The bulls are still trying to maintain the recent bounce gains in the USD/JPY, which is holding around 109.20 at the time of writing. This is pending the announcement of the monetary policy decisions of the US Federal Reserve and important statements from its Governor Jerome Powell. The bounce gains for the currency pair came to a halt after the disappointing US retail sales numbers were released. Retail sales fell -3% last month when expectations were of a decline of -0.5%, according to the National Bureau of Statistics data, which was more than enough to offset a large upward revision of the previous estimate of a 5.3% increase for January.

Core US retail sales fell -2.7% in February after adjusting upwards of +8.3% in January, although the previous month's growth was originally announced at +5.9% while economists were looking for a 0.2% increase in February sales. Commenting on the findings, Ian Shepherdson, Chief Economist at Pantheon Macro Economics, says, “The combination of the potential continuous buildup of stimulus payments made under the December 19 Covid-19 relief bill and the blow from the mega-mid-month storm made these numbers a wild card. It is impossible to know whether sales will rise without the storm, because, we do not know how much of the 166 billion stimulus payments will have been spent. Accordingly, we expect the next few months to bring significant increases, against the backdrop of the current round of one-time payments - two-and-a-half times larger than January checks - and reopening.”

Separately, other data showed that US industrial production declined -2.2% for the past month, while expectations were of a 0.5% increase, which also offset the upward revision of the original January estimate of a 0.9% increase to 1.1%. "The severe winter weather in the south-central region of the country in mid-February was responsible for the bulk of the decline in production for this month," the Fed says.

Overall growth projections in the United States increased this year, but were boosted last week when US President Joe Biden signed a $1.9 trillion financial support package that provides many families with up to $1,400 in direct transfers.

US President Biden promised that all American adults can "get in line" for the vaccine by May 1.

Investors' attention today is on the Fed's monetary policy decision for the month of March in which investors will look to see if members of the FOMC can vote to raise the current interest range from 0% to 0.25% as soon as 2023. Today the Fed decision will be released at 18:00.

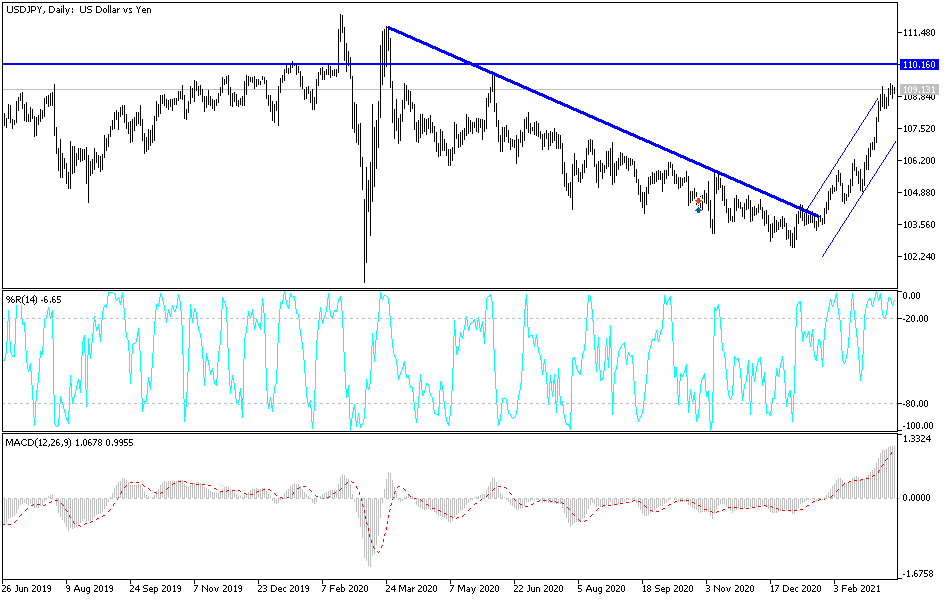

Technical analysis of the pair:

On the daily chart, the USD/JPY remains stable around its recent gains and is closest to its highest in 10 months, and the bulls are preparing to test the psychological peak of 110.00 in the event that the Federal Reserve's decisions are in favor of the dollar. We believe that the stimulus plans will give the bank the opportunity to adhere to its policy, while emphasizing that these plans are in the interest of a rapid recovery of the US economy, especially with the progress in the pace of vaccinations. On the downside, according to the performance over the same period of time, the first reversal of the trend will be by moving below the support level of 108.20, and from there to 107.70.