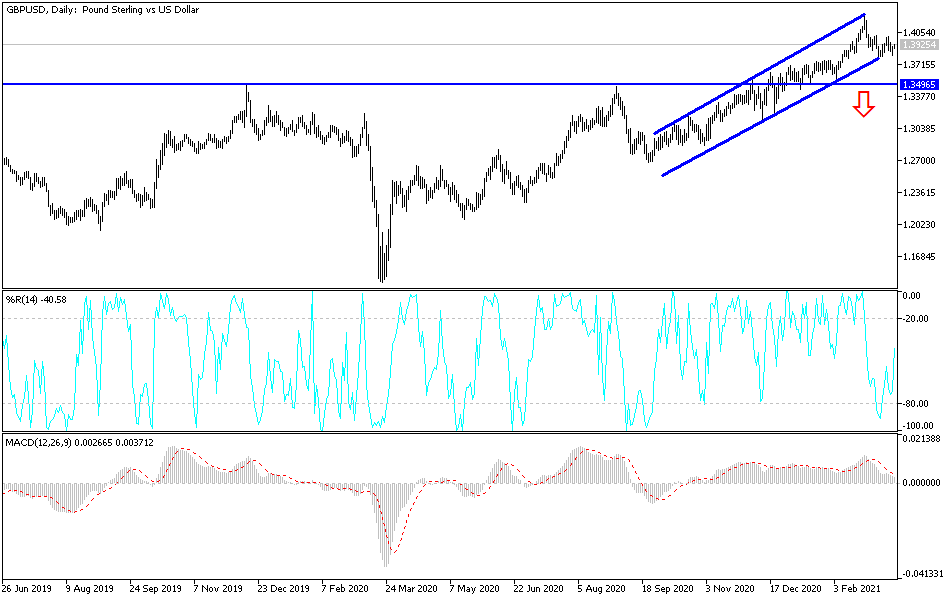

The British pound has fallen a bit during the course of the trading session to slice below a major uptrend line before turning right back around. This was kicked off by Gov. Bailey at the Bank of England stating that the central bank would buy more bonds to keep yields under control. This is bad for currency, but at the end of the day it looks as if people are more focused on the Federal Reserve as one would expect. We fell towards the 50-day EMA before turning around, and as we are closing at the New York session, we are basically unchanged.

What is going to move this market is going to be the FOMC statement and possibly the question and answer session shortly thereafter. If the Federal Reserve states that it are looking to control yields or at least hint at that, it will drive down the value of the US dollar. That would be extraordinarily bullish for the British pound, because the Federal Reserve has the ability to fight the market much more than the Bank of England. Furthermore, it also will drive down the value of the US dollar against almost everything. It would have a bit of a “knock on effect” over here as a result.

To the upside, I believe that if we do see the Federal Reserve doing something to protect the market from higher yields, then I believe that the British pound will reach towards the 1.40 level. That is an area that is massive resistance, so breaking above there opens up the possibility of a move towards the 1.42 handle, which had been the most recent high. Furthermore, that level had been resistance on a weekly chart, so it makes sense that people have been paying close attention to it. What we have here is a pullback that may be an attempt to build up enough momentum to finally break out above that level. Historically speaking, the British pound is still relatively cheap, but if we were to break down below the 1.3750 level, it opens up a move towards the 1.35 level, where I see even more support possibly coming into the marketplace as the 200-day EMA races towards it.