Investors temporarily abandoned optimism for the UK's progress in vaccinations, which contributed strongly to the sharp gains of the British pound against the other major currencies. The historical gains of the bond market supported the dollar, along with the positive results of US economic data and the near passage of US stimulus plans, all of which contributed to the collapse of the GBP/USD to the 1.3777 support level, the lowest for the currency pair in a month. After its gains in the week before last to the 1.4240 resistance level, its highest in more than three years, the currency pair closed the trading session last week flat around the 1.3830 level. Despite these losses, the British pound is ready to breach the psychological resistance level of 1.40 again.

The pound fell as the dollar rose against the other currencies, cementing its position as the best-performing major currency last week after US Central Bank Governor Jerome Powell neglected to calm the ailing bond market that pushed US yields to pre-pandemic levels last week.

Powell told the Wall Street Journal that the yields “caught my attention” and that the Fed “would be concerned about turbulent conditions,” but then said that the bond sales simply reflect economic prospects that have improved with the introduction of vaccines and federal financial support. He also insisted that the bank does not feel the need to adjust policy, and like other Fed officials, continued to cast doubts about market concerns about a potential future bout of inflation. “The way the money and bond markets behave can be excused for thinking that central banks were preparing to increase short-term interest rates, that is, to tighten monetary policy,” said Joseph Capurso, a strategic expert at the Commonwealth Bank of Australia. "We do not expect global central banks to indicate that they will begin tightening monetary policy anytime soon. We do not expect central banks to quickly change their approach.”

The brighter prospects have seen investors abandon their bets against the dollar at the same time that they turn away from bonds in the event that higher inflation later forces the Fed to raise the US interest rate. However, the 10-year yield was not able to maintain its bullish momentum on Friday even after the jobs report showed that the US is providing double the number of jobs that was expected last month. Bonds and high yields could lose their strength, which could support the pound in this week's trading.

As for what matters to the markets right now, Andreas Steno Larsen, a Forex analyst at Nordia Markets, says, “Economists seem to be competing with each other to raise their growth forecasts in the United States as follows: (1) financial divergence, (2) variation in vaccine offering, (3) a more moderate fiscal impulse than a weaker currency in 2020”.

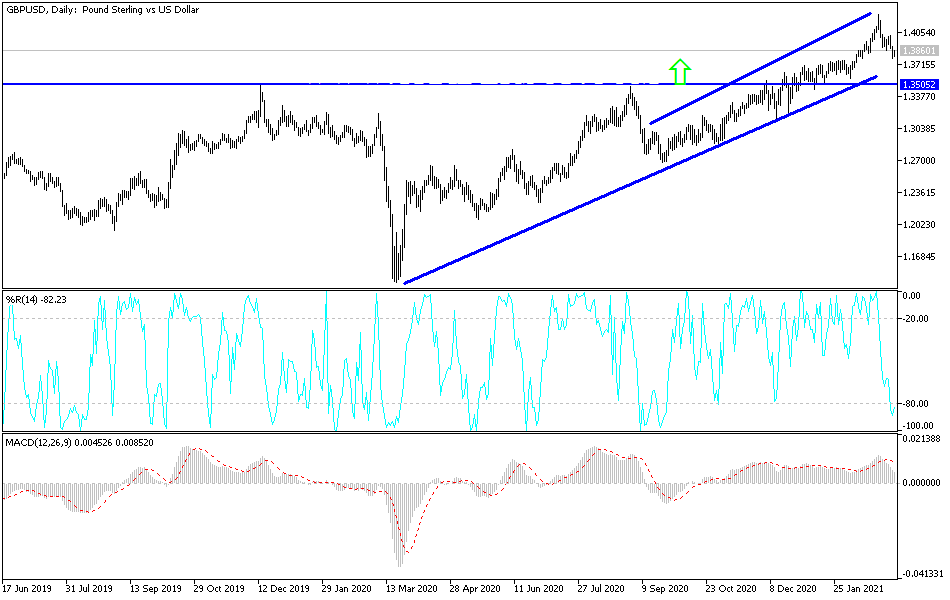

Technical analysis of the pair:

On the four-hour chart, the losses of the GBP/USD pushed the technical indicators to strong oversold levels, suggesting that buying and waiting for a bounce might be the best plan of action. The support levels 1.3780, 1.3690 and 1.3600 may be the best suited for that. On the upside, stability above the 1.4000 psychological resistance will remain important for bulls to take off towards stronger bullish levels for the pair.

According to the performance on the daily chart, bears may still gain control until the indicators reach strong oversold areas. In general, British progress in vaccinations and the government's announcement of a timetable for abandoning restrictions will remain factors supporting the sterling in the rapid upward rebound.

Amidst the absence of the economic calendar today of important US economic data, the pair will focus on the statements of the Governor of the Bank of England and the performance of global stock markets.