The euro continues to go back and forth overall, as we are hanging around at the 1.19 level. It is worth noting that the uptrend line has offered support, but the euro does not look that strong, and it is very possible that it has no business acting very strong. After all, the French are locking everything back down again, and now we are getting word out of Germany that a third wave of the coronavirus is starting to cause major issues. This does not play well in the markets as we also know that the European Union has struggled to rollout the vaccine.

Contrast this with the United States, which is seeing growth again, and looks to be infinitely stronger than the Europeans are right now. The Americans have had a good run of vaccinations at the same time, so if you are looking for growth, you are more than likely going to find it in America and stay away from Europe. Further complicating the situation has been the fact that the 10-year note in America has offered a significant rise in yield, reaching as high as 1.75% recently, which is light years ahead of what you can get in Europe.

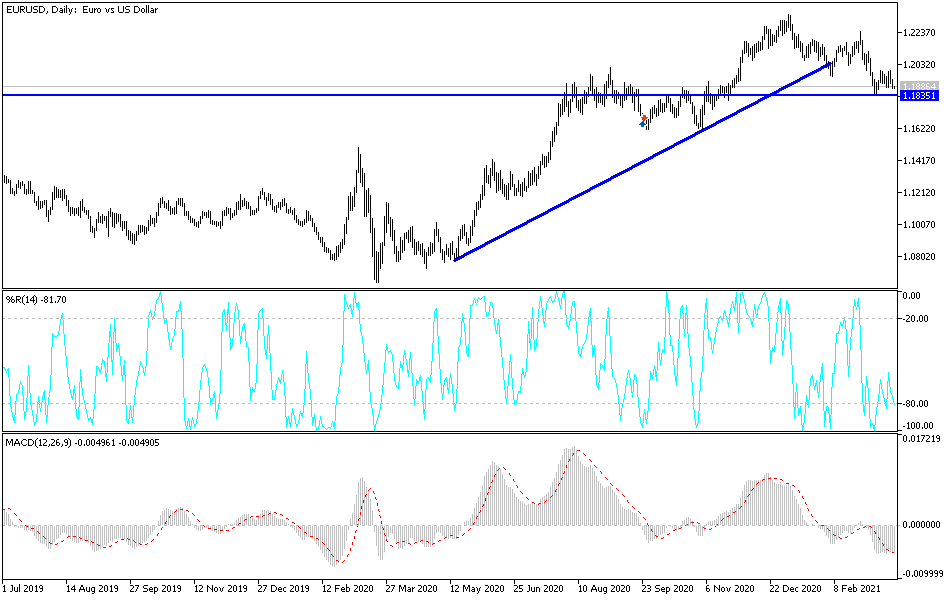

Looking at the chart, you can see that the 200-day EMA sits just below the uptrend line, so there is an argument to be made that there should be a certain amount of support in this area. However, you should also keep in mind that the dichotomy between the United States and Europe will continue to be one of the biggest drivers of this market, not just a few technical indicators. Because of this, I think we are likely to see a bigger move next week, and it should be noted that the US dollar does look like it is trying to strengthen against most other currencies. It is even worth noting that some of the old correlations between this pair and the USD/CHF pair has diverged a bit during intraday trading. Having said all of that, if we can break above the 1.20 level, I would assume that we should continue to go higher and perhaps reach towards the 1.22 level above where we have seen significant resistance and selling pressure previously. Nonetheless, it certainly looks weak at this point in time.