The West Texas Intermediate Crude Oil market has rallied significantly yet again during the trading session on Friday to break out above the $65 level. At this point in time, one of the main reasons that the market broke out was that the jobs number came out much better than anticipated, and as a result it is likely that we will continue to see a lot of volatility because of this. Ultimately, another thing that was like “throwing gasoline on the fire” was that Goldman Sachs stepped out during the day and called for an $80 price target.

The last three days have been extraordinarily bullish, and as a result I do think that we could get a little bit of a short-term pullback. That being said, I would not be a seller of this market after this most recent shot higher. The $65 level was an area where we had seen a lot of resistance in the past, and as a result I am a bit surprised that we took off to the upside. All things been equal though, this is a market that I think still has further to go.

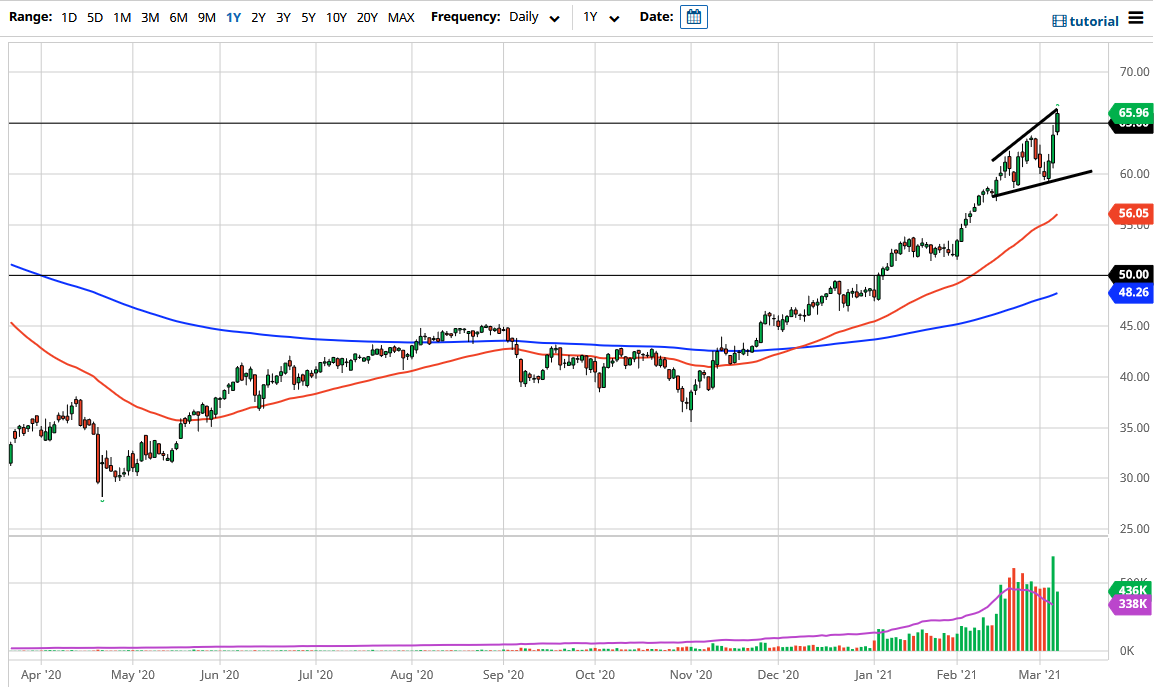

Given enough time, I think that the market is going to eventually show signs of exhaustion. The reason I say that is that the market has shot straight up in the air, but most recently we have seen a lot of choppy and volatility. All things being equal, I do think that the fact that we have a massive reopening trade coming gives us a bit of a boost, but that should be short-lived at best, and eventually oil prices will have to come back down to earth. In the short term though, as long as we can stay within this megaphone pattern that I have drawn on the chart, buying dips probably continues to work.

Unfortunately, we are already above the pre-pandemic levels so now one has to ask how long the “sugar high” can last in the market? It is because of this that I remain very skeptical, especially as supply and demand numbers do not really warrant what we see yet, although the market is trying to price in some type of super recovery that may or may not be happening. Nonetheless, if you cannot fight the market so you have to be looking for short-term rallies at this point.