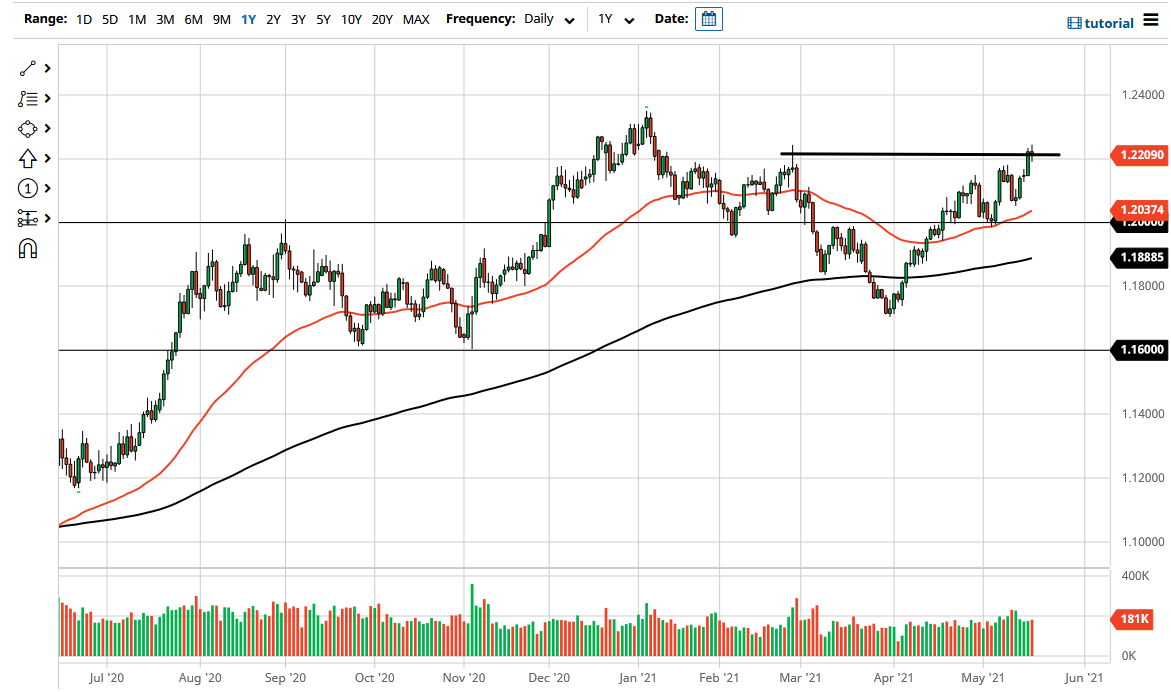

The euro initially rallied during the trading session on Wednesday but found a significant amount of resistance to turn things back around. A lot of this comes down to the idea of people running into the US dollar as a form of safety, as massive liquidation of crypto assets kicked off a ripple effect through several markets. Regardless of the reason, the market had gotten a little bit overdone, and it is likely that we are going to see buyers on dips and therefore we need to take a look at the market through the prism of the longer term.

The 1.22 level has been significant resistance, so pulling back from there was probably going to happen one way or another. At this point, it is likely that we will continue to see the market going higher, and I think a lot of the noisy trading on Wednesday was probably overdue. It is not necessarily due to anything going on with the euro itself, it is just that we have seen massive amounts of volatility in auxiliary markets, so it is not a huge surprise to see that the market would be jumping around over here as well. After all, the euro is the “anti-dollar”, meaning that whatever the dollar does will be felt in this market in general.

Beyond that, this pair tends to be very choppy to say the least, so I again am not surprised by this behavior. At this point, I believe that the market will eventually break out to the upside, but we clearly have not been able to do so yet, and therefore I think it is going to continue to be a bit noisy in general. If and when we finally break above the high of the session on a daily close, then I think it opens up the possibility of a move towards the 1.23 handle. The 1.23 handle being broken to the upside then allows the market to truly break out and go looking towards the 1.25 handle, which is a longer-term target of a lot of analysts out there, including myself. This does not mean that we will get there easily, so I think it is worth paying attention to the fact that this is more of a grind than anything else. Therefore, it is important to pay attention to your position size but recognize that we are still very much in an uptrend.