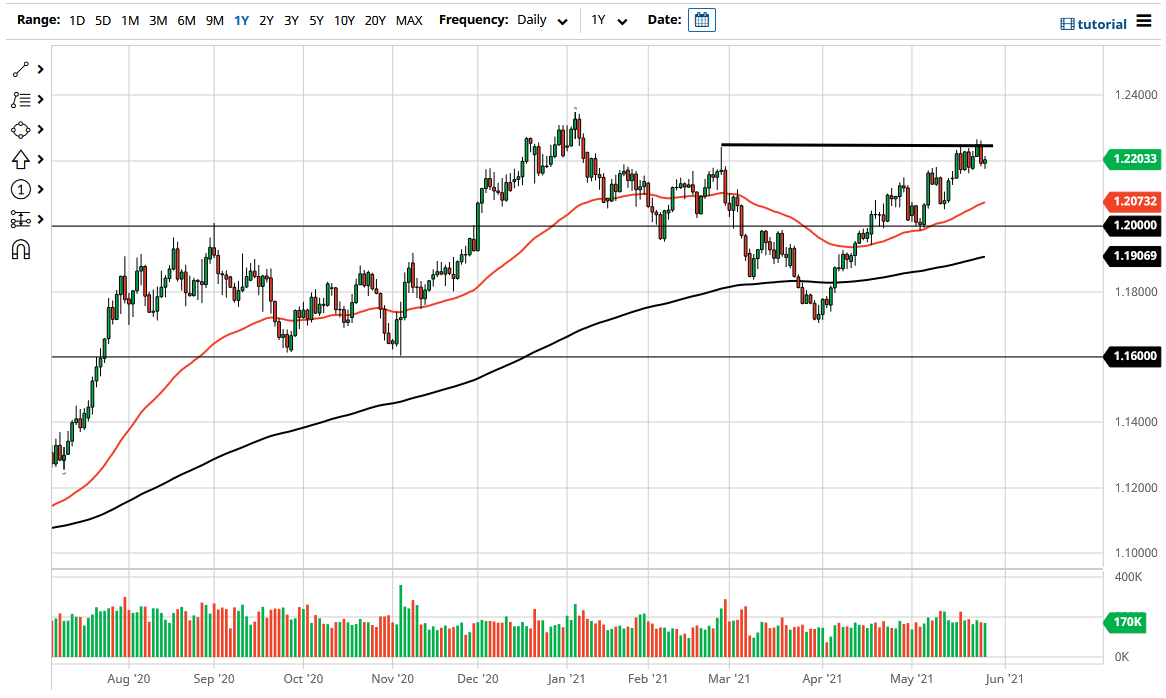

The Euro has initially broken down below the 1.22 handle during the trading session on Thursday but turned around to show signs of life again. The market continues to see a lot of volatility in this area, and I do believe that the high of the last couple of days is worth paying attention to as it is significant resistance previously, so all things been equal I think we are trying to build up the necessary momentum to break out. Even if we do clear that area though, it is likely that the 1.23 handle will continue to be a major barrier, as we have seen more than once. Remember, the Euro pulled back rather significantly from that level and that typically means there is a lot of supply.

If we do break above that level, then it is likely that the market could go looking towards 1.25 handle, which is the longer-term target that I have. After all, the Euro is rallying mainly due to the fact that we are starting to see the European Union open up a bit from the pandemic and of course numbers are starting to look a little bit better from the economic side. Beyond that, we also have the US dollar falling apart and that provides a little bit of a tailwind in this pair going forward.

Pullbacks at this point should continue to see plenty of support, especially near the 50 day EMA, and then eventually the 1.20 handle. That is an area that I think is essentially the “floor the market” going forward, but if we were to see the Euro drop down below there then we could find ourselves having to ask a somewhat more significant question about the overall attitude. If we do break down below there, then it is possible that we could see further selling, but it is very unlikely to be the case. I think we have a lot of choppy behavior ahead of us, but it should continue to favor the upside overall. The market has been trending higher and it certainly looks as if there is plenty of resiliency that continues to jump into this market. Breaking above the short-term resistance should continue to add credence to the idea of a stronger Euro, but as usual this market is choppy to say the least.