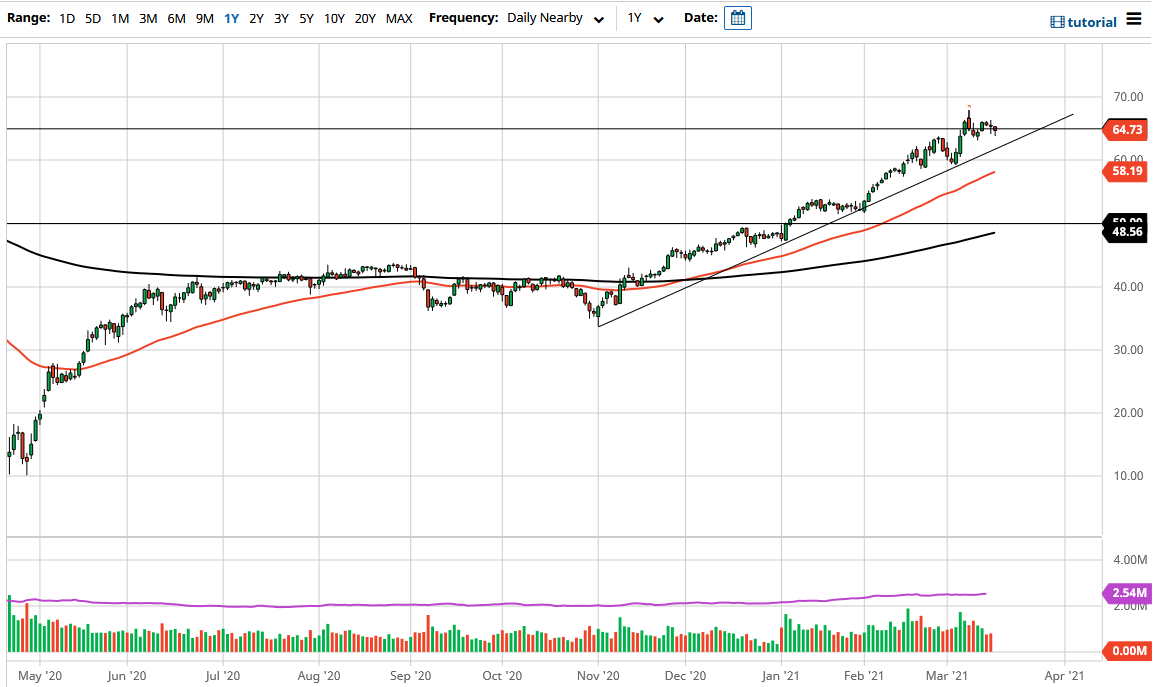

The West Texas Intermediate Crude Oil market pulled back slightly during the trading session on Tuesday but then found buyers underneath to show signs of strength. The $65 level is a bit of a large, round, psychologically significant figure and as a result it does attract momentum. We are in an uptrend and I have no need to fight it at the moment, even though I do think that longer term we will see a massive sell-off. The market looks as if it is trying to simply build up enough momentum to continue going higher, based upon the idea of the reflation trade.

Underneath, we have a nice uptrend line that has been relatively reliable, which currently coincides with roughly $63. I think at this point we will stay above there, so a short-term pullback is probably going to end up being a buying opportunity. Although not directly affecting the market, the US dollar could get a bit of a move late in the day due to the FOMC statement and the press conference afterwards, so if we do see a huge spike in the US dollar that could drive down the crude oil market.

To the upside, I think that the market will eventually go looking towards the $70 level, but we need to get beyond the $67.50 level initially, which has been rather resistive. If we can break above there, I think the $70 level is all but a given. To the downside, if we were to break down below the $60 level, we could break down rather significantly, but I think at that point it would probably involve something to the effect of a massive build in inventory or perhaps a spike in the US dollar, or even both. I think this is a “one-way trade” for most traders, so it is going to take a major shift in psychology to break this market down.

This is a market that I think is going to be noisy for the next few days, as we will use the $65 level as a magnet for price. In the short term, I think a lot of people are going to use range-bound trading systems on short-term charts to take advantage of the choppy behavior.