There’s nothing like a global crisis to reignite animal spirits. Back in 2019, many of us were wondering how long the US equity market could sustain one record high after another in the face of such fundamental evidence to the contrary. Then COVID darkened our collective doors, and perhaps with the exception of bonds and the US dollar, no matter what asset you were holding in your portfolio, be it gold, oil, defensive stocks or even Bitcoin, they were all down. Now, as it starts to look increasingly likely that we’re on the other side of the pandemic, it seems as though the impetus for assets to rally higher is stronger than ever, but this will depend on how well the vaccine works and the extent to which the variants are resistant as well.

Bonds

Investors often refer to the bond market as the capital-T truth of what’s taking place in the macro picture. With bond prices at their yearly lows and yields at their yearly highs, the recent price action suggests a bond market that’s attempting to price-in much more economic activity at the very least, but also the likelihood of inflation, regardless of what the CPI readings are saying. The end of February saw the US 10-year testing, then breaking below all of 2019’s and 2020’s lows. Then, on Thursday, March 18, we saw it dipping even further to test the double-bottom of December 2016 and February of 2018. Meanwhile, 10-year yields have shot up some 240% from their lows at 0.5% in August of 2020, up to 1.72% at the time of writing.

Equities

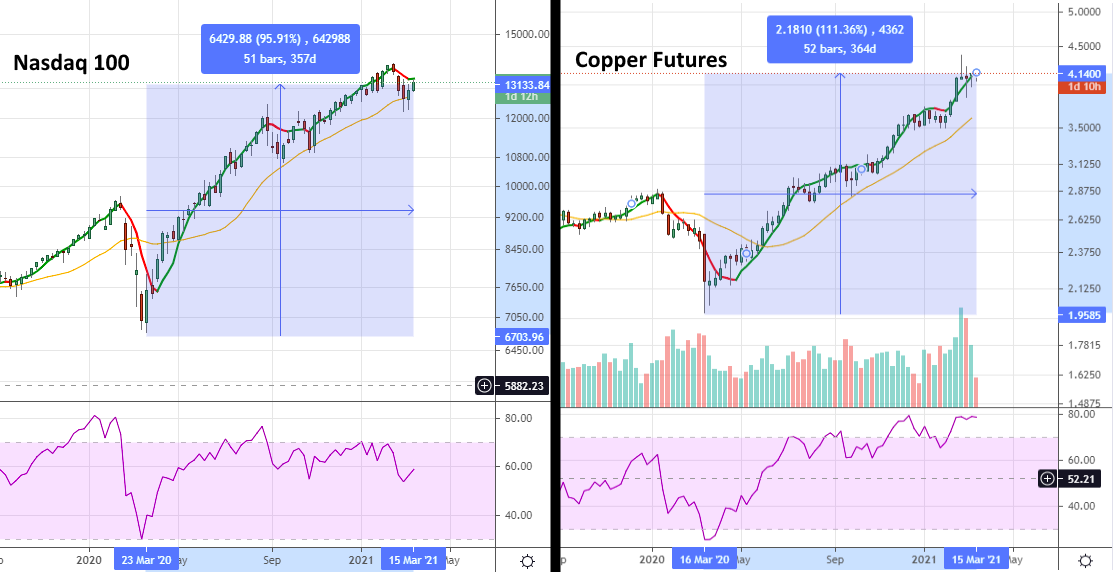

US equities have been on a tear. Not only have they been breaching their record highs, but they’ve been doing so in quite a remarkable manner. Between the 5th and 15th of March, the Russell 2000 closed higher for 7 consecutive sessions. Between the 5th and 17th of March, both the S&P 500 and Dow Jones Industrial Average closed higher for 9 consecutive sessions. The Dow Jones has only ever put in this many consecutive all-time highs a handful of times since 1897, so we’re in truly historic territory here. And this isn’t a sector-specific story either; we’re seeing all sectors of the US economy rallying, including real estate, materials, consumer discretionary and aerospace.

The S-Word

On Thursday, March 11, President Joe Biden signed a $1.9 trillion COVID-19 stimulus package into law that will see cheques of $1400 mailed out to Americans earning $75,000 or less. The package also earmarks $350 billion in aid to local governments, $80 billion for underfunded pensions, with a further $7.25 billion scheduled to be made available to the Paycheck Protection Program that provides loans to small businesses.

It also includes an expansion of the child credit program, money to aid in the reopening of schools, as well as to speed up the country’s vaccination drive and monitor for any signs of mutation in the COVID-19 virus. With former Fed Chair Janet Yellen at the helm of this operation, many regard this stimulus package as the shape of things to come that could see several more years fiscal support from the Biden administration. If past is prologue, then you have to expect at least some of this capital will buoy up the prices of assets, be they stocks, commodities, real estate, or crypto.

Industrial Metals

Several weeks ago, Goldman Sachs released a report discussing a historic shortage in copper looming. “The market,” it said, is “now on the cusp of the tightest phase in what we expect to be the largest deficit in a decade.” When combined with a global reopening and concomitant ramp up in economic activity, the report suggests that copper could be breaking its former all-time highs sooner rather than later.

The combination of a global recovery and a green energy drive has many speculators extremely bullish on a complex of industrial and precious metals, including silver, platinum, nickel, tin and lithium. Recently, Bloomberg’s Industrial Metals Index closed higher for its fourth consecutive month. Since the lows of March last year, it is currently up around 63%, with a lot further to go if it’s to come close to the high of February 2011 at 212, and then the all-time high of 267 in May of 2007.

Some Thoughts and Trade Ideas

We find ourselves at a highly peculiar juncture in economic history. The charts of many assets, particularly US equities, look like they’re at the blow-off top stage right at the end of an economic cycle. Meanwhile, the aftermath of COVID-19 and subsequent global reopening would actually have us at the beginning of an entirely new cycle. Factor in the absolutely incredible amounts of stimulus that’s soon to be looking for things to purchase, as well as the shortages in commodities and pent up demand of a global populace that’s been severely constrained for the better part of a year, and you have a potentially explosive situation.

That old adage of “you don’t fight the Fed” rings so true right now and comes with the addition of “you don’t fight the treasury, either.” As monumentally overpriced as the US stock market may appear, shorting it here could be a catastrophic thing to do. If the reopening is to continue unabated, then you can expect the industrial metals to continue outperforming technology stocks. Finally, the two sectors of the US economy that have yet to reach their pre-COVID highs, despite having rallied substantially from their lows, are aerospace and real estate. As such, a successful reopening could see these stocks having considerably more headroom than tech, especially in the event of a continued rotation out of the lockdown’s top performers.

High Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.