After the recent bullish waves of the EUR/USD, which pushed it towards the 1.2080 resistance level, the pair is stabilizing around the 1.2030 level as of this writing. The euro's gains come amid a widespread decline in the US dollar and indications of optimism for improving investor sentiment towards Europe. Therefore, the EUR/USD rate was raised against the dollar thanks to better-than-expected economic data, improved trends in coronavirus infections and increased hopes for an increase in vaccinations in the European Union.

Forex traders have increasingly bet on the euro in favor of the dollar due to vaccination challenges in Europe, leading to fears of the bloc lagging behind in the imminent global economic recovery. But the pace of vaccinations has already increased in recent weeks and is expected to rise even more this summer, while some surveys measuring private sector sentiment indicated an increased resilience of the economy in the face of measures to contain the virus such as lockdowns.

This has seen investors take profit from previous bets against the euro in April, which were initially expressed through sales of EUR/GBP, EUR/CAD, EUR/AUD and others in the first quarter.

Expectations for the currency pair are increasingly bullish according to the latest forecast from Goldman Sachs. Its analysis team expects the European Central Bank to slow down the pace of PEPP purchases after its June meeting. At the same time, the recent stability in US interest rates despite strong growth and inflation data may indicate that market pricing for the funds rate path has reached a domestic cap.

The Goldman Sachs research team this week called for clients to buy the EUR against the dollar and look for a rally to 1.25 in a relatively short time, noting that they do not expect the price to return to 1.175 or below. The peak of 1.25 coincides with the bank's new three-month forecast, which was upgraded from 1.21, although this is only the first step in the recovery seen to lift the euro to $1.27 in six months and $1.28 before early 2022.

The EUR/USD rally could see its highest level since 2018, while the 1.28 level had not been set since before the European Central Bank announced its first quantitative easing program in January 2015.

“We believe the combination of increased growth prospects in the Eurozone, strong equity returns for the region, initial signs of normalization from the European Central Bank, and more stable Fed pricing will extend the recent shift in the euro,” a Saxo Bank analyst wrote. The euro saw its highest level in several years around 1.2350 in January of this year before retreating during the first quarter, apparently in response to a range of factors, including the European Central Bank's concerns about what the currency's strength might mean to achieve the inflation target.

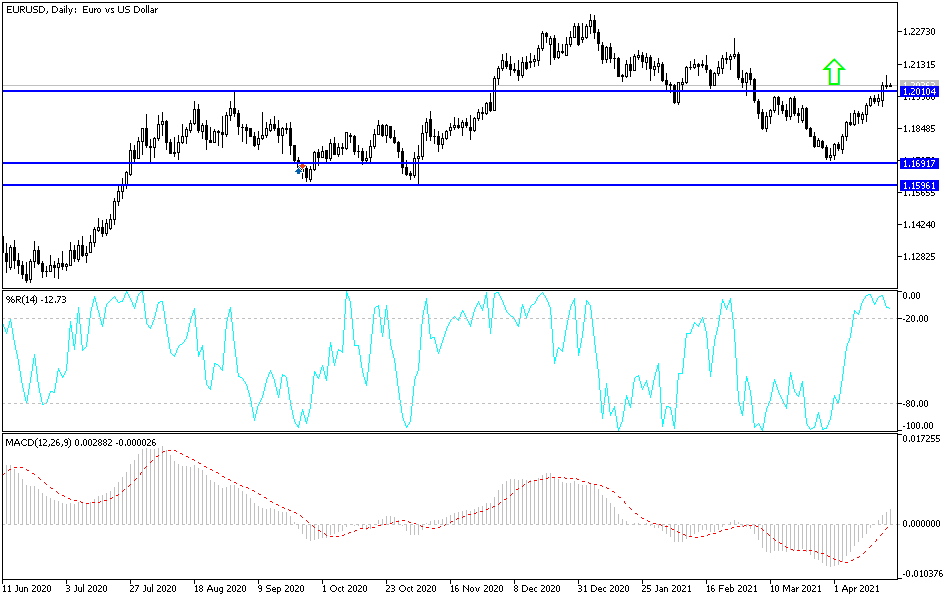

Technical analysis of the pair:

As I mentioned before, the stability of the EUR/USD currency pair above the psychological resistance of 1.2000 will support the bullish performance, but the pair's gains may stop or decline as Forex traders prepare for the European Central Bank decision on Thursday. Therefore, I still prefer to sell the currency pair from every resistance level, the closest of which are currently 1.2085, 1.2120 and 1.2200. On the downside, the bears will have stronger control over the performance by breaking through the support level of 1.1855.

Today's economic calendar is devoid of any important US or European economic data, so investor sentiment will have a strong and direct impact on the currency pair's movements.