Bearish View

Set a sell stop at 1.3760 (yesterday's low).

Add a take-profit at 1.3700 and a stop-loss at 1.3800.

Timeline: 1 - 2 days.

Bullish View

Set a buy stop at 1.3800 and a take profit at 1.3850 (yesterday high).

Add a stop loss at 1.37.50

The GBP/USD pair is little changed after falling by 0.65% yesterday. It is trading at 1.3778, which is a few pips above yesterday's low of 1.3755.

US Bond Yields

The GBP/USD pair declined as the market reflected on the rising US bond yields. After cooling down last week, the 10-year bond yield rose to 1.74%, the highest level in 14 months. The 30-year and 5-year bond yields have also risen.

This performance of the bond market is probably because of the overall expectations that US inflation will bounce back in the second quarter of the year.

Some analysts expect that the headline consumer inflation will rise to more than 4%, helped by the recent $1.9 trillion stimulus package and the reopening of the American economy. Also, the upcoming $3 trillion infrastructure package will help boost consumer prices. If this happens, the Fed will likely turn hawkish even if it leaves its interest rates and quantitative easing policies intact.

Today, the GBP/USD movements will be affected by consumer confidence data from the United States. Economists polled by Reuters expect the data to show that the overall confidence rose from 91.3 in February to 96.9 in March. This improvement will be because of the ongoing vaccination drive and the $1,400 stimulus checks provided in March.

The pair will also be affected by the UK and US Treasury yields. If the US benchmark 10-year yield keeps rising, there is a possibility that the pair will continue falling as the dollar strengthens. Also, the pair will likely react to the upcoming UK GDP data and Nationwide House Price Index (HPI) and the US pending home sales numbers scheduled for tomorrow.

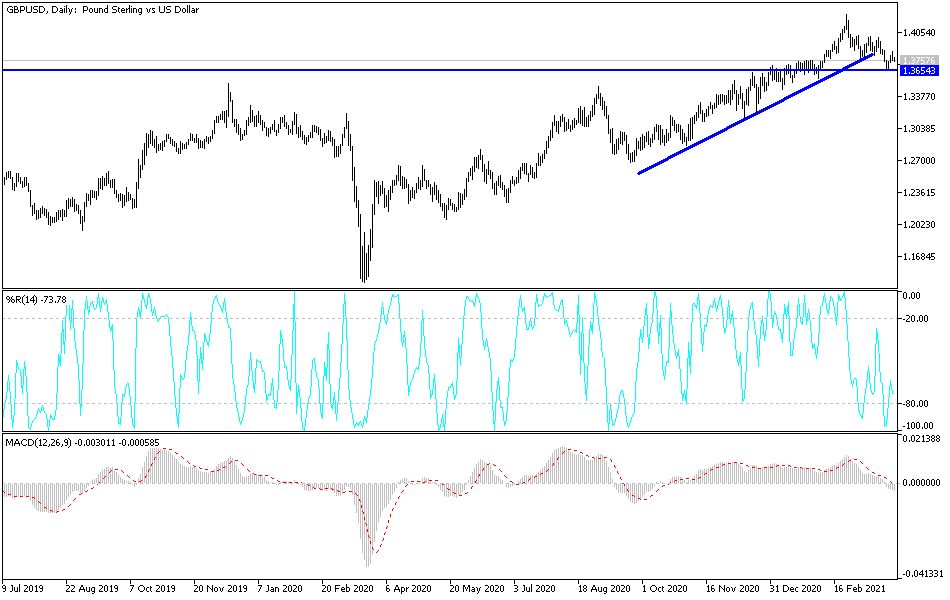

GBP/USD Technical Forecast

The GBP/USD pair declined sharply yesterday as US bond yields continued to rise. On the hourly chart, the price is slightly below the 61.8% Fibonacci retracement level. It is also slightly above the ascending black and is slightly below the middle line of the Bollinger Bands. The pair also seems to be forming a bearish flag pattern. Therefore, it will likely break out lower as bears target the next key support at 1.3700. A move above 1.3800 will invalidate this trend.