The difference between success and failure in Forex trading is very likely to depend mostly upon which currency pairs you choose to trade each week and in which direction, and not on the exact trading methods you might use to determine trade entries and exits.

When starting the trading week, it is a good idea to look at the big picture of what is developing in the market as a whole and how such developments and affected by macro fundamentals and market sentiment.

It is a good time to be trading markets right now, as there are some valid and strong long-term trends in favor of the U.S. dollar and against some other traditional safe havens such as gold, the Swiss franc and the Japanese yen.

Big Picture 7th March 2021

Last week’s Forex market saw the strongest rise in the relative value of the U.S. dollar and the strongest fall in the relative value of the Swiss franc. There is a long-term bullish trend in the U.S. dollar, which is making the Forex market quite interesting to trade now.

Fundamental Analysis & Market Sentiment

The headline takeaway is that we saw last week a continuation of a recent change in market sentiment which is mixed and hard to describe. It is neither risk-off nor risk-on, but is driven more by whether assets are in favor or not. Although major global stock indices fell sharply at times last week, some ended the week higher in the U.S. (e.g., Dow Jones 30, S&P 500), while others fell (e.g., the NASDAQ 100, Nikkei 225, Hang Seng). In the U.S., the “old economy” has outperformed the new, which can be seen from the fact that the Down Jones 30 has outperformed the S&P 500.

We are seeing a continuing strong rise in the relative value of the U.S. dollar, driven partly by the increase in the 10-year U.S. Treasury yield to well beyond the benchmark 1.5% rate, and partly by another anticipated event which has just become reality – the passage of another coronavirus relief / economic stimulus package by the U.S. Senate, which will shortly become law and mandate the spending of a further $1.9 trillion in federal funds. This will inject liquidity into the economy and provide most adult Americans with direct one-off payments of $1,400.

Last week saw the performance of the U.S. economy exceed consensus forecasts, with 379K new non-farm jobs being created over the past month well ahead of the 197K, which had been expected. The unemployment rate also fell slightly from 6.3% to 6.2%. With the new stimulus bill expected to become law shortly, we can expect a healthy tailwind for U.S. economic growth.

Bitcoin recovered from its low the previous week, but not strongly enough to break up past key resistance levels above $50K, meaning that a renewed push to new highs is now looking less likely to happen.

The coming week will bring central bank input from the European Central Bank and the Bank of Canada, as well as a release of important U.S. inflation data.

Last week saw the global number of confirmed new coronavirus cases and total deaths again drop worldwide, although by less than recent weekly decreases. The amount of daily new cases is down by almost half from its peak in early January, while daily deaths are down by more than one third over the same period.

Many countries have begun vaccination programs. Israel has vaccinated over 53% of its population (including 80% of over-50s) with a first dose of the Pfizer vaccine, and over 40% with a second and final dose. The U.A.E. is next with 22% of its population fully vaccinated.

The strongest growth in new confirmed coronavirus cases is happening in Austria, Bosnia, Brazil, Bulgaria, Chile, Cyprus, Czech Republic, Estonia, Ethiopia, Finland, Greece, Hungary, Iran, Iraq, Jordan, Kenya, Kosovo, Kuwait, Malta, Moldova, Mongolia, North Macedonia, Norway, Oman, Pakistan, Paraguay, Philippines, Poland, Romania, Serbia, Slovakia, Sweden, the Ukraine, and Uruguay.

Technical Analysis

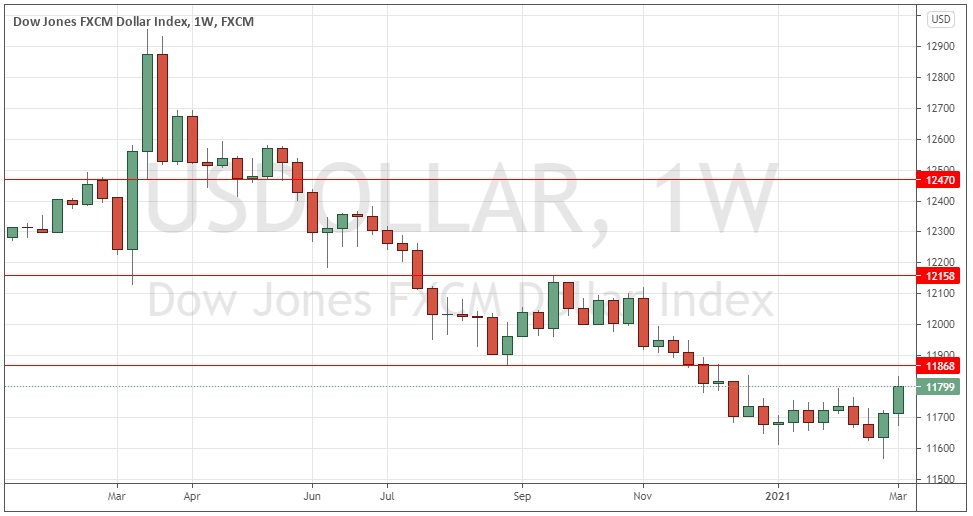

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar index printed a reasonably large, bullish candlestick last week which followed a bullish engulfing candlestick from the week before. The consolidation of the past few weeks appears to have ended, with the dollar showing some bullish momentum. Despite that, the index is still below its prices from three and six months ago and below a nearby resistance level, suggesting that the upwards movement may be capped over the near term. Overall, next week’s price movement in the U.S. dollar looks at least a little likely to be downwards. For this reason, it will probably be wise to focus on trading the USD long over the coming week.

USD/JPY

This major currency pair printed a strongly bullish weekly candlestick which closed at a 6-month high price on Friday near at the top of its weekly range. These are bullish signs, with the Japanese yen also acting as a generally weak currency in recent weeks. This Forex currency pair looks somewhat likely to rise further but may well struggle to get any higher once it begins to approach the major psychological round number at 110.00.

EUR/USD

We saw a strong, relatively large bearish candlestick in this currency pair last week, closing near the low of its range. This is the lowest weekly close in over 3 months. The price getting established below the 1.1950 area is technically significant for bears. These are all bearish signs, and it is somewhat likely that the price will continue to fall over the coming week.

Bottom Line

I see the best likely opportunities in the financial markets this week as being short of EUR/USD and long of USD/JPY.