During last week's trading, the bears tried to push the GBP/USD to breach the 1.4000 level, but the dollar retreated after disappointing US retail sales figures, and the pair closed around the 1.4100 resistance. The pair's gains did not cross the 1.4166 resistance level. The US dollar gained some momentum against the rest of the major currencies. The gains came after US inflation more than doubled the Fed's 2% target for April. The inflation data appear to have spurred speculation that the Fed may cut its quantitative easing (QE) program or raise interest rates sooner than it has so far been directed, leading to a stronger dollar and higher bond yields at a later time.

The dollar was unable to hold onto the gains with disappointing US retail sales figures, which enabled the pound to find support above the 1.40 level in mid-last week's trading. Commenting on the performance, UOB Strategist Kwik Sir Liang says: “The bias has turned to the upside but the GBP/USD pair should close above its year-to-date high of 1.4240 before a sustainable rally is expected.”

However, investors and the British pound are interacting with the growing line of domestic and international developments that threaten to lift price pressures in the short term and prolong the point at which the market can be confident of the likely timing of any decision by the Fed to raise interest rates. For his part, Stephen Gallo, Forex Analyst at BMO Capital Markets, said: “The dollar is not far from the tipping point; we believe that the turning point in the US dollar will be another downside point against the euro and the pound sterling if the Fed's 'pessimism' in the face of rising inflation pressures leads to a further decline in real dollar prices (or if bonds outperform European debt significantly)."

All in all, the prolonged uncertainty may cause investors to remain reluctant to abandon the greenback for too long, which could in turn limit any further gains for the GBP/USD pair for the time being. For its part, the Fed emphasized that it is unlikely to adjust its policy settings until "significant additional progress" is made towards labor market reform and has committed to keeping borrowing costs near zero so that inflation spends enough time above the 2% level.

Achieving the Fed's targets on jobs and inflation seemed less likely anytime soon when the April non-farm payrolls report missed market expectations by a mile in the past week, helping to lower US bond yields and leveraging the pound against the dollar in GBP/USD in recent days. The pound sterling will now have to face increasing economic risks at home in the coming days and weeks, including the government's concerns about a new strain of coronavirus.

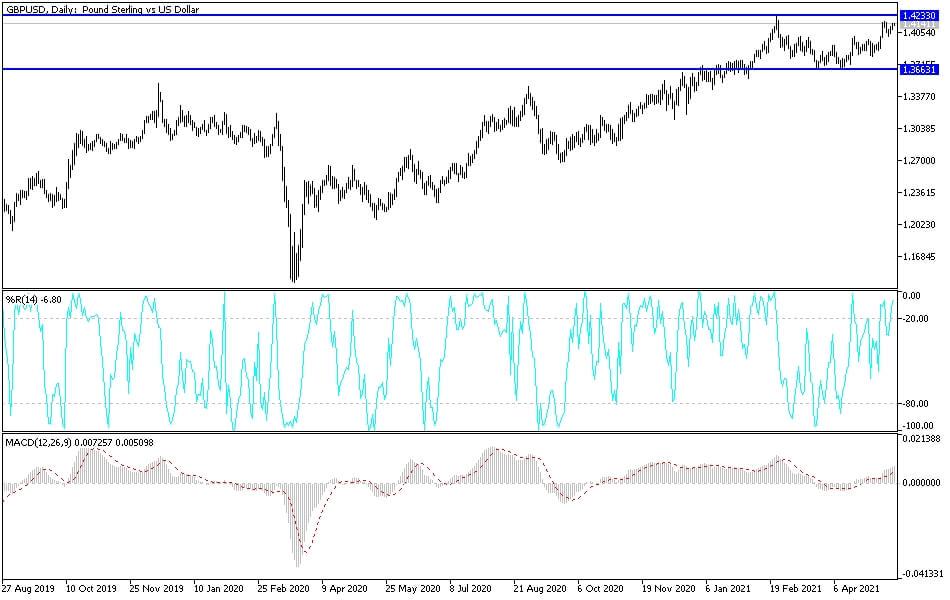

Technical analysis of the pair:

The stability of the GBP/USD currency pair above the 1.4000 psychological resistance continues to strengthen the bullish performance. The pair's gains last week, reaching its highest in two-and-a-half months, added to this momentum. The sterling's gains may be subject to a setback: the increasing fears of the emergence of a new strain of coronavirus threatening the British government's plans to reopen the country's economic activity according to a timetable supported by Britain's advanced vaccinations against the epidemic. On the daily chart, the bulls' next target will be the 1.4240 resistance level.

On the downside, the bears will have stronger control over the performance in case the currency pair moves towards the support level of 1.3880. The currency pair does not expect any important British or American economic data today.