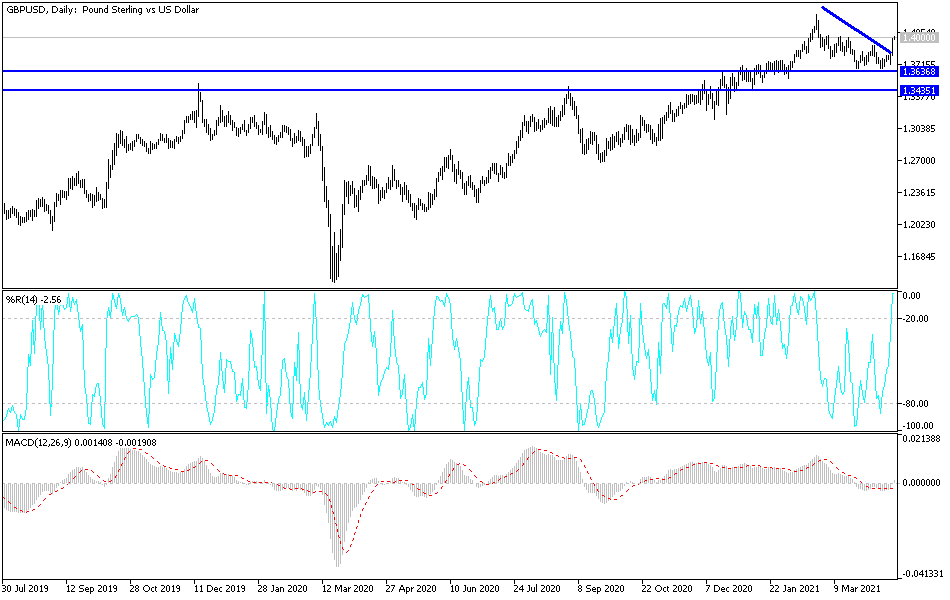

The British pound had a very strong session during the day on Monday, breaking above the downtrend line that I drew last week, and now that we are above there it looks like we are going to go to the 1.40 level. In fact, we not only looked like we were going to go there, but we got there almost immediately. If we can break above the 1.40 level, that is a major resistance barrier that we have been paying attention to for some time. If you can break above the 1.40 level, then it is likely that the 1.42 level would be the next target.

This candlestick for me is a major signal, as it shows a clear upward proclivity in this market that had been building a base. At this point, I would anticipate a possible pullback, but the pullback for me is simply a nice buying opportunity. The size of the candlestick tells me that there is real interest in this market, so I am looking for short-term charts to show a pullback that has plenty of support. However, if we were to break above the 1.40 level, then I would have to look at it has more of a “breakout play” than anything else.

I do not have a scenario in which I'm willing to sell this pair, especially after the Monday session. With that being the case, simply being cautious and trying to get a decent entry is my plan from here. I do not necessarily think that we will break above the 1.42 handle easily, so I think we still have plenty of noise ahead. Keep in mind that this is probably more about the US dollar than anything else right now, so pay close attention to the US Dollar Index. As that goes up and down, that will give you clear signals as to where this pair will probably end up going. The market looks likely to see plenty of value hunters every time they get an opportunity to get involved, because if you are sitting on the sidelines now, you are wanting to get into what is a huge buying signal. We have been going higher for quite some time, so it looks like perhaps the consolidation phase might be coming to an end.