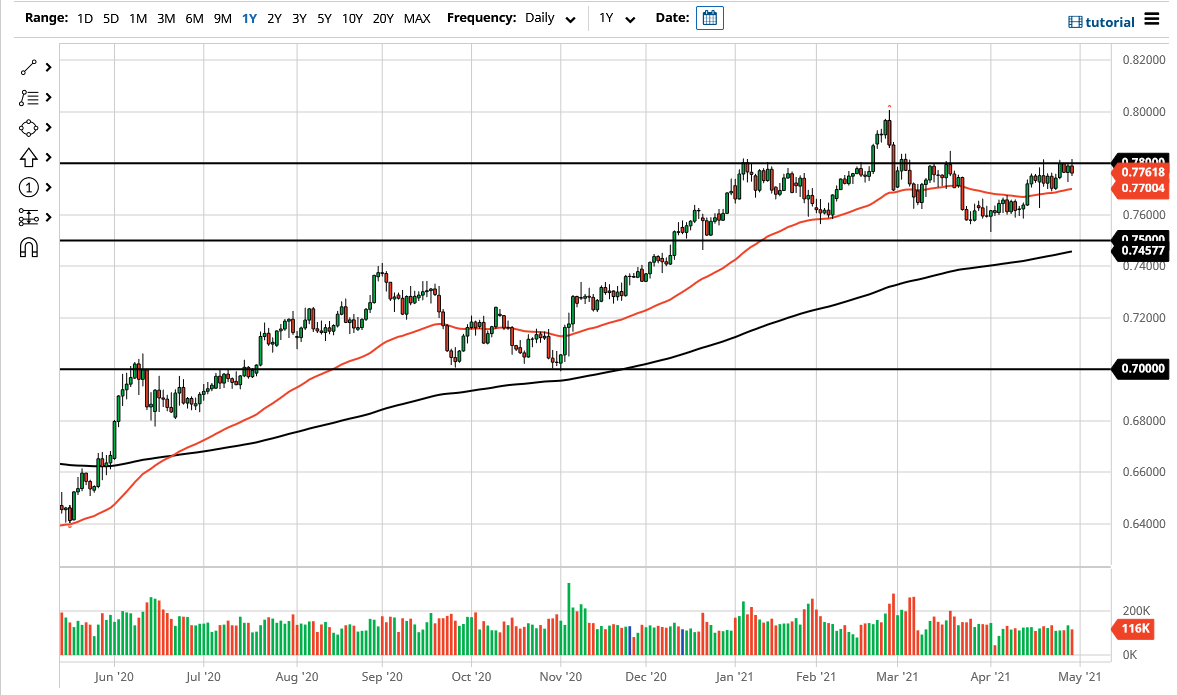

The Australian dollar has initially tried to break above the 0.78 handle, only to turn around and started falling again. At this point in time, the market is likely to continue to see a lot of resistance above there, because as you can see, we have failed to stay above there for any significant amount of time. Furthermore, it is worth noting that the longer-term charts are showing a lot of weakness, especially as the February candlestick is a massive shooting star, followed by the March candlestick that is very similar. It looks like we are going to continue to see it a lot of downward pressure just above the 0.78 handle, which is quite interesting considering that the US dollar has struggled against most other currencies.

Underneath the current trading area, we have a significant support area in the form of the 50 day EMA, which has been quite reliable over the last couple of weeks. That being said, it is a bit of transitory dynamic support/resistance, meaning that it does get broken eventually. If we break down below there, then the market is likely to go looking towards the 0.76 handle next. Underneath there, then it is probably a move down to the 0.75 handle that the market will try to accomplish. I do believe that between the 0.76 level in the 0.75 level is significant support but kicking off a move down below there could open up the trapdoor to much lower levels, perhaps down to the 0.71 handle.

That being said, the market certainly looks as if it is somewhat resilient, despite the fact that we could not break out to the upside and reach towards the 0.80 level again. The 0.80 level has massive resistance to the 0.81 handle, and it is clearly important on the monthly charts. If we were to break above there, then the market is likely to go looking towards the 0.88 handle, possibly even the 0.90 level. This becomes a buy-and-hold type of situation. Nonetheless, I believe in the short term we are simply going sideways in this general vicinity and look a bit confused. Perhaps this is due to the situation of tensions between Austria in China, or perhaps something bigger. Nonetheless, it is obvious that the market is trying to break out, but it simply does not have the momentum.