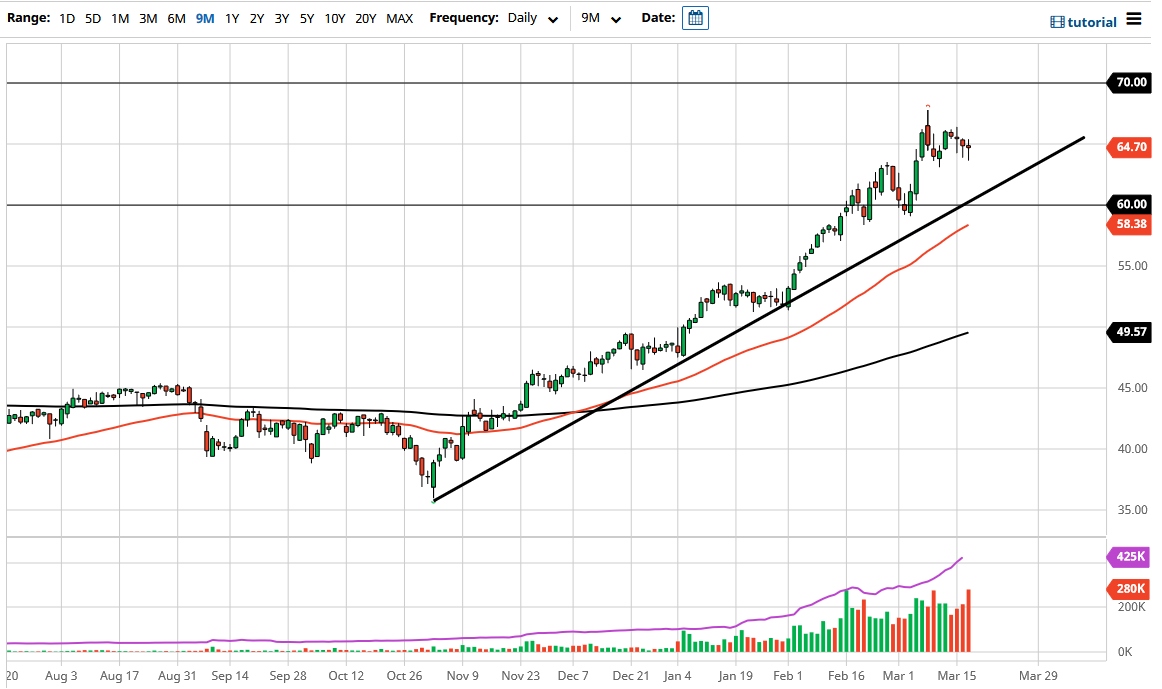

The West Texas Intermediate Crude Oil market dipped during the trading session on Wednesday only to turn around and show signs of life again. The market is likely to continue to see value hunters coming back in to take advantage of crude oil being cheap. The market also looks likely to see plenty of support underneath near the $64 level, as we have seen a couple of times. What we are seeing here is a base-building expedition to send the oil market higher yet again. In fact, even though I do think that we are a bit overdone, it is worth noting that we are going sideways more than anything else over the last week or so. This could be the market simply trying to “kill time.”

At this point, I do believe that there is plenty of support underneath that extends all the way down to the uptrend line, which is a support level that people will be paying close attention to, so I think that if we do drop towards that uptrend line, is very likely that we would see plenty of buyers coming into pick up the market “on the cheap.” Furthermore, we also have the 50-day EMA reaching towards the $60 level, which is sitting just below the uptrend line as well. It is not until we break down below the $60 level that I would be concerned.

If we did break down below the $60 level, then it is likely that we would see a bit of a drop from there to reach towards the $53 level. I think it is much more likely that we see buyers coming back in on short-term dips in order to build up the necessary momentum to reach towards the crucial $70 level. The $70 level is a large, round, psychologically significant figure, but at this point it makes a juicy target that a lot of people are going to have to pay attention to. Whether or not we can break through the $70 level is a completely different question, but it certainly looks as if we are trying to get there as we continue to see inflationary pressures when it comes to energy markets overall.