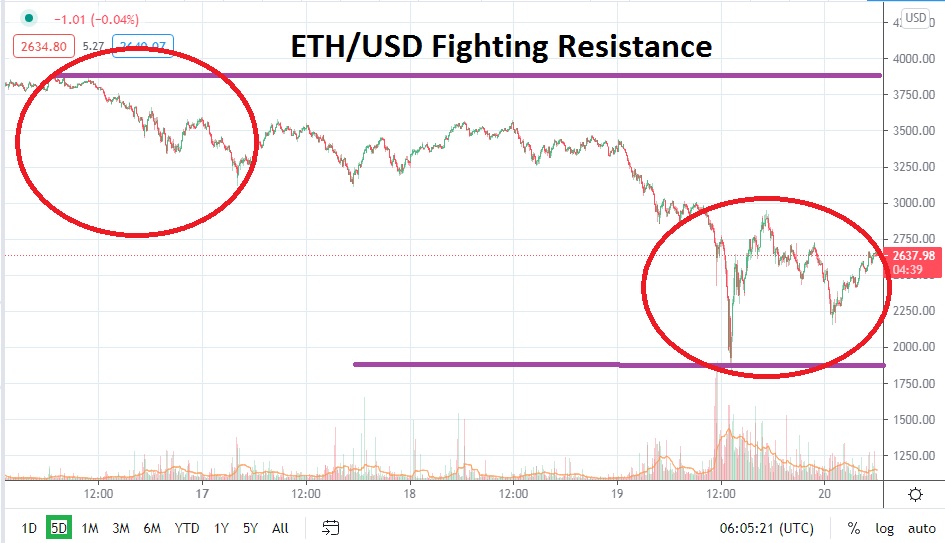

ETH/USD suffered a bad day of trading yesterday. Within a hectic atmosphere, ETH/USD touched the 1840.00 level briefly on Wednesday. As of this writing, ETH/USD has managed to climb higher and is now within the vicinity of 2650.00, but the market remains fast and traders are urged to monitor the price of Ethereum before jumping into a speculative position blindly.

Importantly, for the first time in months, a real change of sentiment can be felt within cryptocurrencies, and speculators need to be able to consider important support and resistance levels technically. The combination of a storm within behavioral sentiment and technical charts for ETH/USD will certainly lead to more volatility in the short term. After trading near the 3400.00 ratio early yesterday and falling to a momentous low of approximately 1840.00, traders need to make a decision if they can handle these types of changes in value.

Resistance at the 2700.00 to 2750.00 juncture may prove to be a target for speculators who still are hanging onto the notion that bullish buying will strike again. Traders who feel compelled to sell ETH/USD may be looking at the 2400.00 level as important support. What ETH/USD needs to accomplish now from a trading perspective is show an ability to sustain a higher range or demonstrate that support levels are still vulnerable. If this resistance juncture above cannot be punctured short term, it could be an indicator for more bearish action to come.

The current price of ETH/USD should be wagered on using limit orders to protect against irrational fills which may be seen due to the fast trading which exists. Having wiped out a bit less than one thousand dollars of its value in two days as of this writing, ETH/USD is not a speculative endeavor for traders who do not know how to manage their risk-taking.

ETH/USD has certainly experienced a slew of selling and support levels are still within sight. Speculators cannot be blamed for having the perception that ETH/USD has further room to fall and may test key psychological values near term. The sudden and sharp bearish momentum within Ethereum may continue to experience waves of selling, particularly if investors decide to cash out profits, which may still exist based on a fear that ETH/USD could trend lower in volatile conditions.

Ethereum Short-Term Outlook:

Current Resistance: 2734.00

Current Support: 2400.00

High Target: 2963.00

Low Target: 2000.00