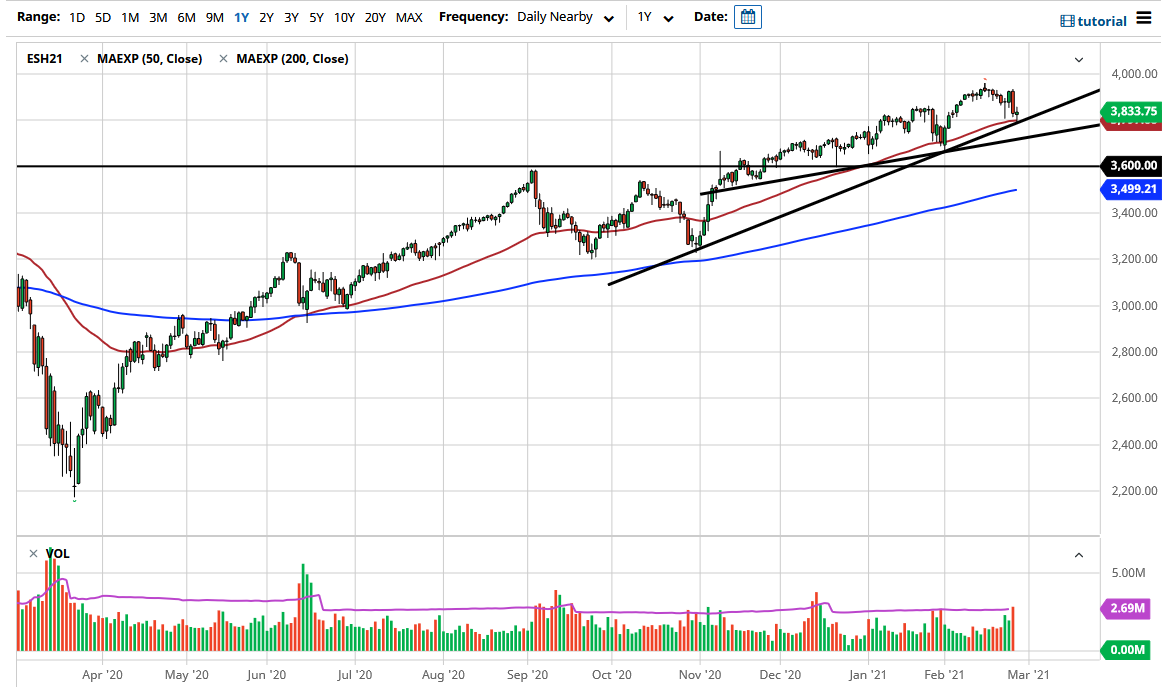

The S&P 500 fluctuated during the trading session on Friday, testing the 50-day EMA and the uptrend line that I have drawn on the chart. Furthermore, even if we were to break down below the uptrend line and the 50-day EMA, there is another trend line just below that could come into play, followed by the 3600 level and then the 200-day EMA which is sitting at 3500. In other words, there are plenty of places where the buyers will probably get involved on any type of significant breakdown, and as we have been so bullish for so long, it is difficult to get extraordinarily bearish.

If we do start to see more downward pressure, perhaps due to yields rising in the United States, then I think you could start buying puts in this market, not necessarily shorting it, because at least then you can define your risk right away and keep huge losses away. After all, as we have seen over the last 13 years or so, any time the market sells off drastically there becomes some type of narrative or action by the Federal Reserve that turns things around. For the last 13 years, I have been listening to people talk about how the market was going to fall apart, and every time it has, we have seen a very quick turnaround.

The 4000 level above is a target that a lot of people are going to be aiming for, not only due to the fact that it is a large, round, psychologically significant figure, but it is also the measured move of the previous consolidation area. Because of this, I think the technical traders and psychology-based traders will be looking for 4000 to be tested. If we can break above there, and I do think we will eventually, the market will then continue with a new leg higher. I also recognize that it may take quite a bit of noise and choppiness to get there, because there are so many concerns around the world. However, the biggest problem that the S&P 500 has to deal with right now is rising yields in the bond market, and as long as those slow down a bit, we should see the S&P 500 hang on.