The US dollar was negatively affected by the Federal Reserve's monetary policy decision and the statements of Chairman Powell, which contributed to an upward rebound for gold. Gold reached the $1752 level, where it stabilized at the time of writing. This comes after weak attempts in recent trading sessions to bounce higher after losses extended to the support level of $1678. The Federal Reserve left its policy rates unchanged and said it was unlikely to raise US interest rates until 2023.

In the same performance as gold, silver futures rose at $26.058 an ounce, while copper futures settled at $4.1190 a pound.

The US central bank kept the interest rate target range unchanged from 0% to 0.25%. At the same time, the central bank raised its forecast for the economy and inflation, but expects interest rates to remain unchanged until 2023. The updated forecasts show that Federal Reserve members expect stronger economic growth and higher inflation this year, although the US central bank still expects to keep Interest rates are at near zero levels through 2023.

The central bank also reiterated that it plans to continue buying bonds at a rate of at least $120 billion per month until "more significant progress" is made toward its policy goals. The bank said that members now expect the gross domestic product of the United States to increase by 6.5% in 2021, compared with expectations of a rise of 4.2% last December.

The forecast for the pace of growth in core consumer prices, which excludes food and energy prices, was revised upwards to 2.2% from 1.8%. In its accompanying statement, the Federal Reserve acknowledged the recent emergence of economic activity and employment indicators. However, the median forecast from Fed members expects interest rates to remain at current levels through 2023.

The Fed assured once again that rates will remain unchanged until labor market conditions reach levels consistent with its assessments of maximum employment and that inflation is on its way to moderately above 2% for some time. The latest projections indicate that GDP growth is expected to slow to 3.3% in 2022 and 2.2% in 2023, while core consumer prices are projected to increase by 2.0% in 2022 and 2.1% in 2023.

Ahead of the bank's announcement, a report from the US Commerce Department showed a significant drop in US housing starts in February, with housing starts extending the sharp decline seen in the previous month. The report said that housing starts fell 10.3% to an annual rate of 1.421 million in February after falling 5.1% to a rate of 1.584 million in January. Economists had expected housing starts to decline 0.9% to the rate of 1.565 million from the 1.580 million originally reported from the previous month.

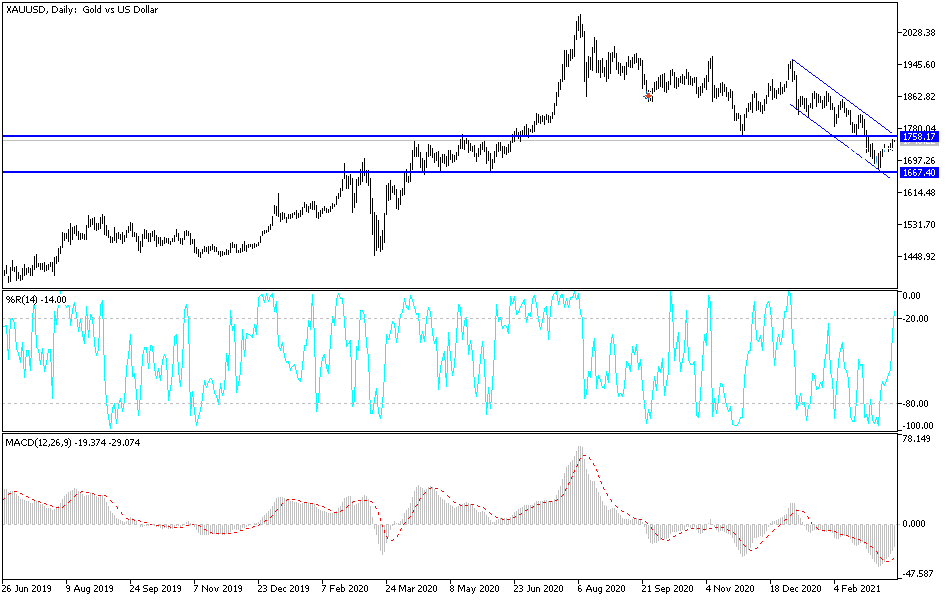

Technical analysis of gold:

In the short term, and according to the performance on the hourly chart, the price of gold started forming a bullish channel, and on the four-hour chart, it still needs to break through the psychological resistance level of $1800 to confirm the bulls' new control over performance. So far, the support level of $1710 remains a threat to the bullish outlook. The return of the strength of the US dollar has halted the current path of correction. Markets may return to a state of optimism from the increasing global vaccination against Corona and the readiness to reopen economic activity. Which paves the way for a global economic recovery during the year 2021, as expected, and will be negative for the gold price in the medium term. But in the long term, any decline in the price of gold will remain an opportunity to buy again.

The price of gold will be affected today by the strength of the dollar, the Bank of England policy announcement, the number of US jobless claims and the Philadelphia Industrial Index reading.