For the second week in a row, the bulls tried to launch the EUR/USD price above the 1.2000 psychological resistance, to break out of its last bearish channel. But they failed to achieve this. The pair's gains did not exceed the 1.1990 resistance level, and by the end of last week’s trading, it collapsed to the 1.1873 support level before closing the week’s trading steady around the level of 1.1904. In addition, the currency pair was affected by what was announced by the US Federal Reserve and the European Central Bank officials' statements.

The Fed revised its forecast for growth and increased the number of officials expecting an increase in 2022 and 2023, but the market got the message that it was dovish in two important ways. First, most officials still don't see a pick-up even after 2023. Second, Powell has emphasized that the significant progress towards maximum employment and price stability is not related to forecasts but to actual data. The Fed chairman has been explicit that a temporary rate hike will not meet the criterion for a policy shift. As we discussed, the primary effect of last year's epidemic downturn impulse from year-on-year comparisons will raise consumer inflation readings starting this month.

So the Fed will see this, and monetary policy will remain affordable. Separately, Powell indicated that a decision on exemption from the Treasury's special leverage ratio and excess reserves from the account will be announced in the coming days.

Generally, the race between the vaccine and the virus and its continued mutations at a very uneven pace has economic consequences. The Eurozone has lagged behind in the fiscal and monetary policy response compared to the United States, despite being hit hard by the virus. It also lags behind in vaccinating its population.

While US President Biden has suggested a return to normal life after early July, Europe may struggle to reach the 70% vaccination target by the end of the third quarter. The latest OECD forecasts indicate that the US economy will grow 6.5% this year and 4% next. On the other hand, the European Union economy is expected to grow by just under 4% in both years.

Data from the German statistics agency Destatis showed that producer prices in Germany rose for the third month in a row in February. The Producer Price Index recorded a reading of 1.9% year-on-year in February, after rising by 0.9% in January. Excluding energy, German producer prices rose 1.4% year-on-year in February. Energy prices grew 3.7%.

Among other components, intermediate goods prices rose 3.8% year-on-year in February. Consumer and capital goods prices rose 1.4% and 0.8%, respectively. Meanwhile, consumer prices fell 2.0%. On a monthly basis, producer prices rose 0.7% in February, after increasing by 1.4% in the previous month.

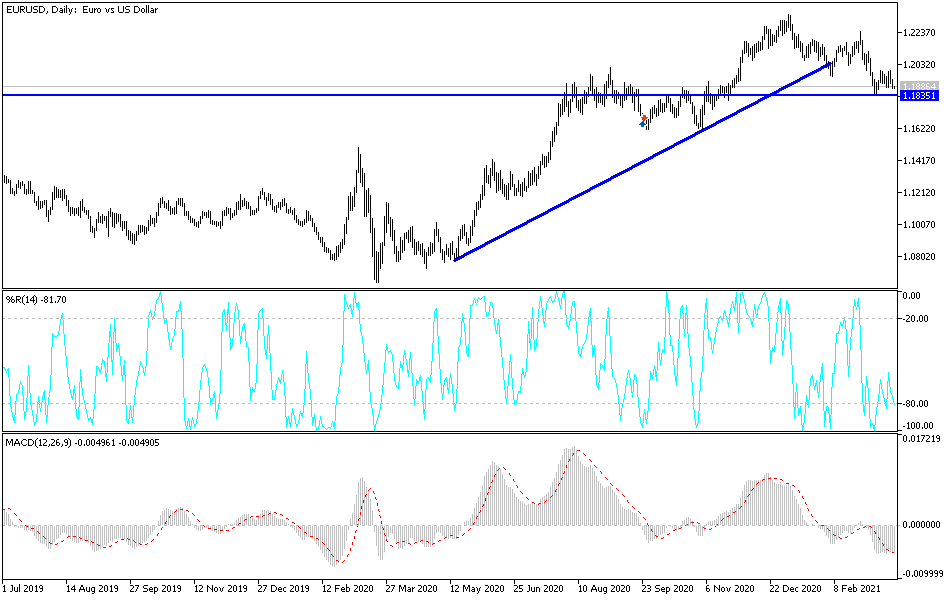

Technical analysis of the pair:

There is no change in my technical view of the EUR/USD, as the bulls' attempts to rebound higher will only succeed by settling above the psychological resistance of 1.2000, which may increase buying and thus a rush towards stronger bullish levels. The closest ones are 1.2065, 1.2130 and 1.2200 respectively. On the downside,a breach of the 1.1880 support level will increase the bears' control and continue moving inside the month-long descending channel. I still prefer to sell the currency pair from every upward level as long as the factors above persist.

Today's economic calendar:

The current accounts figure for the Eurozone will be announced, followed by the monthly report from the European Central Bank. Then, we will hear important statements from US Federal Reserve Chairman Jerome Powell, as well as the number of existing US home sales and statements from a number of US monetary policy officials.