The British pound's performance may be subject to strong and violent movements after an announcement later by the British Ministry of Finance. The ministry is expected to announce the details of the country's budget, which will help identify additional stimulus plans to revive the British economy. Ahead this important event, the GBP/USD currency pair has experienced strong profit-taking amid the dollar's recovery, reaching the support level of 1.3858. The pair is holding around 1.3965 at the time of writing. The US dollar is now the best performing G10 currency since last week, so analysts say that those watching the pound should be prepared for a deeper near-term correction lower before the current selling impulse recedes.

Commenting on the performance, George Vessy, a Forex Analyst at Western Union Business Solutions, said: “The British pound is declining for the fourth consecutive day against the dollar and is approaching a major support area located on an upward sloping trend line. A breakout below the $1.37- $1.38 area could open the door for a significant drop.”

The British pound has not suffered any major fundamental setback, but is instead heading towards a decline against most currencies after a strong start to 2021, leaving it vulnerable to any recovery in the US dollar. This recovery is now evident and data shows that the US dollar is the best performing major currency since last week, confirming that there is real demand for the currency. Investors' attention during the past ten days has focused on the increase in global bond yields, especially the increase in the yield on the ten-year US Treasury bonds.

Usually, the dollar benefits in an environment in which the United States' rate of return is higher than in other countries.

The higher returns reflect investor expectations of strong growth in the United States in the coming months, in addition to stronger-than-expected inflation levels. So bondholders require a higher return on their holdings, which is reflected in higher bond yields, to hold these assets in a higher inflationary environment. The rise in yields also reflects an expectation that the US Federal Reserve will likely go ahead as it cuts its quantitative easing program and begins raising interest rates again.

According to ING's projections, the US Federal Reserve could begin to "curtail" its bond purchases under the quantitative easing program as early as September, all of which fit into a stronger dollar environment.

Growth in the UK manufacturing sector was boosted slightly in February as extended supply chains and rising costs weighed on growth. Accordingly, survey data from IHS Markit showed that its index rose to 55.1 in February from 54.1 in January. This was above expectations of 54.9. A reading above 50 indicates growth in the sector and the PMI indicated growth for nine months in a row.

Output growth was the slowest in the current nine-month increase. New orders grew slightly after a slight decline in January, due to improvement in domestic demand and export businesses. Employment rose at the fastest pace since June 2018. Supply chain disruptions and a shortage of raw materials pushed input cost inflation to its highest rate in more than four years. After that, production prices rose at the fastest pace since January 2018.

Business optimism rose to its highest level in 77 months in February, with more than 63 percent of companies reporting that they expect production to be higher within one year, according to the survey. The ongoing recovery from the pandemic and the reopening of the global economy - including reduced transport restrictions and reduced Brexit uncertainty - have boosted confidence.

Survey data were collected from February 11 to 23. Commenting on the findings, Rob Dobson, Director of IHS Markit, said: "With the current restrictions likely to continue in the foreseeable future, pressure on prices and production volumes may remain a feature over the coming months."

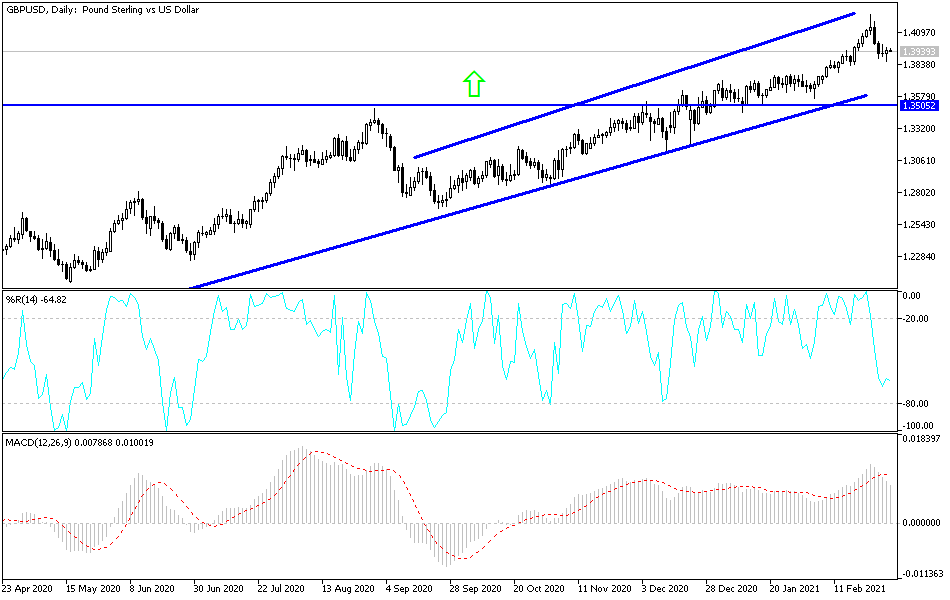

Technical analysis of the pair:

The bulls will try to push the GBP/USD pair to stabilize above the 1.4000 psychological resistance, to start compensating for the recent losses of the pair. Stability above this resistance means more buying, which is our expectation. The closest levels of support where buyers will be looking for a rebound are 1.3890, 1.3800 and 1.3720.

Today's economic calendar:

In Britain, the Service PMI reading will be announced. On the US side, the ADP survey reading will be announced to measure the change in the number of non-farm jobs, and the ISM Services PMI will be released.