The USD/TRY has not recovered its value in any significant form after last week’s change in Turkey’s central bank leadership. The USD/TRY remains above the 8.00000 juncture and speculators have every reason to be nervous. However, a trip down memory lane underpins the notion that the USD/TRY will remain volatile and retain its bullish sentiment.

Financial institutions need to make decisions regarding their capital holdings and how best to protect long-term commercial transactions, which involve the Turkish lira and its relative value. Taking into account the lack of transparency the current Turkish government offers, except the giant size of President Erdogan’s ego, financial institutions are bound to be cautious; which simply means that holding Turkish lira may not be a confidence-building measure for the next few months for many who have transactions which will have to be done via the USD/TRY.

This lack of confidence, which is definitely surging within the commercial offices of financial institutions, should underscore any technical perceptions traders may have regarding the USD/TRY. Yes, the USD/TRY is an important Forex pair because of the large amount of export business Turkey conducts regarding its manufacturing and supply to Europe and Asia, but a lack of leadership which practices sound economic fundamentals is a major concern.

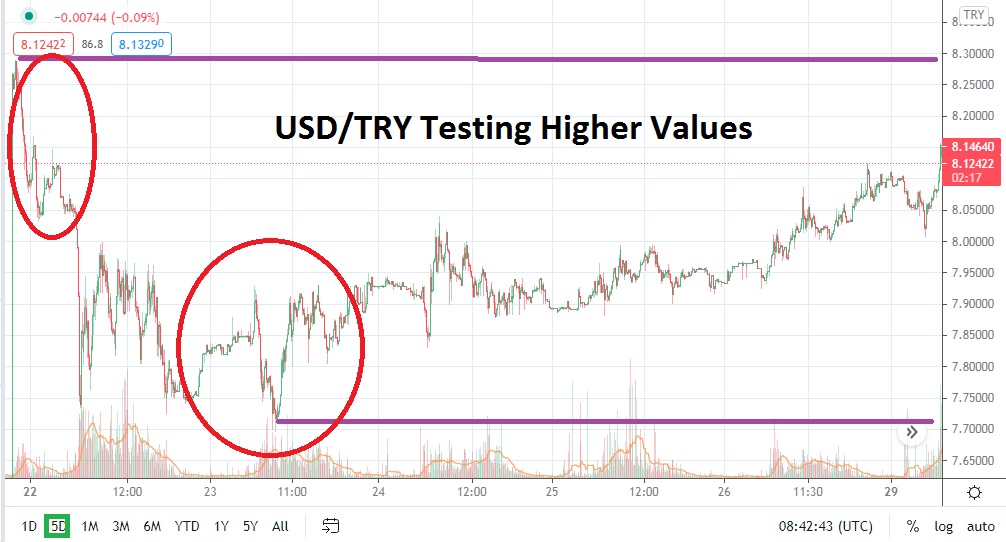

The inability of the USD/TRY to recover any significant value since its spike higher early last week is evidence that the financial world is not about to embrace Turkish central banking mandates easily. Technically, the fact that the USD/TRY is struggling to trade below the 8.00000 juncture demonstrates weakness that may continue to build a speculative element which believes the Forex pair has further room to climb. At the peak of the USD/TRY’s troubles late in 2020, a value range of 8.16000 to 8.48000 was seen from the 27th of October until the 9th of November.

Traders who want to sell the USD/TRY on the notion that things will improve may be taking a huge risk. Yes, financial institutions and speculators have seen winds swirl with questions before regarding the leadership of the Turkish monetary policy, but an answer is unlikely to be delivered short term which will help ease nervousness. Until then, traders will be engaged in a game of ‘Who Do You Trust?’ regarding the USD/TRY, and the problem is that faith is a hard commodity to find. Speculators should continue to pursue buying the USD/TRY on slight pullbacks until proven otherwise while practicing solid risk management.

Turkish Lira Short-Term Outlook:

Current Resistance: 8.19000

Current Support: 8.03000

High Target: 8.34000

Low Target: 7.89000