Risk-aversion is weakening the GBP/USD pair, which is moving away from the 1.4000 psychological resistance level, confirming a bearish performance and causing profit-taking. The pair settled around the 1.3866 support level at the time of writing. The pound sterling has come under constant selling pressure against most of the other major currencies, but some recovery from these losses is possible in the coming days, some analysts say. The strength of the pound's decline on Friday was surprising due to the scarcity of news and data presented, and the British currency was softer against all of its peers in the G10 currencies, except for the New Zealand dollar, which was the biggest loser today.

There was no clear indication of the cause of the weakness, but the profit-taking of traders who saw strong gains from betting on the British pound in 2021 was suspected by some analysts to push the move lower, especially as the sell-off took place.

The future performance of the pound in the Forex market in the coming days will depend on what will be announced from the March policy meeting of the Bank of England (BoE), and if there is an optimistic message from the bank that tends to support the British pound. “The Bank of England should maintain its constructive view in place, with the rapid pace of vaccination (and the pace doubling from next week onwards) which supports the optimistic outlook for an economic recovery,” says Francesco Bisol, Forex Strategist at ING. Unlike last week's European Central Bank (ECB), ING does not expect BoE to incline against higher bond yields.

The fundamentals of the Forex market confirm that if one country experiences higher bond yields compared to others, then that country's currency tends to benefit. Consequently, the currency will also find support if its central bank is heading towards raising interest rates in the future. Analysts widely believe that this combination of monetary conditions in the UK supports the pound.

Valentin Marinoff, Head of Forex Strategy for the Group of Ten at Credit Agricole, says: “The British pound remains supported across the board, in part because investors still expect the Bank of England to begin removing some of its policy provisions once the quantitative easing program ends later this year.” "We remain optimistic about the pound sterling, especially against the euro," says Marek Rachko, an analyst at Barclays Bank.

Rachko says that the Bank of England should not follow the dovish stance of the European Central Bank and must maintain its balanced tone. The analyst believes that the MPC is likely to acknowledge the good progress in vaccinations in the UK along with the general improvement in the COVID-19 situation since their last meeting. Accordingly, the BoE should also highlight that the larger-than-expected financial package poses some bullish risks to the recent GDP forecast.

ING's analysis shows that the market has already anticipated one short hike in the UK rate for 2022 and another for 2023, saying that the cautiously optimistic BoE message could be modestly positive for the British pound. However, they do not envision the Bank of England as a catalyst for some of the “deep sterling gains”.

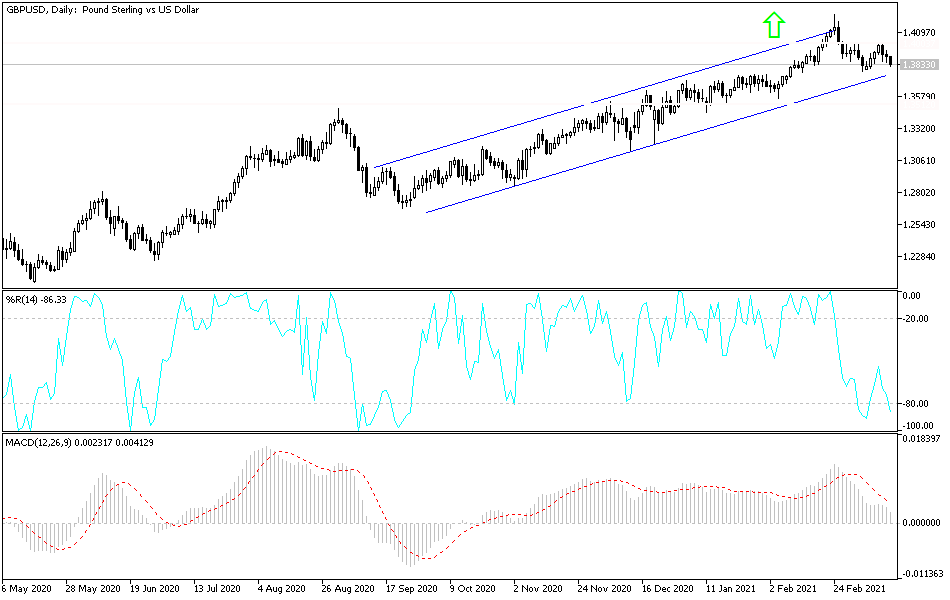

Technical analysis of the pair:

On the daily chart, and despite the recent decline, the GBP/USD pair is still within its ascending channel, and buying will increase again if it returns to settle above the 1.4000 psychological resistance. On the downside, a breach of the support level of 1.3800 will give the bears enough momentum to move towards stronger support levels, which I see as suitable to consider buying again.

The currency pair does not expect any important British economic data today, and from the United States of America, the retail sales and industrial production figures will be announced.