Bearish sentiment within the USD/INR has been firmly reestablished and important support levels are again within the targets of speculators who believe that pursuing the downward trajectory of the Forex pair remains worthwhile. Last week’s brief surge higher, which happened on the heels of risk-averse sentiment spiking in the US government bond markets and its knock on effects in Forex, appears to have been short-lived.

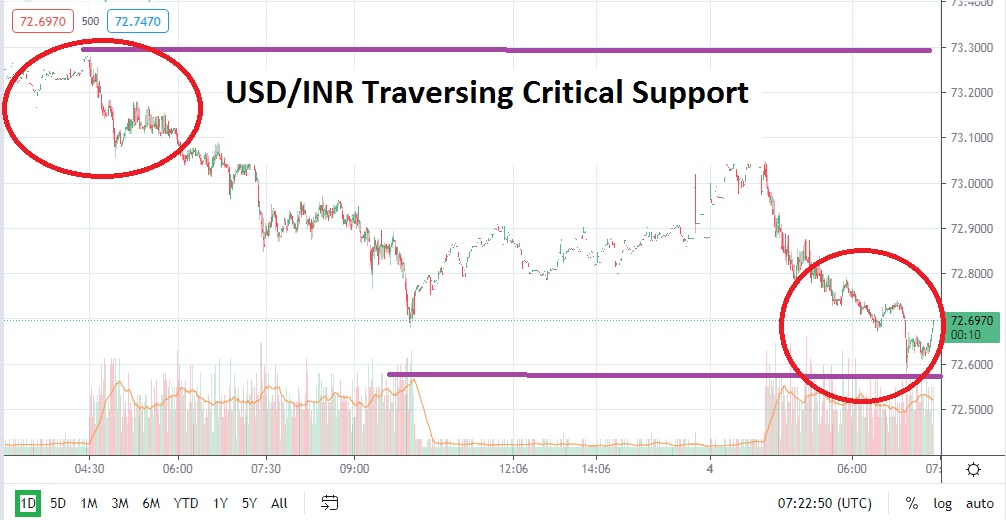

Trading remains fast in the USD/INR and traders still need to protect against the possibility of sudden spikes emerging. The USD/INR is traversing below the 73.0000 juncture, and if it can sustain its current price range within the junctures of 72.6500 to 72.8000, it could cause speculators to believe that the opportunity to take advantage of a potential leg down has merit.

Before the violent spikes higher in the USD/INR late last week, the Forex pair was hovering within lower values and was testing long-term prices not demonstrated since the middle of February 2020. The USD/INR was trading for a brief moment between the 72.4000 and 72.2900 junctures. In fact, from the 19th until the 25th of February, this value range within the lower depths was sincerely tested.

After the climb higher to literally the 74.0000 mark on the 26th of February, the USD/INR has seen its value incrementally lower. The Forex pair has reestablished its bearish trend and, since the 2nd of March, the USD/INR has gone from 73.5000 to the depths it is trading today. No, there aren’t one-way avenues when trading, and speculators need to place positions using tactical decisions when risk-taking.

However, selling the USD/INR under the present circumstances continues to look like a logical choice if a speculator can use limit positions and short the Forex pair on slight climbs higher. Traders should pay attention to sentiment in the global equity indices, but if markets remains steady, this may be enough to serve as a catalyst for the USD/INR to continue its bearish trend.

Traders may want to consider selling the USD/INR if it touches the 72.7500 to 72.8300 junctures depending on their conservative leanings. If the Indian rupee continues to be bearish against the USD, another test of important support levels below could develop, because a retest of lows looks technically possible.

Indian Rupee Short-Term Outlook:

Current Resistance: 72.8300

Current Support: 72.5900

High Target: 73.0800

Low Target: 72.4000