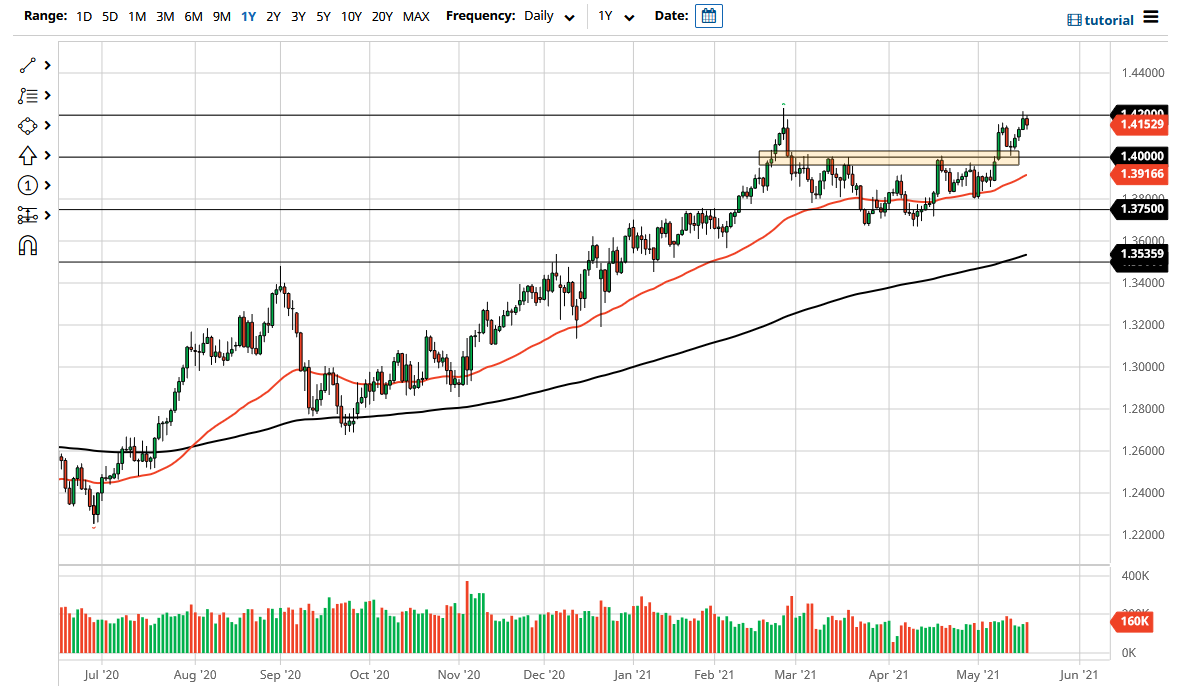

Risk sentiment around the world fell rather hard at one point during the trading session on Wednesday as the market had a lot of risk assets falling in general. This made the US dollar much more palpable to own for some traders, and that translated into a slightly lower British pound exchange rate. That being said, this is an area that the market was always going to struggle with, as the 1.42 level has been massive resistance.

What I pay the most attention to is the fact that the most recent pullback looked at the 1.40 level as an interesting area to get long again, and that is exactly what we have seen happen. By pulling back from the 1.42 level, it simply means that we need to build up more pressure to go to the upside. With the Federal Reserve likely to keep the spigot wide-open, that should weigh upon the greenback in general. With this being the case, I think that the market will continue to look at the US dollar as an asset that they want to get away from, but in the short term, it is worth paying attention to the fact that the market is pulling back from a major level, and this could offer a little bit of a buying opportunity once the market decides to settle down.

To the upside, if we can break above the 1.42 handle, then it is likely that the market goes looking towards the 1.45 handle, which is a large, round, psychologically significant figure. I think it is only a matter of time before we continue to see buyers jumping back into the market to take advantage of what has been a longer-term uptrend. The entire scenario around the US dollar should continue to be somewhat negative, as the Federal Reserve is going to continue to keep liquidity running, and the British economy is getting ready to open up, so there is a certain amount of pricing in of that fact. In general, I like buying dips, but I also recognize that we need to see a little bit of stability before it is worth putting money into this market. Give it a couple of days; hopefully we will see signs of stabilization that we can take advantage of.