Last Thursday’s EUR/USD signals were not triggered, as there was no bearish price action when the support level at 1.2016 was first reached.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be entered prior to 5pm London time today only.

Short Trade Ideas

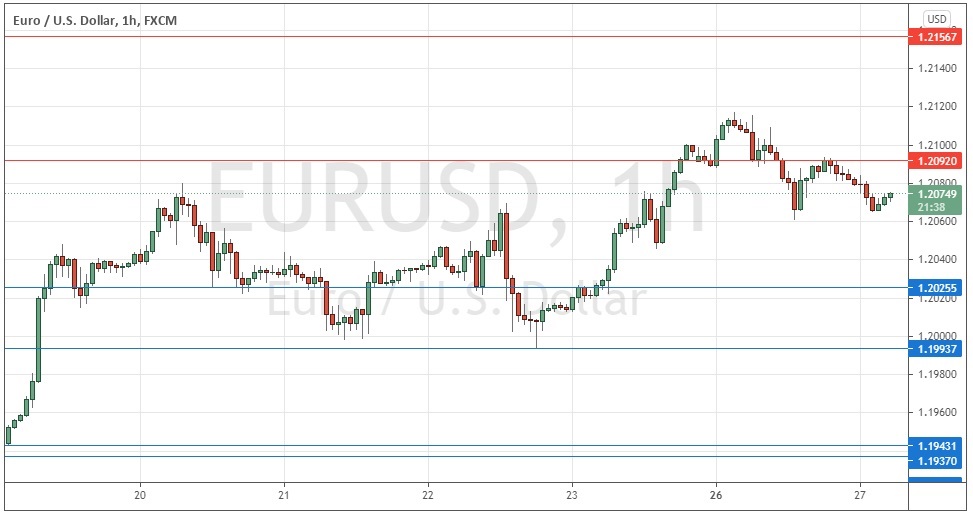

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.2092 or 1.2157.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the 1H1 time frame H1H1H1 time frame immediately upon the next touch of 1.2026, 1.1994, or 1.1943.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that the technical picture was one of muted bullishness.

I thought that the price had the potential to pop up quickly beyond 1.2050 but may not be able to clear the closest resistance level at 1.2075.

I was looking to enter a long trade if we had gotten a bullish bounce from any of the nearby support levels after the ECB release.

I was wrong about the price popping above 1.2050 in any sustained way as that move quickly failed, but I was correct over the longer term to look for a long trade from support as the price moved higher after pulling back.

We have seen strong medium-term bullish momentum in this currency pair, but it may well be fading away now as the price approaches a key inflection zone roughly between 1.2100 and 1.2200.

Either a long trade from a bounce at 1.2026 or a short trade from a bearish reversal at 1.2157 will be likely to be the best opportunity in this currency pair which might arise today, but there will likely be better opportunities in other markets.

Regarding the USD, there will be a release of U.S. CB Consumer Confidence data at 3pm London time. There is nothing of high importance scheduled today concerning the EUR.