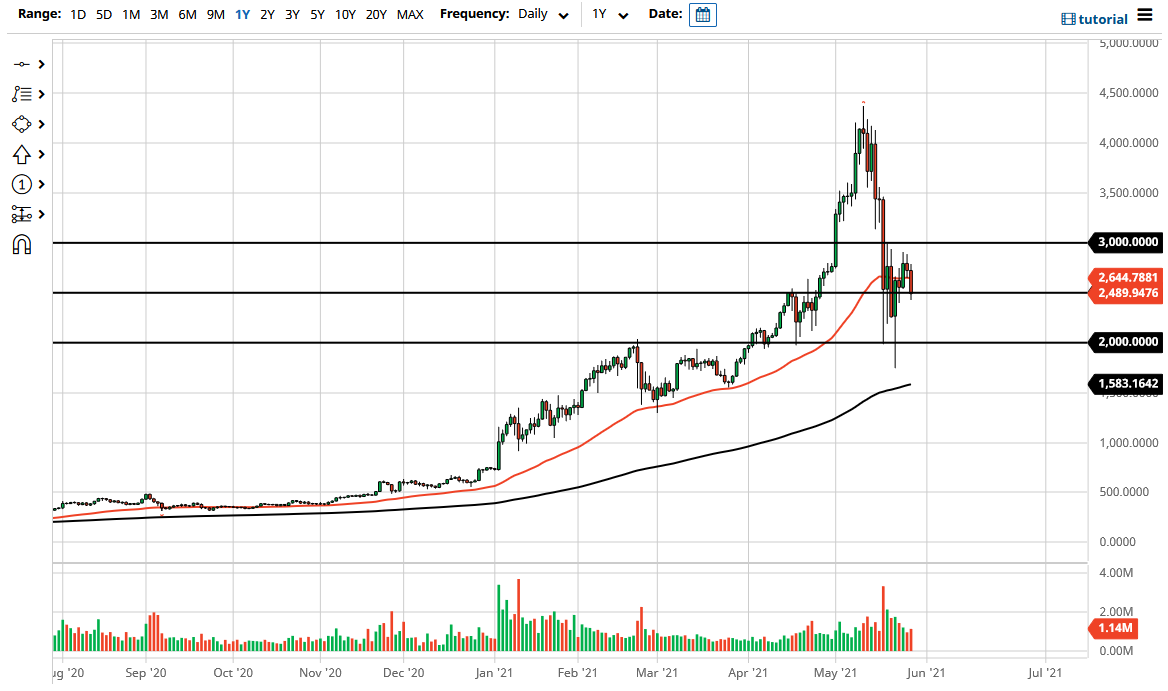

The Ethereum market initially tried to rally during the trading session on Friday but gave back the gains to show signs of exhaustion again. After the massive bloodbath that we have seen in the cryptocurrency markets, it should not be a huge surprise to see that Ethereum continues to struggle to reach higher. As you can see on the chart, I have this market marked off in $500 increments, paying special attention to the $2500 level, the $2000 level, and the $3000 level. We are currently in the middle of this overall area, which is also backed up by the 50-day EMA.

The size of the candlestick is rather negative as well, so I suspect that as we head into the holiday weekend, it is very possible that we could see this market break down towards the $2000 level again. What is interesting down there is the fact that we had seen such a massive bounce, and it is a large, round, psychologically significant figure. Furthermore, we also have the 200-day EMA reaching towards that area, so I think it is very likely that it could cause a little bit of support.

I know that a lot of crypto evangelists will continue to talk about the future, but the reality is that the market right now does not look that healthy. This does not mean that I would be bearish on the outlook for Ethereum for the future; just that we have struggled to maintain the insane amount of momentum going into the market. With this being the case, I think what we are seeing now is a scenario where the overall froth has to be worked out of the market. Remember, although Ethereum is more or less a “highway” for the crypto universe, as a lot of applications are going to be built upon it, I think it is only a matter of time before we would see this market take off again, and I am currently looking for value. I think the first place where you might find it is closer to the $2000 level, but a little bit of patience probably goes a long way. I think the next couple of days could be a little dicey, just due to the fact that a lot of traders will be thinking more along the lines of Memorial Day celebrations, meaning that liquidity could be an issue in some exchanges.