The Argentine government remains locked in a blame game as leaders from the ruling party point fingers and accuse others of wrongdoing. The Argentine peso continues to suffer from a terrible loss of value against the USD and its trajectory doesn’t appear to have any significant capabilities to stop, as the economic crisis which has engulfed Argentina get uglier by the week.

In recent comments the ruling government has begun to blame the International Monetary Fund for allowing the nation to borrow so much money in the past, this as it tries negotiate a new borrowing deal. We have all heard this story about impending economic calamity and injustices from Argentina before.

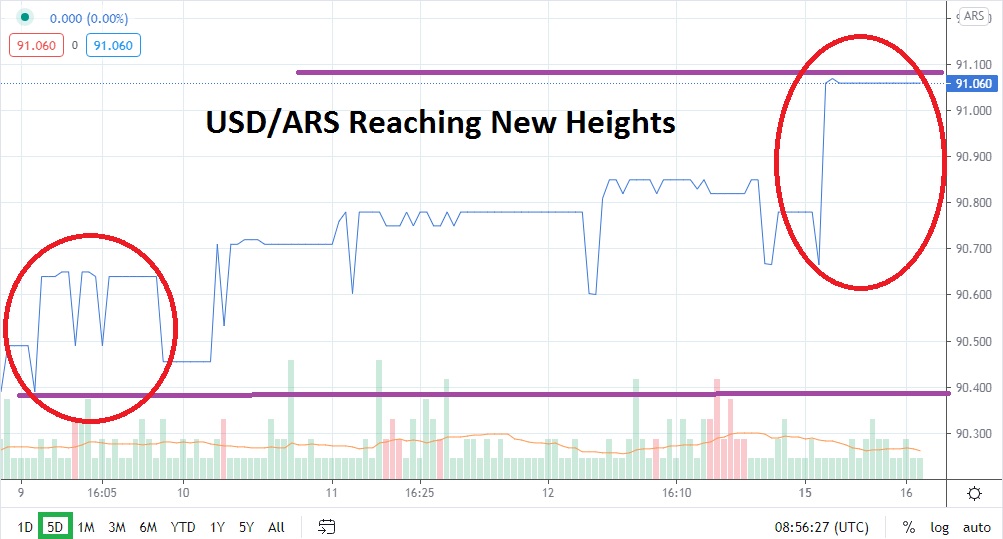

Since the beginning of March the 90.000 juncture has been surpassed and the 91.100 mark now appears to be the next resistance level which should be targeted by speculators. As a friendly reminder for traders, the exchange rate being quoted on most trading platforms is the ‘official’ government price from Argentina; it should be known that the black market rate on the streets of Buenos Aires for the USD/ARS in much higher than the ‘sanctioned’ value. Which means the Forex price being speculated on trading platforms for the USD/ARS is manipulated by the Argentine government as they remain non-transparent about the economic realities within the nation.

Speculators should be buying the USD/ARS and pursuing the bullish trend higher, but they should know the costs of the transactions they are undertaking. Traders may have to hold onto their positions overnight which can be costly. The rate of ascent by the USD/ARS has been steady and incremental, but it remains challenging to pinpoint it velocity. It is highly encouraged to use limit orders when buying the USD/ARS to protect against unexpected price fills.

If a trader can buy the USD/ARS below the 91.100 level and has the capability of holding onto the position while using a wide stop loss to protect against sudden spikes lower, the trader may have the chance to target higher values capably. Trading the USD/ARS is not so much a question about direction, it is a puzzle which must use carefully selected amounts of leverage and know the costs of buying the USD/ARS as a speculative wager, which sometimes takes time to develop properly.

Argentine Peso Short-Term Outlook:

Current Resistance: 91.100

Current Support: 90.780

High Target: 91.300

Low Target: 90.600