DOGE/USD was able to traverse near one-month highs this weekend when solid values near six and four/tenths cents was briefly challenged. Dogecoin remains a favorite of cryptocurrency speculators because it continues to deliver large percentage changes of price in a swift manner. Using technical charts within DOGE/USD are useful to gauge risk sentiment and potential behavior, but this also show the steep moves which can often lead to changes in value of nearly 20 percent within a short period of time.

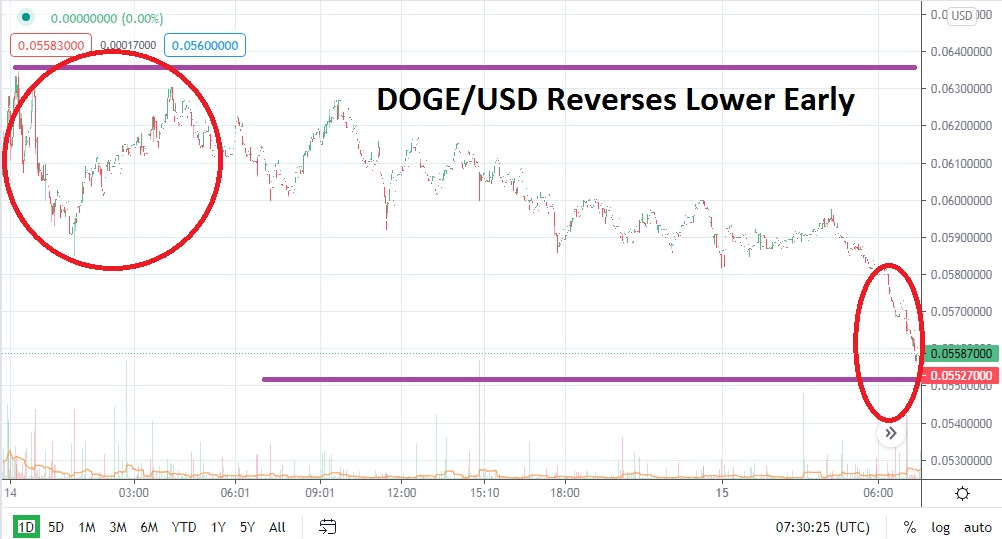

Having come off this weekend’s highs, DOGE/USD is correlating with other major cryptocurrencies which also flirted with higher values and then seemed to have experienced a round of profit-taking the past twelve hours. The reversal lower in DOGE/USD has placed the cryptocurrency within a rather functional mid-term price range which traders may suspect will now begin to see support emerge and the potential for another surge higher.

The support level of five-and-a-half cents appears to be a rather important inflection point for Dogecoin. Speculators may believe this area and slightly above the five-and-a-half cents mark is a solid ground to try and place limit orders to buy DOGE/USD and look for short-term moves higher, which will again test the six cents level. However, if the five-and-a-half cent junctures do not prove adequate and fail to sustain value, traders may also anticipate a move towards the five cents support marks below.

Speculative wagers in the broad cryptocurrency marketplace remain heightened. DOGE/USD continues to receive plenty of attention, but traders must understand that its transactional volume remains rather light, even if it is ranked near the 14th biggest digital currency in terms of market capitalization. Dogecoin must be treated carefully because large transactions by ‘whales’ within the cryptocurrency market can have an effect and reversals are common.

Most of the price action for DOGE/USD has been between four and eight/tenths and up to the six and two/tenths cents vicinity since the start of March. This morning’s price action downward has been steep, but it follows a rush towards one-month highs which were tested this weekend.

Traders need to remain alert and nimble when trading DOGE/USD, but remaining a buyer on reversals lower which test current support levels remains a speculative endeavor which may produce positive results. Tactically, traders need to know what their goals are before pursing long positions of DOGE/USD and have their orders entered and working so they may be able to take advantage of the volatility within the cryptocurrency.

Dogecoin Short-Term Outlook:

Current Resistance: 0.05850000

Current Support: 0.05488000

High Target: 0.06230000

Low Target: 0.05250000