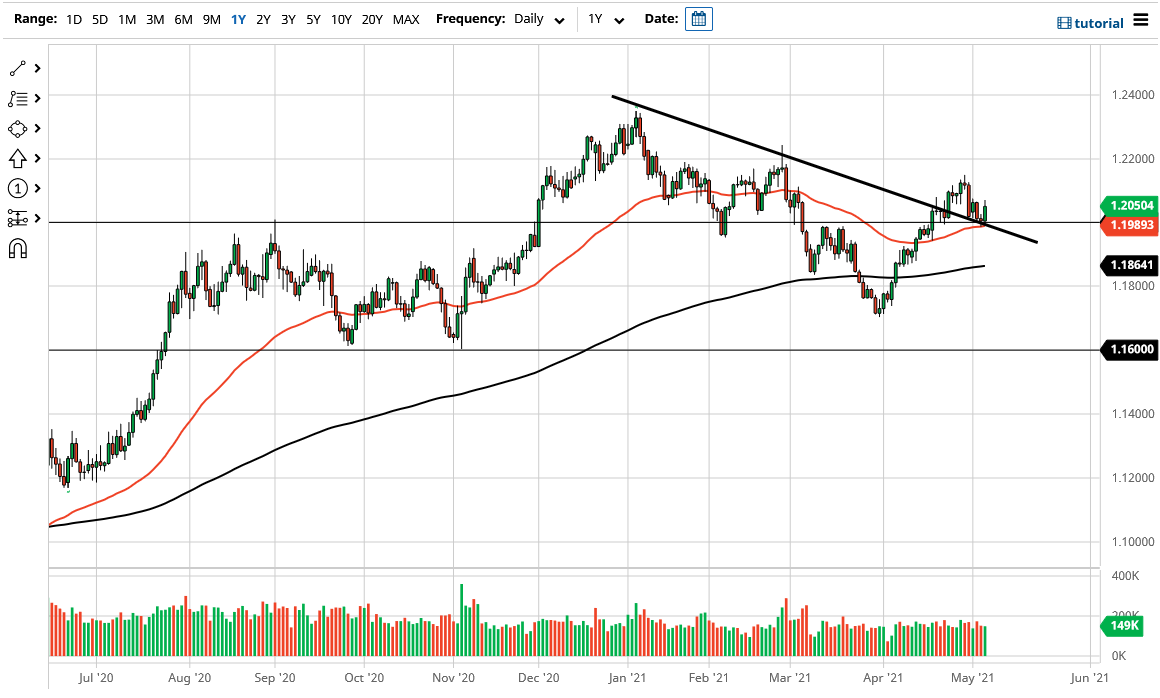

The Euro rallied significantly during the course of the trading session on Thursday as the 1.20 handle has offered enough support to keep the market going. Furthermore, there are a slew a technical indicators in this general vicinity that should continue to attract attention as well. The 50 day EMA is sitting just below this area, and of course we formed a very neutral candlestick during the previous session. The previous downtrend line has offered support now that we are broken above it, so I do think that it is given enough time continue to offer a bit of a floor. Ultimately, the Euro is benefiting from a weak US dollar more than anything else.

While the candlestick was only about 70 pips, it is bigger than most of the other recent candlesticks that we have seen. This being the case, I do believe that it is worth paying close attention to this pair, as we have been forming a bit of a bullish flag. All things being equal, the market also has formed a bit of a “falling wedge” on shorter time frames, so it looks as if we are ready to go higher.

To the upside, the market could very well go to the 1.22 handle, possibly even the 1.23 handle. The jobs number will obviously make a big difference as to what happens next, so I think that you will probably see a lot of volatility in the short term, but I think that at this point in time the overall attitude of this market is still present to the upside as the traders continue to ditch the dollar based upon the massive amounts of stimulus that the Federal Reserve is flooding the market with liquidity.

Beyond all of that, then you have to look at the idea of the US government spending trillions of dollars in the blink of an eye, so therefore one would have to think that should have an effect on the greenback as well. Nonetheless, this is a market that I think is going to continue to struggle to make huge moves, simply because it is very choppy to say the least. To the downside, if we were to break down below the 50 day EMA, it is possible that we could go down to the 200 day EMA underneath.