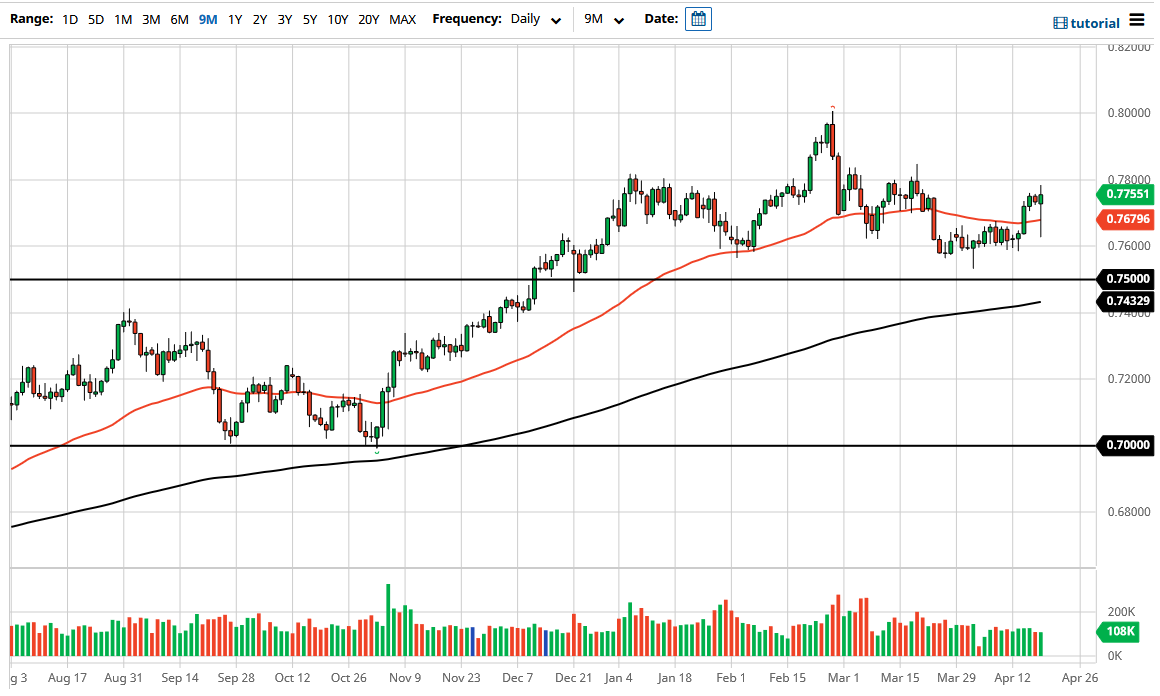

The Australian dollar kicked off the session to the downside, breaking down towards the 0.76 handle. The market has exploded to the upside since then, forming a massive candlestick that is shaped like a hammer. At this point, it looks as if the Aussie is trying to break through the 0.78 level above, which is a large, round, psychologically significant figure. It is also an area where we have seen a lot of resistance previously, so it is likely that it may take a bit of effort to get above there. Currently, this is a market that is moving probably more on the idea of what is going on with the US dollar than anything else, as the greenback has been beaten down.

If we do break above the 0.78 level, then I think it opens up a move towards the 0.80 level above. The 0.80 level is a massive round figure that is important from a long-term standpoint. In fact, I believe that the resistance extends to the 0.81 handle, so breaking above all of that has the Australian dollar more of a “buy-and-hold” type of situation than anything else. At that point, I would be adding to a longer-term core position. However, until we get to that point it becomes much more of a tactical game going forward.

If we break down below the 0.76 handle, that would be a very negative sign, perhaps opening up a move to at least the 0.75 handle, and then possibly even lower than that. The one really bearish thing that we have in this market currently is the fact that both the February and the March candlesticks on the monthly charts have formed shooting stars, something that you do not see very often. However, it should be noted that the market has been extraordinarily resilient, so it may just simply be a matter of the market trying to build up the necessary momentum to break through the barrier.

I have a couple of areas, as mentioned previously, that I am paying close attention to, and that I will trade accordingly. Until then, I think the only thing you can count on is a lot of noisy trading and sideways action in general. The shape of the candlestick certainly suggests that the buyers are starting to take over yet again.