For two days in a row, gold was subject to profit-taking that pushed it towards the support level of $1814 after a period of upward stability around the $1845 resistance. The US dollar recovered after the higher-than-expected inflation numbers, which contributed strongly to pressure on the gold price, which settled around the level of $1818 at the beginning of Thursday's trading, waiting for anything new. All in all, data showing a jump in US inflation during the month of April sparked speculation that the Fed will take some measures to curb prices.

In the same performance as gold, silver fell to $27.24 an ounce, while copper futures settled around $4.736 a pound.

The Labor Department said its US Consumer Price Index rose 0.8% in April after rising 0.6% in March. Economists had expected consumer prices to rise 0.2%. Excluding food and energy prices, core US consumer prices also rose 0.9% in April after rising 0.3% in March. Core prices were expected to rise another 0.3%. The larger-than-expected jump in core consumer prices reflected the largest increase since April 1982.

With a much larger-than-expected monthly increase, consumer prices in April rose 4.2% compared to the same month last year, reflecting the largest jump since September 2008.

Since the late 1960s and early 1970s, there has been no chronic high inflation in the United States, as consumer prices have increased by double or close to 10% year-on-year. In fact, the opposite was true for nearly a decade. Inflation has consistently remained below the 2% annual target set by the Federal Reserve. Under Jerome Powell, the Fed is thus betting that it can keep interest rates very low even as the economic recovery begins - and that it will not have to raise interest rates quickly to stop runaway inflation.

Few economists believe the nation is on the verge of uncontrollably high inflation. But concerns among businesses, consumers and investors about alarmingly high inflation are growing.

The International Federation of the Red Cross said yesterday that coronavirus cases are exploding in Asia and the Pacific with more than 5.9 million new confirmed infections in the past two weeks, more than all other regions combined. He warned that the increase is pushing hospitals and health systems to the brink of collapse. He also said that seven of the world's 10 nations are doubling their numbers the fastest in the Asia-Pacific. The Red Cross said in a special statement that Laos only took 12 days to see its cases double, and the number of confirmed infections in India doubled in less than two months to more than 23 million.

He also said that our data scientist at the University of Oxford reported more than 5.9 million new cases of COVID-19 in Asia and the Pacific during the two weeks. The official figures in most parts of the region are widely believed to be undervalued.

Alexander Matthew, Director of the Red Cross for the Asia-Pacific region said, “COVID-19 is spreading in most parts of Asia, confusing hospitals and healthcare. More people have been diagnosed with the disease in Asia in the past two weeks than in the Americas, Europe and Africa combined. At the present time, we need global solidarity for regional support with more medical equipment, support for prevention and urgent access to vaccines."

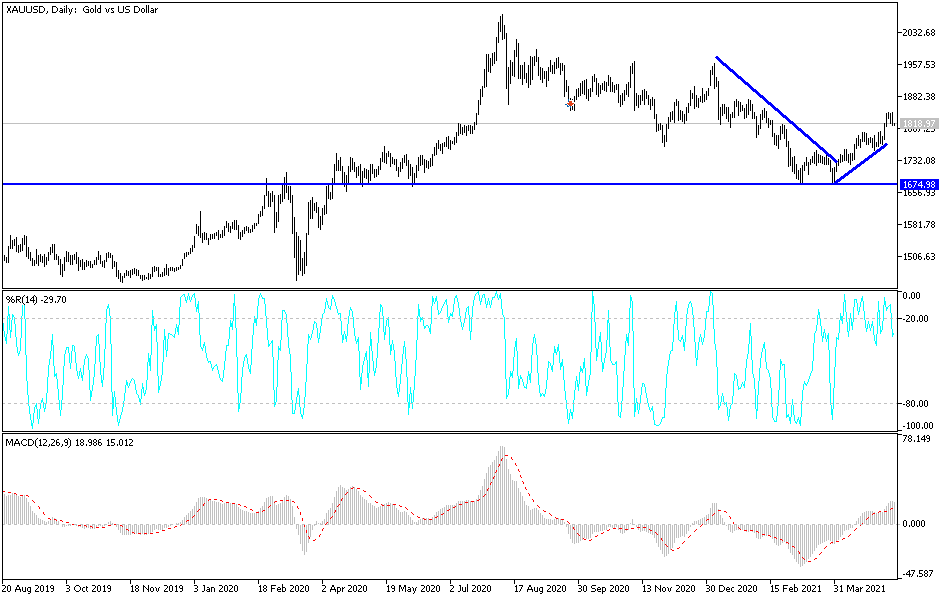

Technical analysis of gold:

The bulls are holding the price of gold above the psychological resistance of $1800, which will continue to support the positive outlook of the gold price in achieving stronger gains. All of this will depend on whether or not the US dollar continues to gain, as well as the extent of risk appetite, especially after the announcement of the rest of the results of the US economic data, which include the weekly US jobless claims and PPI later today. Tomorrow will bring the release of US retail sales numbers.

Currently, the closest resistance levels for gold are $1829, $1855 and $1870. A bearish reversal will occur again if the price of gold moves towards the support level of $1775.