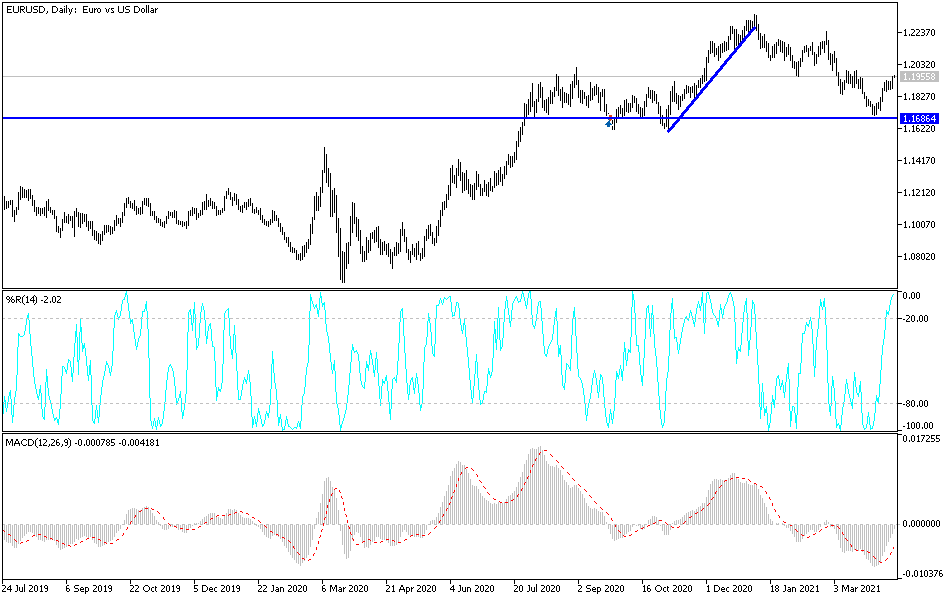

The euro initially pulled back during the trading session on Tuesday, but then found support underneath the 1.19 level. At this point, the market looks as if it is ready to go looking towards the previous uptrend line that had been so important to the market. We also have the 50-day EMA right in the same area as well, so it makes sense that we would see a bit of hesitation. That being said, the market is obviously very strong, so it will be interesting to see how it plays out over the next couple of days.

When you look at the CPI reaction during the trading session, it was essentially a “green light” for Wall Street to celebrate cheap money and throw indices higher, and the US dollar lower. The Federal Reserve is nowhere near tightening market rates, but that does not mean that bond traders will do it for them. It will be interesting to see how this plays out over the next couple of weeks, but we are clearly approaching an area that we are going to have to pay close attention to. With that being the case, the 1.20 level is the area that is most important going forward, because it should open up more buying.

On the other hand, if we were to turn around and break below the last couple of lows during the previous three or four sessions, the market will probably go looking towards the 1.16 level underneath, which is a massive support level on longer-term charts. I do not know what would cause the market to get down there, but I would anticipate that would have something to do with yields, which may have something to do with climbing coronavirus numbers.

Nonetheless, this is a market that is still technically in a downtrend over the last couple of months, so I will be paying close attention to one of these trigger points. Until then, I do not have much to do with the euro, but that is not that uncommon, considering that the market tends to chop around more than anything else. With that being the case, it is worth noting that the candlestick for Tuesday was rather impressive in the short term, but longer-term it may have been nothing more than just a bit of noise.