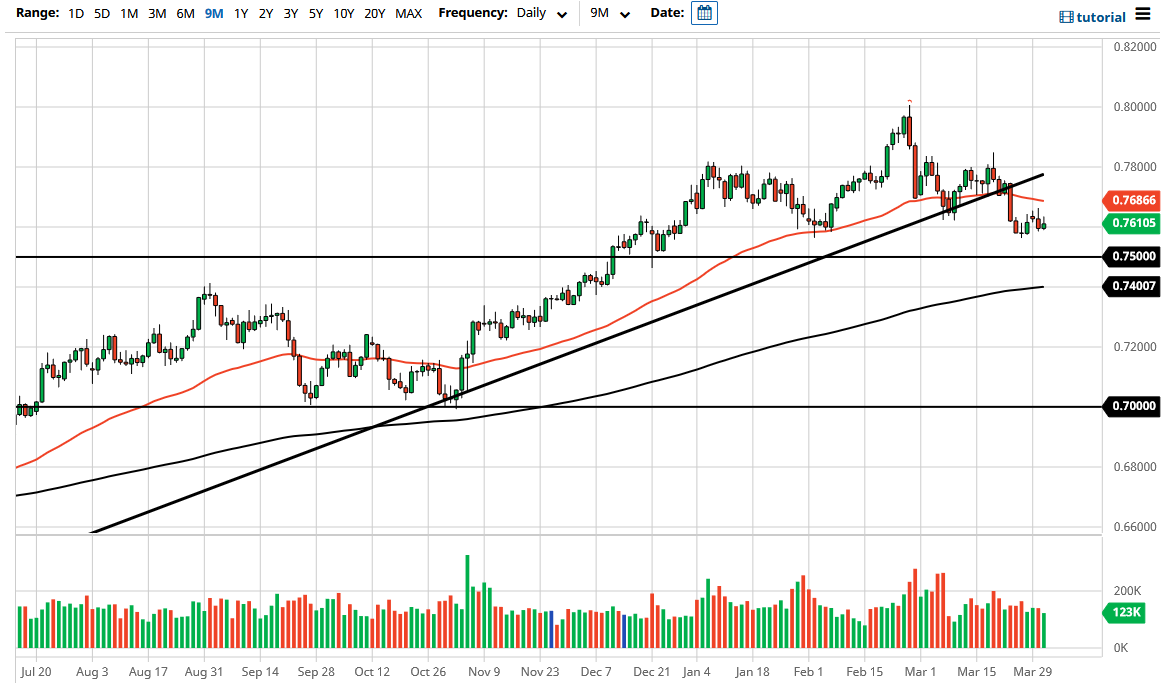

The Australian dollar rallied a bit during the trading session on Wednesday only to turn around and fall apart again. The candlestick looks as if it is going to continue to see selling pressure, and therefore I think that if we clear the lows from the last week or so, it is likely that we will go diving towards the 0.75 handle.

After the 0.75 level, then the next thing to pay close attention will be the 200 day EMA, but I think that the 200 day EMA is but a speedbump on the road to much lower levels, especially near the 0.72 handle. That is an area that I think will have a lot of market memory attached to it, and it is a target that I have come up with based upon the measured move coming from the head and shoulders that we are forming. Furthermore, if we continue to see yields in America rise, that will put downward pressure on this pair going forward.

The closer the 10 year yield gets to the 2% level, the more likely we are going to see currencies like the Aussie get hammered. That being said, there is a huge infrastructure play coming, but the whole world knows that, so the fact that we have seen the Australian dollar fall in that environment speaks volumes. There is also the added noise coming out of the spat between Canberra and Beijing, which continues to be a bit of an anchor around the neck of the Australian dollar. This is despite the fact that there should be a lot of demand for commodities, but the Australian dollar has gone so far straight up in the air that it probably needs to see some type of pullback.

Looking at the chart, if we do turn around and rally, I think that we need to break above the 50 day EMA before you put serious money to work. Breaking above the 50 day EMA will more than likely trigger more buying based upon the psychology of this particular technical indicator. With this being the case, I think it would coincide with a major shift in attitude overall, but right now I just do not see that happening in the short term. Keep in mind that the February candlestick was a massive shooting star.