The bullish rebound attempts of the EUR/USD pair during last week’s trading did not breach the psychological resistance of 1.2000 and closed trading steady around 1.1951. The lowest during the Friday trading session was the support level at 1.1909. Forex investors are still awaiting the opportunity to buy the currency pair, but the factors of decline are still strong, especially the slow pace of European vaccinations. The outbreak of the epidemic continues to send negative signals to investors about the future of European economic recovery.

Italy may head to another national lockdown during the Easter holiday, and German health officials fear what has been described as a third wave of COVID-19 infections.

The US dollar is still in a winning position against the rest of the major currencies, after the US bond markets witnessed more selling, which pushed the longer-maturity yields to new heights and appeared to disturb stock markets, commodity prices and riskier currencies. US bond yields rose after US President Joe Biden signed Washington’s latest stimulus bill, which provides a total of $1.9 trillion for federal and state government programs and includes an allocation for more checks of up to $1,400 for eligible families as compensation for lost wages during the outbreak.

Commenting on this, John Hardy, Head of Forex Strategy at Saxo Bank said: “This will energize the new era of financial dominance in the US. Therefore, the EUR/USD pair will need to avoid closing above 1.2000 if the recent breakdown is to maintain the trend."

The big spending on the economy has a negative effect on bond prices, which is exactly the same thing that could raise yields. Although the package was approved earlier last week and was expected months ago, the US Treasury Department sold a total of $24 billion of bonds. For a 30-year period with returns of 2.3%, the highest level since February 2020, demand was tepid or average at best with the bid-to-coverage ratio of 2.3. This is close to the middle of the bid range, from 2.1 to 2.5 since the end of 2018.

The outcome of the auctions has been a source of uncertainty this week given higher US government spending, high inflation expectations in financial markets, and the monetary policy stance of the Fed, which has insisted that it will not raise US interest rates until it actually does. We have seen some inflation above target for an indefinite period. Kit Juckes, Senior Forex Strategist at Societe Generale, said: "The G10 currency pairs that are most sensitive to higher Treasury yields are the US dollar, Japanese yen, the euro and Swiss franc."

Auctions went smoothly, with no problem financing the US deficit, although yield and demand results illustrate and underscore the seemingly very limited downside of US bond yields and an ample rally. However, its long-term impact on the dollar and the euro is more uncertain. Generally, high returns from time to time may lead to a demand to buy the US dollar because they reflect some of the best returns offered to investors in the currency market today, although the epidemic continues all the time and the global economy remains burdened with restrictions, but higher returns will act as well.

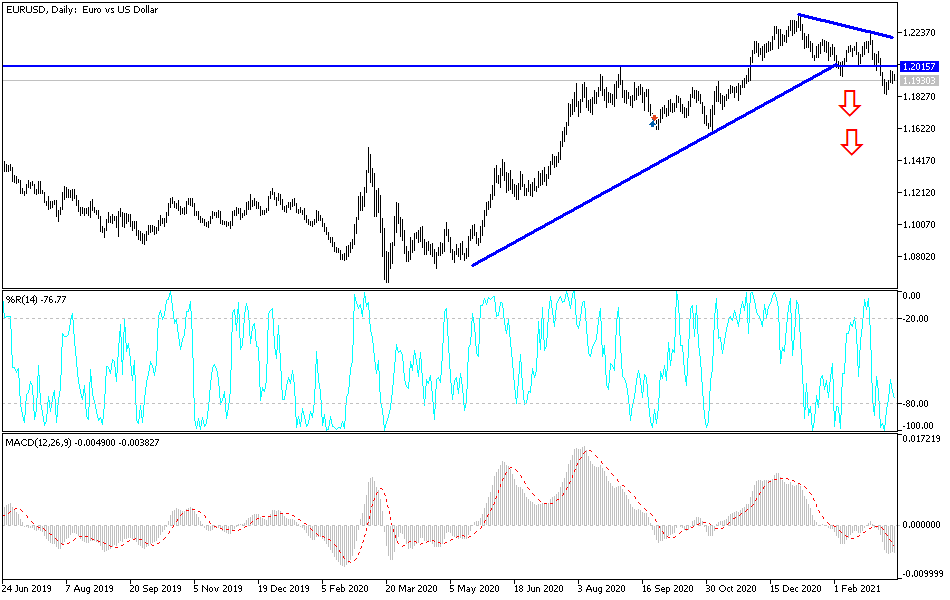

Technical analysis of the pair:

On the daily chart, the EUR/USD is still in a bearish correction range, and approaching the 1.1800 support level will open a move towards stronger support levels. On the upside, the bulls are still trying to launch the currency pair higher, surpassing the 1.2000 psychological resistance level, because it may increase buying. But at the same time, it must be taken into account that the gains of the euro are still subject to a rapid collapse as the European delay in vaccination will impede economic recovery. Accordingly, the gains in the EUR/USD will remain a target for selling again.