A temporary stall in the gains of the US dollar contributed to a limited upward correction for the EUR/USD since yesterday's trading. The pair retreated to 1.1915 before settling around 1.1898 at the beginning of Wednesday's trading. The pair's recent losses pushed it towards the support level of 1.1835, its lowest in more than three months. The currency pair picked up momentum from the stalled gains in bond yields and the US dollar after recent bullish levels, although expectations indicate that the resumption of the EUR rally still needs more momentum. The 10-year US bond yield charted a path to its first decline in five days, which may have played a role in causing widespread losses of the dollar against the rest of the other major currencies.

The pressure on the euro increased after data from the German statistics agency Destatis indicated that German industrial production contracted by more than economists had expected in the new year. Besides, Eurozone GDP growth for the fourth quarter was revised down by 10 basis points to -0.7% on a quarterly basis, with weak private consumption resulting from the virus outbreak partially offset by restocking and steady investment. Across the board, industry registered another strong quarter while services shrank. Amidst tight restrictions, growth of 1.5% QoQ in the first quarter is expected.

In general, the euro was not affected much by the official announcement of the economic contraction in the last quarter of the year, which was slightly lower than economists had expected, with declining US bond yields and a contraction of the safe-haven dollar, which dominates the lower-yielding currencies. Expectations for a global economic recovery in 2021 have been boosted in recent weeks by the agreement in Washington of another US stimulus package, which is expected to be signed by President Joe Biden this week, and is likely to have a role in the market downturn now.

Rising debt issuance due to the stimulus package along with a host of other factors, including the inflationary impact of damage to the production capacity of some industries due to restrictions linked to the coronavirus, has made investors fear that inflation may return soon.

This, combined with the unprecedented new money already leaking into the markets as a result of the pandemic, is among the drivers of the violent bond selling that has had spillover effects in many other parts of the world including Europe. The decline in bond prices and high yields negatively affected the stock and commodity markets during the end of the month to March, which led to investors taking profits on previous bets against the dollar and in favor of other currencies, which had a particularly clear impact on low returns such as the euro.

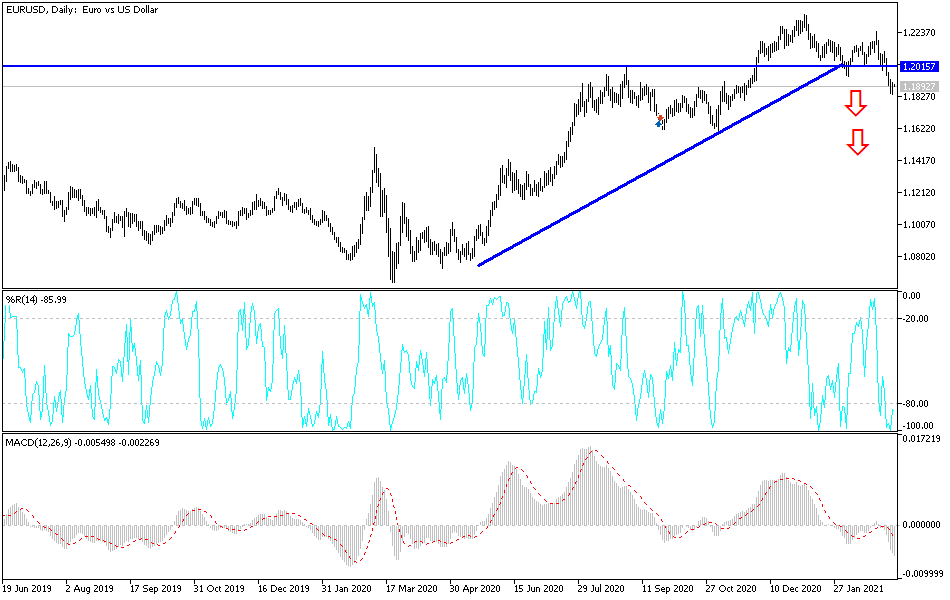

Technical analysis of the pair:

On the daily chart, the EUR/USD is still under bearish control, and stability below the support level of 1.1880 supports more selling. At the same time, it pushes the technical indicators to strong oversold areas. Accordingly, the most important support levels for buying opportunities are currently 1.1820, 1.1765 and 1.1690. On the upside, stability above the 1.2000 psychological resistance remains important for the bulls to start taking control and change the current bearish outlook. The pace of European vaccinations and easing restrictions will remain important for the euro to get the momentum to go higher.

Today's economic calendar:

The rate of French industrial production will be announced. From the United States, the Consumer Price Index reading will be announced.