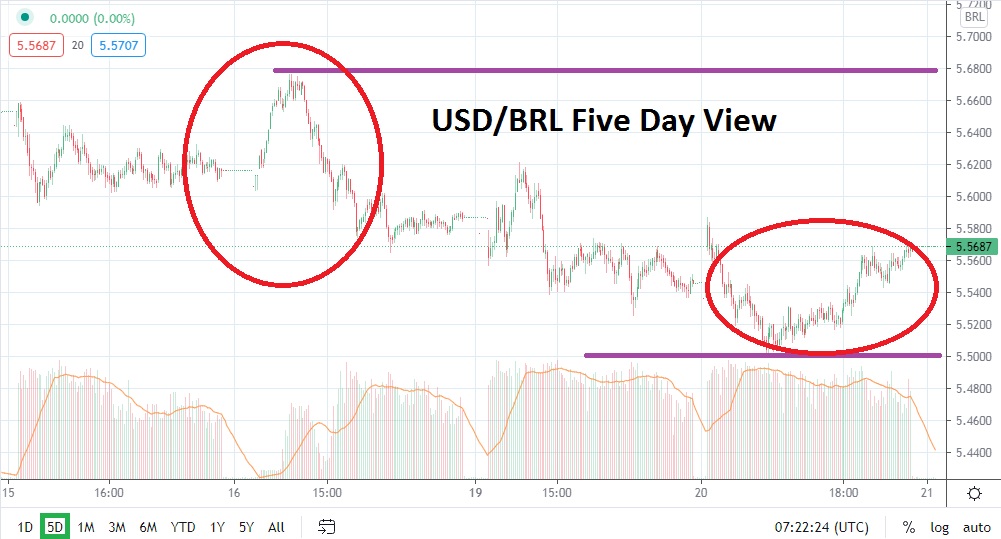

The USD/BRL has produced more range-bound trading activity the past couple of days, but curiously, resistance levels have incrementally lowered. The USD/BRL remains within the clutches of a tight price spectrum, and this lack of volatility may prove quite tempting for speculators who are patient, can use moderate amounts of leverage and endure the costs of holding a position overnight if needed.

The USD/BRL has remained twisted within the juncture between 5.5100 and 5.5900 rather consistently the past two days. However, from a technical viewpoint, the USD/BRL has also shown slight signs of creating a small but productive bearish stance. Importantly, current resistance near 5.6000 could prove to be a lynchpin for trading sentiment short term. If the value of 5.6000 holds as adequate resistance, it could be signaling that further downside price action is possible and a test of support may grow.

The problem within the USD/BRL is that the consolidated range of the Forex pair has not delivered a serious breakout downward since late October and the middle of December 2020. Since achieving a low of 5.0200 in the middle of December, the USD/BRL has rather consistently shown an inclination to produce bullish sentiment. On the 8th of March, the USD/BRL was trading near the 5.8800 mark. While the current price near 5.5700 is certainly lower, this has not come with a fight within choppy waters.

Support near the 5.5100 and 5.4900 junctures remains imperative for traders who want to pursue potential bearish momentum. From the 17th until the 22nd of March, the USD/BRL did trade slightly below the 5.5000 value, but it was not able to maintain its lower boundaries. Until the 5.5000 juncture is broken lower and sees sustained trading beneath, it may prove unwise to believe that the USD/BRL is suddenly going to be bearish.

Traders may prove wise to simply continue taking advantage of the rather tight range within the USD/BRL, looking for support levels to buy and resistance to sell the Forex pair. The lack of fast movement within the Brazilian real when conservative amounts of leverage are used makes the USD/BRL enticing for traders who can use limit orders to pursue incremental trends. The junctures of 5.5300 to 5.5900 remain a battleground and traders should use these values short term to consider limit orders while pursuing reversals within the USD/BRL’s slim range.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.5940

Current Support: 5.5430

High Target: 5.6200

Low Target: 5.5100