Amidst a sharp struggle between bears and bulls for the performance of the GBP/USD, the bears succeeded in pushing the pair towards the 1.3705 support level. We notice the pair’s attempts to resist the strong dollar gains recently. Nevertheless, analysts note that April is a traditionally strong month for the British currency. Hence, volatility may be a good feature of the coming days and may provide a lot of frustration for those watching the sterling exchange rates while looking to make a deal. Therefore, it is likely that the true reversal of the pound's position in the global markets will be evident on Thursday only when the fears of the end of the month and first quarter trades evaporate.

However, sterling's near-term momentum is turning constructively and increasingly as investors appear to be taking a more optimistic view of the UK and its currency, as data showed a significant improvement in demand for British assets recently. The demand for UK assets comes after the elimination of risks related to Brexit and the country's slow but confident progress towards a COVID-19 virus-free future due to a robust vaccination program.

According to Bank of America analysts, “International flows to the UK have rebounded sharply after the signing of the Brexit deal. It remains to be seen whether these flows come too soon for the balance of payments data to be released later this week. But at the moment, foreign participation in both the gold bonds and the UK equity markets (stock purchases or mergers and acquisitions) should still be seen providing near-term support for the British pound.”

According to a Bank of America analysis, the purchase of British government bonds (gold bonds) by foreigners showed a strong rebound in February, rising by 15 billion pounds. Demand for gold bonds in February 2021 was the largest of its kind in any February, surpassing the previous record recorded in February 2009 as investors returned to UK assets after abandoning them during the major financial crisis of 2008.

On the other hand, Barclays bank analysts expect the pound to recover this week after the devaluation of the currency last week caused by an increase in the risks associated with the third wave of COVID-19 infections. The UK had Europe's best record of vaccinations, and is relatively isolated from the third wave of COVID-19 infections. In addition, we have the rebalancing pattern at the end of the month which is giving a weak buy signal for the British pound.

There were several aspects that affected investor sentiment. The UK has won favorable contracts but lacks the manufacturing capacity to produce adequate vaccines. The European Union has the manufacturing capacity but it has not secured the favorable contracts, and when they did, it appears that they backed the wrong contracts. The United States has manufacturing capacity and favorable contracts. Indeed, the New York Times has warned of an abundance of vaccines in the United States. Therefore, the Biden administration promised sufficient doses to immunize all adults in the United States (260 million) by the end of May. In the following two months, through the end of July, the United States will receive 400 million additional vaccines.

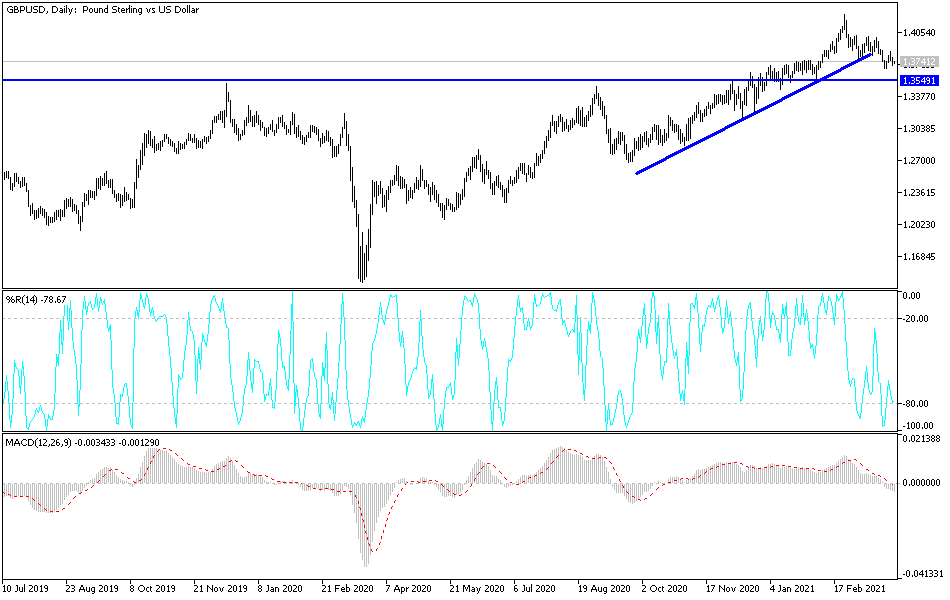

Technical analysis of the pair:

Since last week’s trading, the GBP/USD pair tried to maintain the neutrality of its performance as evident on the daily chart, but the bears’ control succeeded in breaking the strong upward trend, especially with the pair abandoning the 1.3880 level. Currencies are prepared to test stronger support levels, which are at the same time the most appropriate for buying in preparation for a rebound to higher technical levels, which are 1.3675 and 1.3580. On the upside, the bulls will not return to control the performance without testing the psychological resistance level of 1.4000 again, which will support the move towards that high by testing the resistance level of 1.3885. The divergence of stimulus and vaccination plans against the coronavirus will continue to affect the sentiment of Forex traders who prefer trading the GBP/USD.

The market expects the announcement of the British economy's growth rate, current accounts numbers and the rate of business investment. Regarding the dollar, the ADP reading will be announced to measure the change in the number of US non-farm payrolls, the Chicago PMI reading and the pending home sales.