Amid recent selling, the EUR/USD moved to the 1.1990 support level, then made an upward correction after buyers returned and settled around 1.2094 as of this writing. The latest bounce does not signal the end of the recent downward correction, but it has stalled and is waiting for any new impact on investor sentiment.

In general, the euro is under pressure against the strong US dollar, a movement supported by weak global stock markets and a view that the US economy is on its way to outperform the Eurozone in 2021. Many analysts in global institutions and banks see that breaking below the psychologically and technically important level at 1.20 could open the door to a faster downward move, and a possible reset in the EUR/USD range in the short term. However, other analysts say the dollar is benefiting from the instability in ambitious markets, and the dollar's movement may soon fade as the rebalancing process is complete.

Global equity markets have been softer due to the lack of real moving news, indicating that the old rule that the dollar rises when stocks are down contributes to the dynamics of the Forex market. George Vessy, Forex Analyst at Western Union Business Solutions, said: “The stronger US dollar pulled the EUR/USD to the main support of $1.20, while the GBP/USD extended below $1.39 after it was higher than $1.42 last week. The bets on a faster economic recovery in the United States compared to other economies, and the US Federal Reserve's expectations that allow bond yields to rise higher compared to other global central banks are helping the US dollar to rise against its low-yielding peers."

Kit Juckes, Forex Analyst at Société Générale, says: “This morning and perhaps this week, there is no doubt that the momentum is with the dollar and against the euro.” The analyst believes that expectations of a faster rate of economic growth and inflation in the United States of America provide basic support for this step. It indicates that the forecast for GDP growth for the Eurozone in 2021 in September was 2% higher than the US consensus (5.7% vs. 3.7%).

The outperformance of growth in the US is likely to be supported by further financial support stemming from the US government which intends to distribute an additional $1.9 trillion in stimulus to help combat the economic downturn in the near future. Therefore, when the market rebalancing is complete, the euro may find itself better supported.

Global markets have become increasingly in tune to developments in the yield on government bonds, as analysts say the dollar is benefiting from the rapid increase in the yield on US bonds, especially those with a 10-year maturity. The rise in earnings, in turn, reflects expectations of strong growth in the US in the coming months, and stronger-than-expected inflation levels. So bondholders require a higher return on their holdings, reflected in higher bond yields, to hold these assets in a higher inflationary environment.

The rise in yields also reflects an expectation that the US Federal Reserve will likely go ahead as it cuts its quantitative easing program and starts raising interest rates again. Some analysts argue that the Fed could begin to "curtail" its bond purchases under the quantitative easing program as early as September, and in contrast to the European Central Bank's reluctance to contemplate such moves, it provides some potential additional support for the dollar as the European Central Bank appears eager to fight the rising bond yields in the Eurozone.

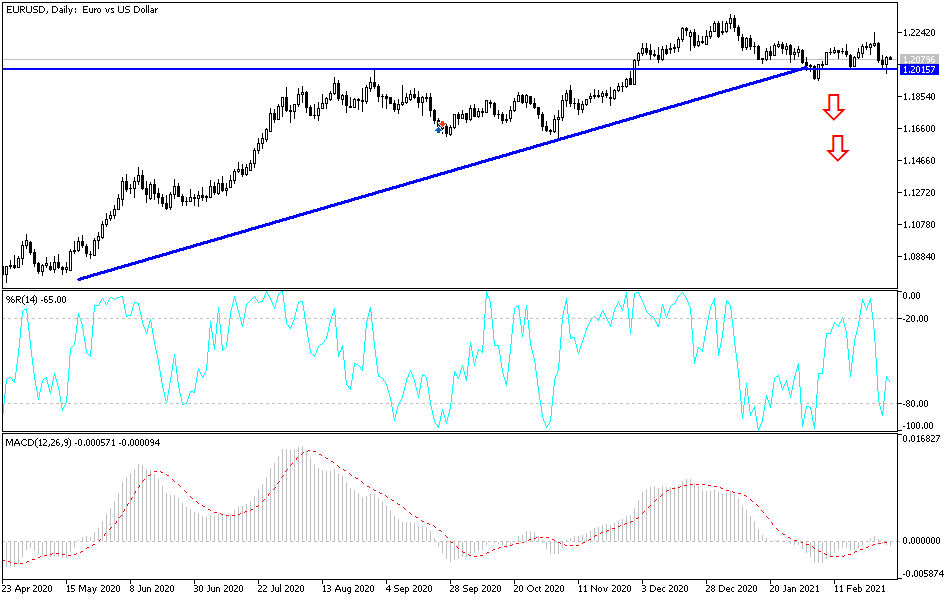

Technical analysis of the pair:

On the daily chart, bulls will not regain control over the EUR/USD pair's without breaching the 1.2300 resistance level. At the same time, the bears approaching the vicinity of the psychological support level of 1.2000 confirms that the pair is indeed ready to test stronger support levels, the closest ones being at 1.1965, 1.1880 and 1.1800. The weakness of European vaccination programs continues to negatively affect investor sentiment towards the euro.

Today's economic calendar:

The Service PMI reading for the Eurozone economies and the PPI reading for the bloc will be announced. On the US side, the ADP survey reading will be announced to measure the change in the number of non-agricultural jobs, and the ISM Services PMI will be released.