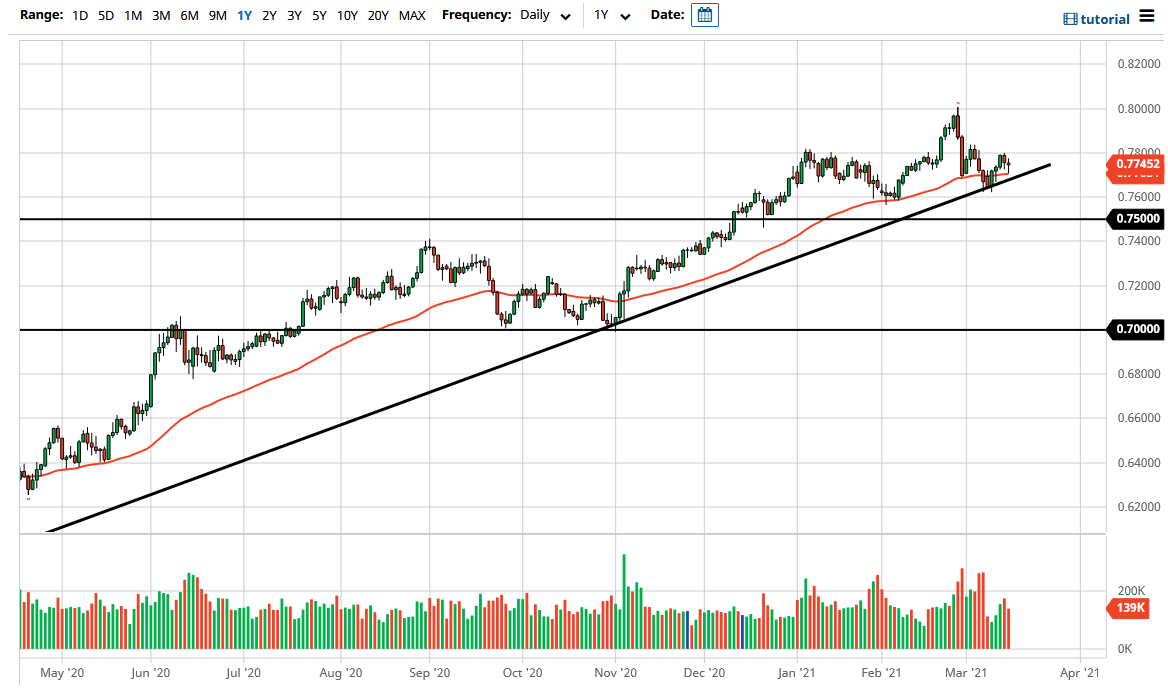

The Australian dollar initially fell during the trading session here on Monday but found enough support at the 50 day EMA to turn things around and form a supportive looking candlestick. Furthermore, the uptrend line sitting just below continues offer support, so it does look like we are going to continue to see a lot of buying pressure underneath, therefore it is worth noting that the 50 day EMA looks as if it is trying to tilt higher. Remember, the Australian dollar has been in a massive uptrend for some time, and therefore it is not a huge surprise to see this continuation come into play.

All of that being said, the one thing that I am a bit concerned about is the fact that the February candlestick was a shooting star. However, there are two things that I would pay close attention to when it comes to that, not the least of which would be that most of the selling was done in two trading sessions at the end of the month. This was in reaction to the yields spiking higher in the United States, which of course shock the markets. In other words, it may be a little bit of a false impression of what really happened during the month of February.

Another thing to pay attention to is that we smacked into the 0.80 level, an area that you would not expect the Australian dollar to simply be able to slice through without any issues. It is a large, round, psychologically significant figure, and of course on the monthly chart it is an area that has offered massive resistance. The resistance region extends to the 0.81 handle, so if we were to break above there that would be an extraordinarily bullish sign for the Aussie dollar longer term.

On the other hand, if we did break down below the 0.75 handle, I think that would be an extraordinarily bearish signal, perhaps kicking off a massive drop of at least 400 points, if not 500. Ultimately though, this is a market that I think will continue to see a lot of volatility as we head towards the Wednesday FOMC meeting, which of course everybody will be paying attention to due to the spiking US yields recently. If the Federal Reserve continues to do very little about yields, that could cause significant trouble.