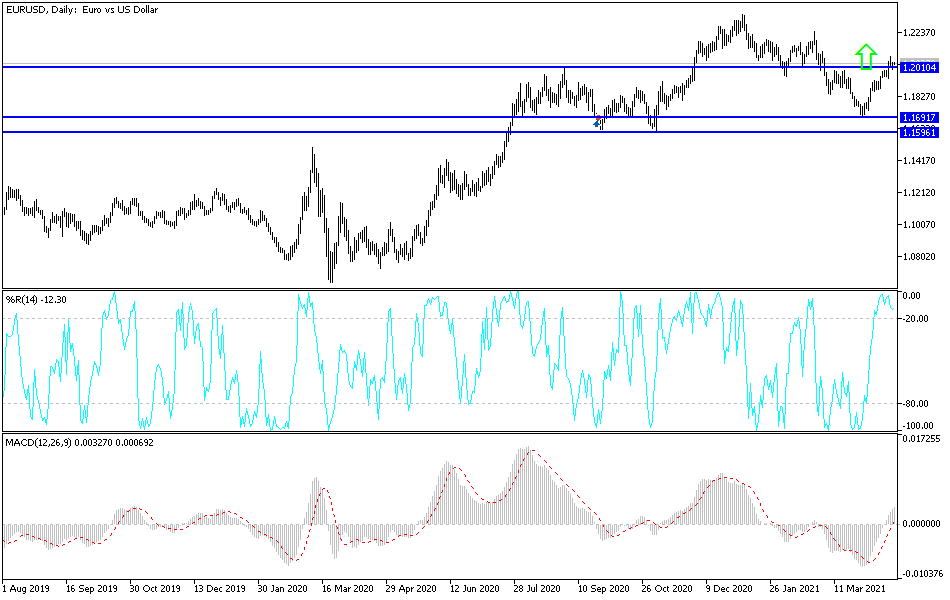

The euro fell a bit during the trading session on Wednesday to reach down towards the one point to zero level, where it turned around promptly and formed a hammer. If you remember my video yesterday, you know that I suggested that there would be a significant amount of support around that big figure and perhaps even down to the 50-day EMA. This is why I do not simply short every shooting star that I see, because when you see a shooting star after a breakout like this, it almost always means that we are simply going to go looking towards support underneath that we can take advantage of.

That being said, this looks as if we are going to try to continue to go higher, perhaps reaching towards the top of the shooting star from the Tuesday session, which is short-term resistance, but then if we can break above there then we can go looking towards the 1.22 handle. The 1.22 level has been a major resistance barrier, so breaking above that would send this market much higher. Keep in mind that this is going to be about the US dollar more than anything else, which is getting hammered due to the fact that there is a massive amount of money printing going on in America, and Joe Biden seems hell-bent on adding a few trillions every few months to the deficit.

The fact that we had a shooting star followed by a hammer typically means that we are going to grind sideways for a while though, so I think short-term traders will probably continue to kick this thing back and forth. With that in mind, I believe that the market is going to be very tight and not so interesting, but we are clearly trying to break to the upside, and now that we have cleared the 50-day EMA and even a couple of other barriers after that, you have to start tilting more to the upside at this point. If we break down below the 50-day EMA, I may revisit that thesis, but right now it looks like we are trying to get to the upside, so I am not looking to short anytime soon, and if I am going to start buying the US dollar it is probably going to be against something else.