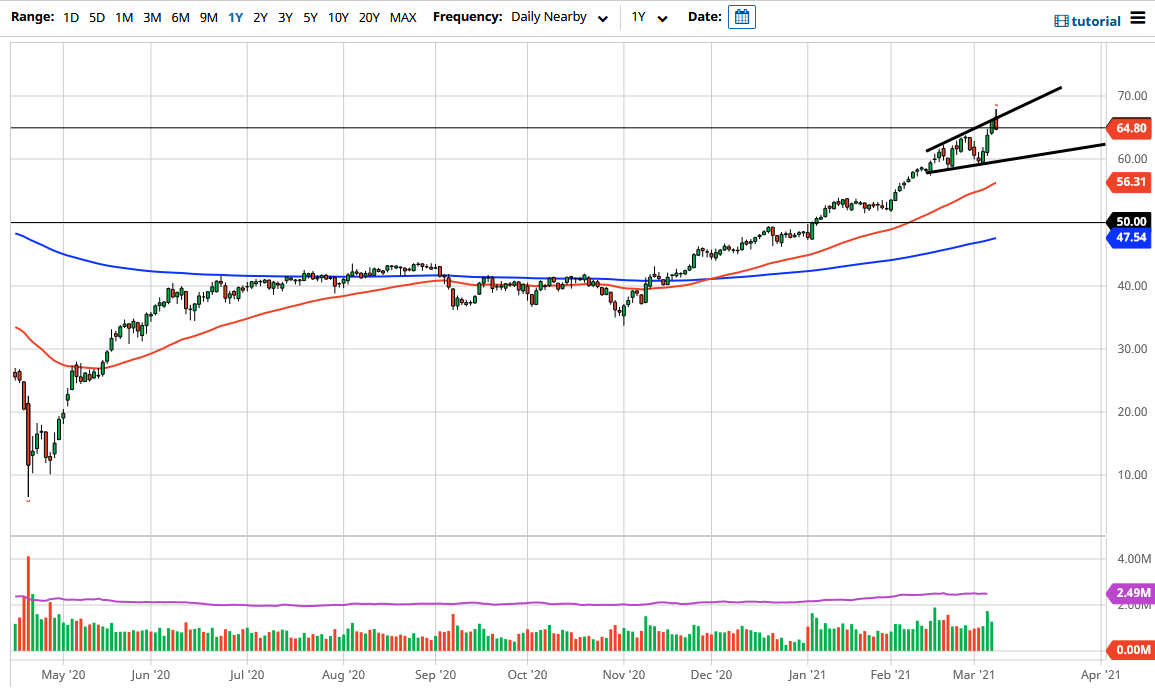

The West Texas Intermediate Crude Oil market initially shot higher during the trading session on Monday as it was reported that Houthi rebels had attacked a Saudi oil pipeline again. However, there was almost no damage, and at the end of the session we saw the oil market turn around completely to break down below the $65 level. That is a psychologically important level, so it is not a huge surprise that we continue to see a lot of possible volatility in this area. If we break down below the bottom of the candlestick, then it could open up a move towards the $62.50 level, possibly even down to the uptrend line underneath.

On the other hand, if we were to break above the top of the candlestick for the trading session of Monday, then it could go looking towards the $70 level. The $70 level is a large, round, psychologically significant figure and an area that shows quite a bit of supply and resistance on longer-term charts, so it makes sense that there would be trouble. This is a market that I think will continue to see a lot of choppiness, as we are dancing around a megaphone pattern.

We are in a bullish uptrend, so pullbacks will continue to be bought into on signs of support, and even though we are a little overbought at this point, I think there will probably still be people underneath that would get involved. If we did break down below the $60 level, then I think we could see a little bit more of a move lower. The $50 level underneath would be the absolute “floor in the market”, and if we break down below there it would be the end of the overall trend in general. I think that crude oil has gotten far ahead of itself, because we have priced in perfection and demand that simply would not be possible after such devastation to the economy. We are about to find out that the demand simply is not there. However, I think that the market has at least one more attempt to go higher.